Folks, the Power Gauge has spotted something interesting happening over at Walmart (WMT)…

You see, America’s legacy retailer had recently been underperforming the S&P 500 Index across several time frames.

But now, it seems the company is turning around…

In fact, the Power Gauge recently assigned Walmart a “bullish” rating. And using our system’s proprietary relative strength measure, we can see that a big change is taking place.

So today, let’s take a closer look at what’s going on with this retail giant…

Back on January 19, I discussed how Walmart had been working on growing its e-commerce business. As I said at the time…

Walmart has soared from almost no presence in the U.S. e-commerce market in 2016 to the No. 2 spot today. The company now holds more than 6% of the space.

But as I also explained, it’s still a long path to the No. 1 spot…

Amazon (AMZN) is still the runaway leader. It controls roughly 38% of the U.S. e-commerce market.

That makes Walmart’s dilemma all too clear…

Folks, Walmart is still a legacy retail business trying to catch up with the e-commerce pioneer on its own turf.

Furthermore, at that time, WMT shares were lagging the S&P 500. As I also said…

Over the past three months, the difference is extreme. The S&P 500 soared about 10% in that time frame. Meanwhile, Walmart’s stock is roughly flat.

Back then, Walmart’s stock had also been underperforming the S&P over the past year and the past five years.

But fast-forward a few months, and the Power Gauge is picking up on some new developments with the stock.

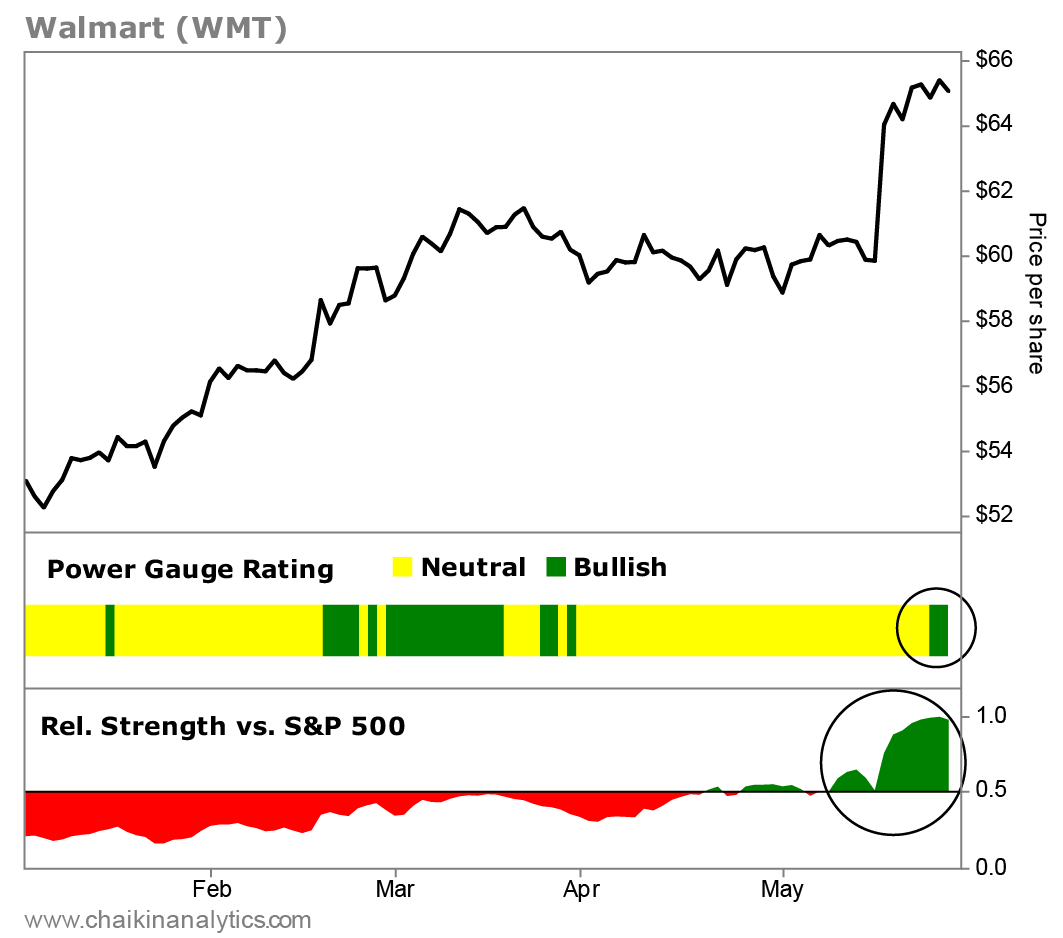

Let’s start with a year-to-date chart of Walmart’s stock with some data from our system…

First, notice that Walmart has recently earned a “bullish” rating from the Power Gauge.

Next, take a look at the bottom panel on the chart. That’s the Power Gauge’s proprietary measure of relative strength.

And as you can see, a major change has taken place. Walmart’s relative strength had been weak against the S&P 500 in recent months. But now, you can see that it has ticked much higher.

In fact, the Power Gauge rates Walmart’s relative strength as “strong.” And it sees the company’s consumer-staples industry group as “strong.”

Meanwhile, Walmart is making progress in e-commerce. In its first-quarter earnings release earlier this month, it reported that its U.S. e-commerce sales had jumped 22% year over year.

Walmart said that store pickup and delivery of online orders are growing. And it also said that Amazon-style sales are up. I’m talking about sales made by third-party vendors on the company’s online marketplace.

Now, Walmart is profiting by offering advertising and fulfillment services to those third-party vendors. Put simply, the company is still out to take increasing market share from Amazon.

In the most recent quarter, Walmart grew its pool of online marketplace vendors by 36% in the U.S. And it has grown the number of stock-keeping units on the marketplace to more than 420 million.

That doesn’t sound like a lot, but it’s possible that Walmart will end up offering a more curated experience than Amazon.

If you’re a regular Amazon user, you’ve likely noticed the site is flooded with odd off-brand products and bogus reviews. Walmart has the opportunity to learn from Amazon’s mistakes.

And if it navigates this right, consumers might eventually end up seeing Walmart as a more trustworthy online vendor.

It’s possible we’re already seeing the beginnings of that now…

Walmart attributed much of its e-commerce gains to households earning more than $100,000 annually. For a company traditionally associated with low-income consumers, that’s a notable development.

As I said back in January, I’m hoping to see a full-tilt “very bullish” rating. And Walmart still has a long way to go to catch up with Amazon in e-commerce.

But with its current “bullish” rating and booming relative strength, Walmart could be poised to move into even stronger territory. I’ll have my eye on this stock.

Good investing,

Vic Lederman