If you’ve never eaten at a Potbelly Sandwich Shop, you’re missing out…

A colleague introduced me to the Chicago-based fast-casual restaurant chain during a business trip to the city years ago.

At first, I balked at the long line… I just wanted to get a quick bite to eat.

But I’m glad we were patient. As it turned out, my colleague was spot-on… My sandwich was well worth the wait.

I ordered the sandwich called “A Wreck.” It’s a combination of turkey breast, ham, roast beef, salami, and Swiss cheese… Potbelly (PBPB) describes it as a “meaty fan favorite.”

It’s true, too… I’ve been a big fan since that first sandwich. And once I discovered the nearest location in my hometown of New York… well, let’s just say my waistline got bigger.

Now, combining my love for Potbelly sandwiches with my day job, my first inclination is to dig a little deeper into the company’s stock. And right now… I would avoid it at all costs.

Let me explain…

I’m also a huge fan of Peter Lynch… He’s one of the most successful investors of all time.

Under Lynch’s management, the Magellan Fund from financial-services giant Fidelity returned a remarkable 29% per year from 1977 to 1990. The mutual fund beat the benchmark S&P 500 Index in every year except two during that span.

Lynch also co-wrote a few bestselling books, including One Up on Wall Street and Beating the Street. One of his favorite investment maxims is to “invest in what you know.”

In other words, use what you know from real life to inform your investment choices.

That’s what I tried to do with Potbelly.

But the thing is, Lynch’s oft-recited maxim is actually only the first part of what he wrote. The rest of the chapter is less popular, but it’s perhaps even more important…

You see, Lynch never tells you to automatically buy based on what you know from real life. He tells you to analyze first.

At Chaikin Analytics, I analyze stocks using our “Power Gauge” system… This proprietary model rates thousands of stocks based on 20 fundamental and technical factors. Our founder Marc Chaikin chose these factors based on the knowledge he gained during his 50-plus years as a successful Wall Street professional.

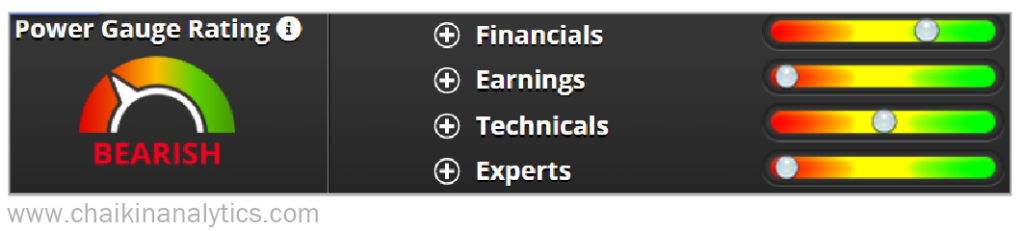

Today, the Power Gauge rates Potbelly’s stock as “bearish.” Take a look…

Now, I must say that few stocks (if any) are all good or all bad… With 20 individual factors in play, there’s a good chance that you’ll find positives and negatives with every stock.

For example, right now, the Power Gauge rates Potbelly very favorably based on its price-to-sales ratio. However, the bad outweighs the good with this stock…

The company receives poor scores from the Power Gauge for most of its earnings-related factors. And it gets a “very bearish” rating from the system for its price strength.

It isn’t just Potbelly, either… You won’t find any attractive alternatives among its fast-casual restaurant peers today.

The Power Gauge has negative outlooks on several other publicly traded companies in this group right now… It’s “very bearish” on other big-name outfits such as Chipotle Mexican Grill (CMG), Shake Shack (SHAK), and Wingstop (WING).

I’ve been investing long enough to know that when it comes to my portfolio, it’s best to listen to the data… And right now, the data is telling me to pass on Potbelly’s stock. If I already owned it, I would sell it.

That doesn’t mean it will always be a bad stock to own, of course… I can put Potbelly on a watch list today and buy later – if and when data causes its Power Gauge Rating to rise.

But again, the Power Gauge shows me that it’s best to avoid the stock at all costs today.

Don’t worry… the workers at my local Potbelly shop won’t know. I’m sure they’ll still serve A Wreck to me tomorrow (and the next day). After all, I’m still a big fan of the sandwiches.

Good investing (and good eating, too!),

Marc Gerstein