Editor’s note: Today, we want Chaikin PowerFeed readers to get to know Joel Litman…

Joel is the founder and chief investment strategist at our corporate affiliate Altimetry. He’s also a college professor and a certified public accountant.

More specifically, he’s a “forensic accounting” expert and one of the smartest guys we know.

Joel’s ability to accurately predict the market’s biggest moves has landed him invitations to the Marine Corps War College and the Pentagon. He has also exposed 57 companies for potential fraud – and many of them went bankrupt or fell to almost zero after his analysis.

Now, Joel is “sounding the alarm” on several warning signs for investors…

To that point, this essay first appeared in Joel’s Altimetry Daily Authority newsletter about a month ago. He believes one company’s looming collapse is just the start of trouble for a certain corner of the real estate sector. And yet, the market doesn’t seem to be concerned.

It’s worth noting that the Power Gauge agrees with Joel right now. Our one-of-a-kind system is currently “bearish” on both this company and the real estate sector as a whole.

So with that in mind, let’s get Joel’s take…

Membership is down…

Occupancy rates are falling…

And its stock price has cratered more than 90% this year…

That’s the situation embattled co-working business WeWork (WE) faces today.

The company was once seen as an exciting innovator that could revolutionize the way we think of office space. Then, a difficult initial public offering (“IPO”) tanked its valuations.

When WeWork finally went public in October 2021, it had to adapt to a corporate world forever changed by the COVID-19 pandemic.

Suffice to say, it failed the test…

In August, the company warned that it may go out of business.

WeWork never managed to adapt to the “work from home” shift. It bet on the growth of shared workspaces and invested heavily in new office spaces.

But then, occupancy in its workspaces fell from above 70% in 2019 to just 50% in 2021.

To try to stop the bleeding, WeWork has been exiting leases since then. It’s scaling back its portfolio and reducing costs.

But those measures weren’t enough…

Management is concerned about operational challenges and the excessive debt that the company is struggling to pay off. And WeWork’s second-quarter earnings failed to meet its own guidance from three months earlier.

WeWork’s stock has been on a one-way trip down since its IPO. And this year has been exceptionally awful for investors.

The company is officially grasping at straws. Earlier this month, it completed a 1-for-40 reverse stock split to avoid getting delisted from the New York Stock Exchange.

One of the most well-known companies in office real estate is officially sounding the alarm. If and when WeWork goes under, it could cause a ripple effect across the broader office real estate market.

Today, we’ll take a closer look at the challenging environment surrounding WeWork. And we’ll detail what it all could mean for the broader office real estate sector…

In short, offices have reopened. And yet, folks aren’t rushing to fill them. Around 30% of workers in the U.S. still operate under some form of hybrid work environment.

Companies are now reevaluating the need for large office spaces. Many businesses have opted to downsize to save money and adjust to having fewer employees in the office.

This shift has put a lot of pressure on office space owners like WeWork. These companies struggled during the pandemic – and are still struggling today.

They have empty buildings. And no one is interested in renting them.

Many investors believe WeWork’s issues are company specific. They don’t realize that this is an industry-wide problem. WeWork could be the first to fall. But we doubt it will be the last.

Folks have stopped paying attention to the lingering issues for office real estate. With declining occupancy and looming debt maturities, investors have been waiting for a catalyst.

And with WeWork approaching bankruptcy, they might finally realize that it’s time to get out of this sector entirely.

Office real estate investment trusts (“REITs”) spend billions of dollars purchasing and managing office real estate. Like WeWork, many of these companies are stuck with empty buildings, piles of debt from purchasing those buildings, and no sign that new tenants are coming anytime soon.

These issues have plunged WeWork to the brink of bankruptcy. It could be the first domino that kicks off a collapse in the office REIT industry.

And yet, the market is choosing to ignore these signs…

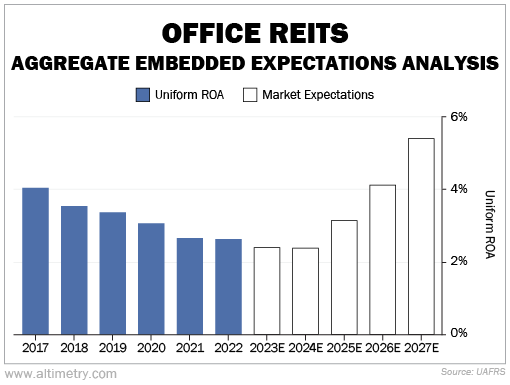

At Altimetry, we can see what investors expect from the office REIT industry through our aggregate Embedded Expectations Analysis (“EEA”).

Our EEA starts by looking at average stock prices across office real estate. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well the industry needs to perform in the future to be worth what the market is paying for it today.

At current valuations, the market isn’t at all concerned about the outlook for office REITs. In fact, investors are gearing up for a surge in these companies’ returns.

Aggregate Uniform return on assets (“ROA”) for office REITs dipped below 3% last year. The market expects that number to turn around, surpassing 5% by 2027. Take a look…

WeWork is a warning that office real estate faces significant headwinds. The world of office work has been forever changed by the pandemic. And those challenges aren’t going anywhere.

But investors somehow think the market for office space will get stronger in the future.

Office REITs have been hurting since the pandemic. And given low occupancy rates and looming debt maturities, we expect the pain to continue.

Work from home is now a staple of the American economy. This trend will continue to cap returns for office REITs and real estate businesses like WeWork.

For now, all eyes are on WeWork’s next move. And it remains to be seen if the company can claw its way back into anyone’s good graces.

In the meantime, considering the headwinds facing office spaces – and the market’s overall lack of concern – we’d recommend staying away from this entire industry today.

Regards,

Joel Litman

Editor’s note: We’re still “bullish” on stocks at Chaikin Analytics. And Joel doesn’t think you need to panic sell. But at the same time, he hasn’t been this worried about the markets and the economy since he predicted the 2008 financial crisis months in advance…

You see, Joel says a new crisis is coming to one part of the markets that could affect up to $50 trillion on Wall Street. And he believes it could have disastrous consequences for hundreds of stocks. (You might even own shares of some of these companies today.)

This shift is only one of the many warning signs Joel says are flashing red right now. That’s why he believes it’s time to take an important step with your money…

Joel used this same strategy to make incredible returns for his institutional clients when the market crashed in 2008. It has nothing to do with stocks, real estate, or anything like that.

He’ll cover all the details in a public broadcast next Wednesday, September 27. We strongly recommend that all Chaikin PowerFeed readers tune in. Reserve your spot right here.