Don’t fall for the cute Super Bowl ad…

CrowdStrike (CRWD) is a major player in the corporate cybersecurity space. And during Sunday’s game, the company marketed its services to more than 110 million people.

The ad was a play on the classic Trojan horse story…

It started with a gigantic wooden horse at the gates of a castle or fort. And several men up on the wall seem excited to receive the horse.

But then, one of the men decided to call in their CrowdStrike analyst. It’s a good thing…

A young woman named Charlotte arrives with a tablet. She “scans” the horse and reveals a threat…

You see, a bunch of men were packed inside the wooden horse. They planned to break in.

Charlotte saved the day. She told the men atop the wall not to accept the gift. And as the ad ended, the wooden horse rolled backward off a cliff.

Like I said, it’s a cute ad… But we’re not fooled.

I’ll explain today why CrowdStrike is “toxic waste” for investors. And as you’ll see, it’s far from the only stock you should avoid at all costs…

My friend Joel Litman founded our corporate affiliate Altimetry. He’s also a forensic accountant.

Joel and I think alike in many ways. We break down ideas in the world of finance into smaller chunks and systemize them. I use the Power Gauge. And Joel has his own system.

But we differ in some ways, as well. That makes us a great team…

You see, I’ve spent my career taking what folks call a “top down” approach. That means I start with a broad view, focus on strong industries, and drill down to specific stocks.

Meanwhile, I’ve never met anyone as in the weeds when it comes to corporate bookkeeping as Joel. He’s what the experts call a “bottom up” analyst.

But in the end, our wildly different systems came to the same conclusion on CrowdStrike…

It’s a “Toxic Waste” stock.

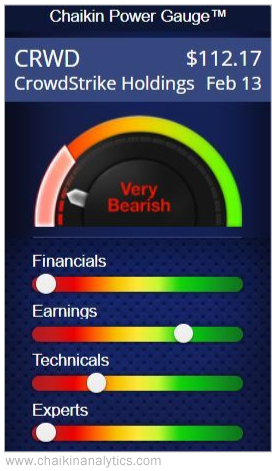

Let’s start with the Power Gauge. As you can see, it’s “very bearish” on CrowdStrike…

With the Power Gauge, we know at a glance that this company is in trouble…

The Power Gauge measures 20 different factors. And many of these factors are rough today.

For example, the system ranks CrowdStrike as “very bearish” for its price-to-sales (P/S) ratio of nearly 13. In other words, the company’s sales would need to grow more than 10 times to make it a “fair value” based on this measure.

Now, sometimes we can expect P/S ratios to end up stretched like that. After all, high-growth tech startups are often valued on potential growth rather than today’s sales.

But CrowdStrike is more than a decade old. It’s not a tech startup anymore.

And Joel’s system backs up the Power Gauge…

His system is called the Altimeter. It issues grades on an A-to-F scale. And among other things, it’s very good at detecting hidden ticking time bombs in a company’s balance sheet.

Today, the Altimeter ranks CrowdStrike as a “D” overall. And the system gives the company an “F” in its Valuations category.

The cute Super Bowl ad might make CrowdStrike look like a hip and flashy company. But thanks to the Power Gauge and Joel’s Altimeter system, we know that it’s really struggling.

And it’s not the only Toxic Waste stock in the markets…

Joel and I recently combined our systems to build a list of the top 10 worst stocks to own right now. Both the Power Gauge and the Altimeter say these stocks are all untouchable.

We put together a special report with all the details on these Toxic Waste stocks. Plus, as you’ll see in our special presentation, our systems can do much more than that…

In short, we’ve also identified a group of so-called “Perfect Stocks” to own today.

By combining the Power Gauge and Altimetry’s rigorous Uniform Accounting standards, we found these Perfect Stocks. They’re unbelievably rare. And they have massive upside.

For all the details, I encourage you to watch our presentation right here.

Good investing,

Marc Chaikin