You’ll either really love today’s essay… or you’ll stop reading in about 10 seconds.

That’s because we’re going to talk about bitcoin – the world’s most popular cryptocurrency.

Bitcoin is polarizing, of course…

Old-school investing traditionalists hate it. They might even go as far as calling it a “scam.” Meanwhile, the younger generation loves it because “it’s the future.”

The timeless debate rages on.

But the thing is, a lot of bitcoin owners don’t even know all the basics about it…

That’s right, bitcoin fanatics, I must admit… I don’t fully understand the craze myself. And it turns out I’m not alone…

Industry group Crypto Literacy published a study in early November that showed 96% of U.S. participants failed a fundamentals of crypto test. In other words… the vast majority of American respondents didn’t understand the basics behind how cryptos actually work.

And that’s not the most alarming part… Of those same U.S. participants, 17% said they owned cryptocurrencies!

So when you crunch the numbers, it means that more than 10% of the people who said they owned cryptos don’t even have a basic understanding of it.

Now, since this industry is still in its infancy, there isn’t a lot of research on cryptos and consumers yet. But this study tracks with what I’ve seen firsthand…

A lot of folks are buying and selling cryptos like bitcoin. And yet, few of them can explain how it works.

So why would they invest in something if they don’t understand it?

That’s easy. It’s because bitcoin has long-term momentum…

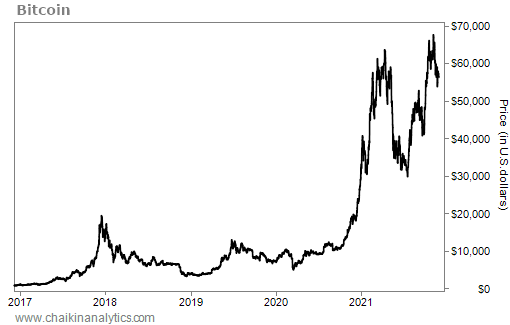

Over the past five years, bitcoin has soared roughly 6,300%. For some context, if you would’ve bought $1,000 worth of bitcoin in early December 2016… it would be worth roughly $64,000 today.

You only need to glance at bitcoin’s price chart to see why it’s drawing people in…

Now, you might notice the start of the most recent pullback on the right side of the chart…

Bitcoin is down from its all-time high of roughly $69,000 in early November to about $48,500 as we go to press. In fact, it plunged roughly 15% over the weekend alone… There’s no question that it’s a volatile asset.

However, the long-term rise is still evident in the five-year chart… And with no strong indication that interest in bitcoin among its loyalists is going to slow down any time soon, the temptation of those huge returns is almost too great.

But is momentum over the longer term a good enough reason to invest in something you don’t even understand?

This is where the debate gets even more polarizing… Older investors often say, “HECK NO!” And younger investors say, “GIVE ME MORE!”

Cryptos are one of the only investment vehicles where younger investors participate more than older investors… The Crypto Literacy survey indicated that only 27% of all crypto investors are older than age 40. Another survey, conducted by news network CNBC in August, found that only 4% of people older than age 65 hold any cryptos at all.

When it comes down to it, both sides could benefit from a shift toward the middle…

Younger investors must make sure they aren’t exposing themselves to too much risk… After all, as the chart above and this past weekend show, wild swings do occur. And older investors should at least consider taking on a little bit more risk, given what the potential returns could be.

Folks closer to retirement should be extremely careful about not overexposing themselves to risky investments. However, if you don’t plan to retire for several more years – or even decades – then you can consider dabbling more in higher-risk assets.

In the end, though, older and younger investors should agree on one basic guideline when it comes to cryptos… If your investment doubles, sell your initial stake and play with “house money.”

As my grandfather always said, “You don’t go broke taking profits.”

Good investing,

Karina Kovalcik