At this point, everyone knows the housing market is a mess…

The median sale price for U.S. homes has soared nearly 28% since 2020. And multidecade-high interest rates mean that housing payments are more expensive than ever.

In fact, the typical payment on a new mortgage has soared more than 90% since 2020. It now hovers around $2,200.

And as just about everyone knows, incomes haven’t kept pace with that change.

In fact, median household income fell roughly 5% from its peak in 2019 through 2022. And preliminary data for 2023 makes it look like 2024 will be another down year.

Put simply, this is a tough market for a consumer to make a move. It has been for a long time, too.

But that’s what makes a newly formed trend so interesting…

You see, consumer expectations around housing have taken a dramatic turn. So today, let’s dig into the details…

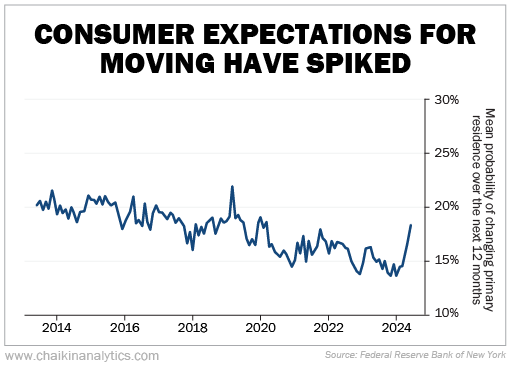

Specifically, we’re looking at what the New York Federal Reserve calls the “mean probability of changing primary residence over the next 12 months.”

It’s from the New York Fed’s Center for Microeconomic Data. And it’s part of its Survey of Consumer Expectations.

Put simply, the Fed collects mountains of data every month. Today, we’re looking at a very specific slice of it.

You see, consumer expectations around moving are changing. Take a look…

For years, consumer expectations around moving declined. Collectively, consumers didn’t expect to move in the next 12 months.

But if you look at the end of the chart, you’ll see that something dramatic is happening. The expected probability of moving has spiked.

In fact, it just hit a four-year high.

That’s a major reversal. And at the minimum, it tells us that consumers are thinking about moving again. But this change implies other things, too…

You see, the number of new single-family homes for sale is at its highest level since 2007. Seriously.

But the homes aren’t selling like they could be…

New-home sales peaked in 2005 at an annual rate of nearly 1.4 million. Today’s annual rate is about 619,000.

That’s less than half of the peak.

Of course, we aren’t aiming for the peak insanity of the housing boom. But we’re still far behind what you would expect.

The peak in the 1990s came in at an annual rate of about 995,000. That was in 1998 – and we’re still 38% below that level.

So we don’t know exactly what the next 12 months will look like. But we do know that a serious change is underway.

A huge number of new homes are for sale in the U.S. Unfortunately, consumers haven’t been able to buy them.

But now, consumer expectations around moving are changing. Expectations just hit a four-year high. So it’s possible we’re on the edge of a major shakeup in the housing market.

Good investing,

Vic Lederman