It’s not official yet… But a recession seems more likely every day.

In fact, one major financial leader is practically calling it already…

JPMorgan Chase (JPM) CEO Jamie Dimon only sees a 33% chance that we’ll come out of the current environment unscathed. He believes a severe recession is just as likely.

And with the S&P 500 Index down about 15% this year, we’re already pretty scathed.

So as investors, how do we navigate these rough waters? After all, we can’t just press a magic “avoid the recession”button.

Fortunately, one time-tested strategy is perfect for these conditions…

It might surprise you given the recent headlines. It’s not glamorous, either. But it exploits a fundamental reality that investors face during tough times like today.

Think about it this way…

Some companies put all their money into visionary projects. But those projects may never happen. That’s especially true during recessionary periods.

Instead of doing that, other companies focus on giving money back to their shareholders…

These companies have the upper hand in recessions. They’re a way for investors to play defense. They’re fortresses standing strong against a coming market storm…

Folks, if you haven’t guessed by now, we’re talking about dividend-yielding companies.

They’re not glamorous. But they’re better suited for turbulent markets like today. It’s clear as day when we look at a pair of charts…

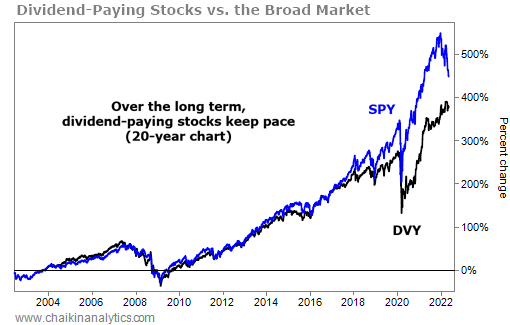

We’ll start with a long-term comparison of the total returns for the broad market and dividend-paying companies. We’ll use the SPDR S&P 500 Fund (SPY) and the iShares Select Dividend Fund (DVY) for the two types of stocks. Take a look…

With results like that, it seemsobvious… At best, the stodgy dividend-paying companies run neck and neck with the nimbler S&P 500 over the long term.

And it’s understandable that SPY crushed DVY in the heyday of the hyper-growth era. Dividend-paying companies can’t keep pace when investors obsess over companies doing what it takes to reinvent the world.

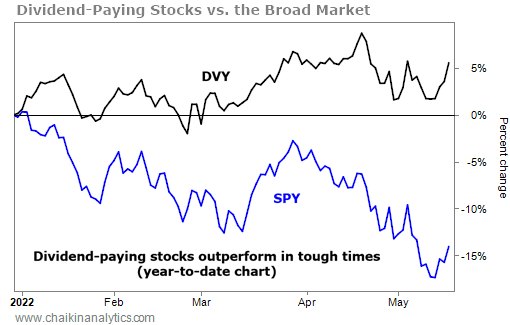

But when the market turns lower, the once-stodgy dividend-paying companies turn into stoic fortresses. Look at what has happened since the S&P 500 peaked in early January…

SPY is down about 15% over that span. Meanwhile, DVY is up almost 5%.

When the economy is in a recession (or nearing one), investors flock to profitable businesses. They don’t want to risk capital in businesses that might never produce profits.

Now, you could just invest in DVY to prepare for a recession. But if you want to take things a step further, you could cherry-pick some of the world’s best recession fortresses…

DVY’s holdings and yields include consumer-goods companies Conagra Brands (CAG) at 3.5% and General Mills (GIS) at 2.8%. Coca-Cola (KO) yields 2.7%. And Altria (MO) yields a whopping 6.8% while operating in the recession-resistant tobacco industry.

Of course, you could just go to 100% cash. But we don’t want to panic and run completely out of the market. Holding only cash is more likely to hurt than help over the long run.

With inflation at multidecade highs, I’d rather put my money in dividend-paying, recession-resistant fortresses. They’re better suited for tough times. Consider investing in them today.

Good investing,

Marc Gerstein