Did you notice the rising prices at the grocery store last year?

At least… did you think you noticed them?

Many U.S. consumers thought prices soared in 2023. But the reality was a lot different…

You see, last year, egg prices plummeted roughly 56% from January through November. Lettuce prices fell around 21% from December 2022 through this past November. And strawberry prices were down about 23% in a similar span.

Despite that misconception, grocery prices are still up over the past couple years. You didn’t completely imagine a higher bill. After all, we dealt with a severe bout of inflation.

That’s creating a big disconnect in Americans’ minds…

You see, a lot of regular folks believe consumer-staples companies are making a killing amid surging grocery-store prices. But many of these businesses actually struggled in 2023.

In fact, as I’ll show you today, consumer staples was one of the worst-performing sectors of the year. And even worse for investors, it still holds a poor rating in the Power Gauge…

Folks, we just finished an incredible year in the market…

The S&P 500 Index gained 24% in 2023. That’s a great return for the broad market in a single year.

Tech stocks did even better. The tech-heavy Nasdaq Composite Index was up 43% last year.

Both these indexes are hovering around new all-time highs. We’re officially in a bull market.

And yet, the Consumer Staples Select Sector SPDR Fund (XLP) fell 3% in 2023. That’s a staggering loss compared with the broad market and tech stocks.

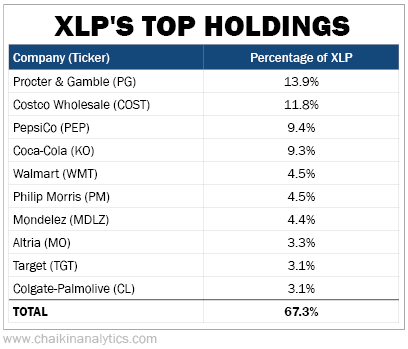

It’s clear that many grocery stores, big-box stores, and their suppliers are suffering. By that, I’m talking about many of the top holdings in this exchange-traded fund (“ETF”)…

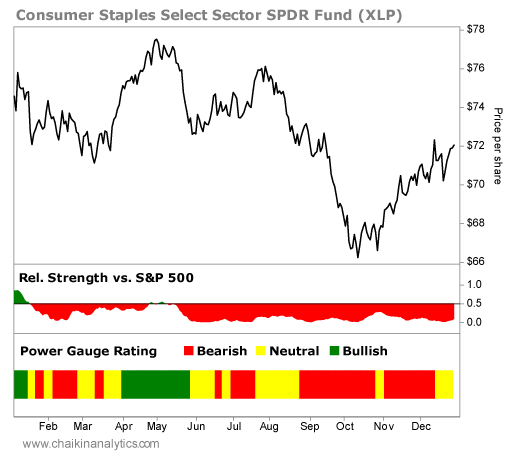

The chart below shows XLP’s poor performance over the past year. The ETF plunged throughout the summer and fall of 2023. And it hasn’t recovered yet. Take a look…

Plus, as you’ll notice, the Power Gauge saw it happening…

You can see in the bottom panel of the above chart that XLP was “neutral” or “bearish” for most of 2023. And as the ETF’s value dropped, the Power Gauge stayed mostly “bearish.”

So the Power Gauge made the right call on XLP last year. Now, the question is…

What’s next?

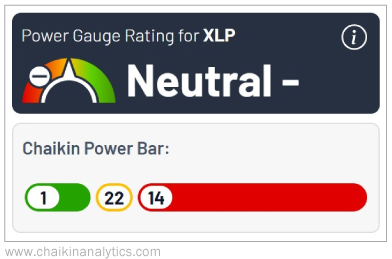

Well, XLP holds an unenviable spot in the Power Gauge today. It’s currently the worst-rated sector in our system based on its Power Bar rating. Take a look…

Only one holding in XLP earns a “bullish” or better grade in the Power Gauge right now. A staggering 14 stocks in the ETF are “bearish” or worse. And another 22 stocks are “neutral.”

When we add everything up, XLP receives a “neutral-” rating from the Power Gauge.

Heading into 2024, consumers are still feeling the squeeze when they shop at places like Walmart. And as it turns out, Walmart is feeling the squeeze as well…

In fact, Walmart CEO Doug McMillon warned Wall Street analysts and investors about these concerns back in November. During the company’s conference call that month, he said…

In the U.S., we may be managing through a period of deflation in the months to come.

So despite still-higher prices in stores, McMillon believes the era of soaring prices is over.

That leaves consumers in a rough spot. Things might get a little cheaper. But they won’t fall below pre-pandemic levels.

It’s tough on investors, too. Wall Street rewards growth. But at least for now, we’re not seeing that with consumer-staples companies.

Today, the Power Gauge agrees with McMillon’s take…

The Power Bar ratio for XLP helps us see that. So does the system’s “neutral-” rating – which signals negative expectations for the ETF.

For now, I’ll be keeping an eye on this sector. But I don’t expect a sharp turnaround soon.

Good investing,

Vic Lederman