Editor’s note: Marc Chaikin sees a lot of “big tailwinds for stocks in 2024”…

But he’s far from alone.

Today, we’re turning things over to Brett Eversole from our corporate affiliate Stansberry Research. This essay first appeared in Brett’s DailyWealth e-letter last Tuesday, January 9.

Like Marc, Brett is always watching the market for signs of what to expect moving forward. And as you’ll see today, he believes stocks could put on an encore of 2023 this year…

Most investors never saw it coming…

2022 had inflicted an incredible amount of pain. Stocks and bonds fell in tandem. Nearly everyone expected the pain to continue in 2023.

The market tends to do the opposite of what everyone expects, though. And instead of falling further, stocks soared.

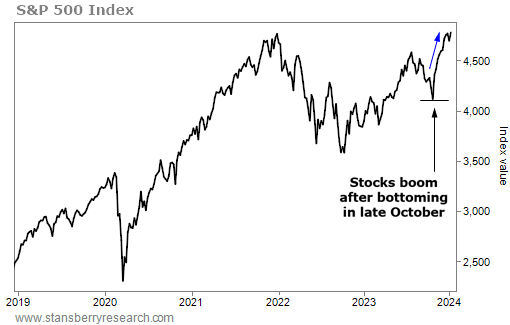

The market finished 2023 with a total return of 26%. A good chunk of those gains came in November and December. And the broad rally since late October points to more gains this year.

In fact, history shows the market could rally more than 20% again in 2024…

A year of 20%-plus market gains might seem like an outlier. But it’s more common than you’d think.

Excluding dividends, the market has posted 20%-plus annual gains 21 times since 1950. That means they happen more than a quarter of the time.

What’s more surprising is that gains of 20%-plus happen more often than losses. Stocks have only fallen in 20 calendar years since 1950. If you include dividends, the number is even lower.

With that in mind, a gain of 20% or more this year isn’t so crazy. That’s especially true when you look at the year-ending rally in 2023.

After bottoming in late October, stocks rallied 16.1% over the next seven weeks. That’s the highest seven-week return since coming off the pandemic lows in 2020. Check it out…

Most folks would look at this rally and assume the market is overheated. They’ll likely expect that a slowdown would come next.

History disagrees.

To see it, I examined every seven-week rally of 14% or more since 1950. We’ve only seen 33 similar setups over that period. And stocks kept soaring in almost every instance. Take a look…

Stocks have been a solid way to build wealth over the long term. Since 1950, the market has returned 7.9% per year.

But you can do much better buying after setups like this one…

Similar rallies led to 7.1% gains in three months, 11% gains in six months, and 19.3% gains over the next year. That’s multiples better than the buy-and-hold return in each case.

What’s more, a year after these setups, stocks were higher 91% of the time. And the market gained 20% or more 55% of the time.

Last year’s incredible rally doesn’t need to end anytime soon. Rather, it will likely continue.

History tells us that another gain of 20% or more is possible this year.

That’s why you should stay invested in stocks today.

Good investing,

Brett Eversole