Folks, this story is front-page news…

But in case you missed it, Fitch Ratings just downgraded the U.S. government’s credit rating.

Fitch’s highest credit rating is “AAA.” And now, the U.S. is one notch below that at “AA+.”

Credit-ratings agencies’ goofy letter systems always crack me up. But this is serious business…

Fitch is basically saying that U.S. debt isn’t as safe today as it was in the past.

That’s a bold claim considering the U.S. literally holds the right to print the world’s “reserve currency.” And many are seeing this downgrade as a political move.

Now, as a rule, I avoid politics as much as possible.

The problem is that politicians like to meddle with the markets. And when that happens, it becomes a story for us as investors. Fitch realizes that, too…

In its public statement, the company said that it doesn’t like our country’s growing ratio of debt to gross domestic product. But in reality, I believe this downgrade is almost certainly in response to U.S. politicians using the so-called “debt ceiling” as a political football.

Let’s sidestep that conversation today, though. The real reason we’re all here is investing. And when I saw the news this week, one big question entered my mind…

“What does this mean for stocks?“

Today, we’re going to answer that question…

If you’re a student of economic history, you’re likely screaming by now…

“This has already happened before.“

You’re right…

In August 2011, Standard & Poor’s (“S&P”) downgraded U.S. debt from its top-notch rating for the first time ever. And it was more direct about the reasoning. The credit-ratings agency said…

The downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges.

S&P’s downgrade came as the U.S. was trying to claw its way out of the 2008 housing crisis.

With the move, S&P made itself a political target. Just about everyone on Capitol Hill made a point of voicing their displeasure with the company in the ensuing days.

Well, in the end, it didn’t matter all that much.

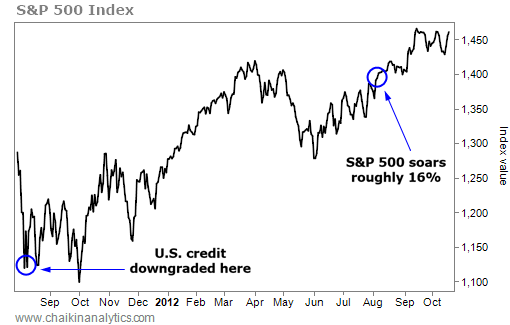

You see, the S&P 500 Index was up roughly 16% a year later. Take a look…

Was this a volatility-free era? Absolutely not.

Remember, like today, the U.S. was coming out of a major economic upheaval.

Despite that, the market marched on. And not long after S&P’s credit downgrade, the talking point became stale.

Of course, we don’t know that the market will soar from here. After all, as Chaikin Analytics founder Marc Chaikin loves to point out, we’re not crystal-ball readers.

But Marc and our other colleagues have also noted all the “bullish” signs in the market. And based on history, this credit downgrade might be yet another positive for investors…

That might sound crazy at first. It’s hard to imagine stocks rising after seemingly bad news. But I wouldn’t be surprised if the S&P 500 marched another 16% higher in the coming year.

After all, we’ve seen this playbook before.

Good investing,

Vic Lederman