Folks, we’re just a week away from Black Friday…

And two of America’s biggest mega-retailers are once again about to battle it out.

I’m talking about Walmart (WMT) and Target (TGT), of course. Together, these two companies accounted for more than $607 billion in consumer spending last year.

But if you’ve looked at their stocks lately, you might’ve noticed they’re on different paths. And to make matters more interesting, both companies just reported earnings this week.

Target surged nearly 18% following its earnings announcement on Wednesday. On the other hand, Walmart fell roughly 8% after it announced its latest results yesterday.

Based on those numbers, you might believe Target’s stock is the better choice right now. However, as I’ll show you today, Walmart is doing much better over the longer term.

So that leaves us with a couple of questions…

Which mega-retailer will win the next battle? And is either stock worth our investing dollars?

Let’s use the Power Gauge to take a closer look…

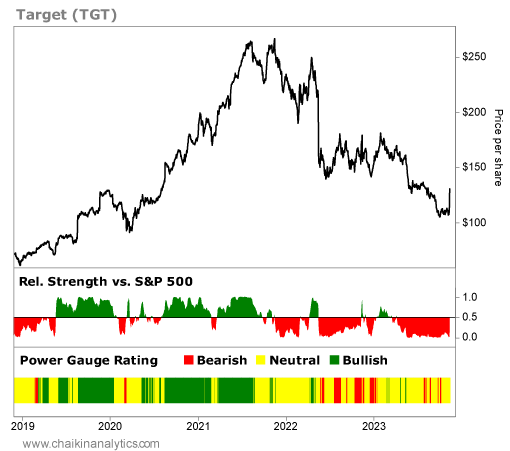

Now, it’s true that Target soared higher after its latest earnings report. But the Power Gauge still believes it’s a precarious pick right now. And it’s easy to see why on the chart…

The company is still down more than 50% from its November 2021 high.

Even worse, it has underperformed the S&P 500 Index for most of that period. And not surprisingly, the Power Gauge has flashed “neutral” and “bearish” warnings along the way.

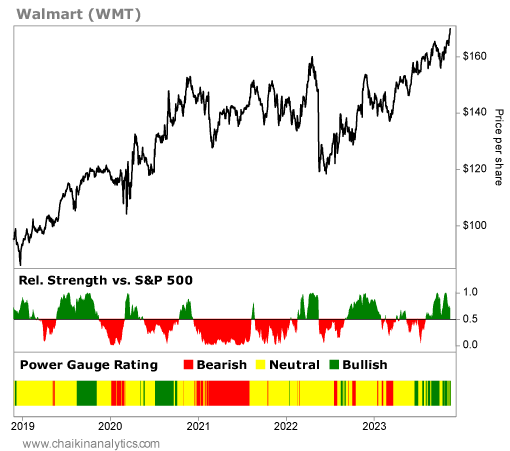

Next, look at Walmart’s chart…

Like the above chart for Target, this one also covers the past five years. And it should be immediately clear that something has been very different with Walmart in that span…

Walmart is in a long-term uptrend. It’s currently outperforming the S&P 500. And unlike Target, the Power Gauge is “bullish” on the company today.

Looking under the hood, I see that Walmart earns “bullish” or better grades for the Technicals and Experts categories. And it’s “bearish” in terms of Financials and Earnings.

So with the Power Gauge’s help, we know that Walmart’s price action is technical in nature right now. That’s not necessarily bad. But it means we should be careful.

For Target, the Power Gauge gives “neutral” or worse grades in every category except Earnings. The company gets a “very bullish” rating in that category right now.

That tells us the possibility for a legitimate turnaround does exist. But with a “neutral” overall grade, the Power Gauge also tells us that Target’s setup isn’t quite right yet.

Because of that, I’ll keep watching Target closely in the days and weeks ahead.

I’ll focus specifically on the grade for Experts. That category includes the factors for earnings estimate trend and analyst rating trend.

An uptick in those two factors could combine with its latest earnings-related bounce to signal a real uptrend. I’ll use the Power Gauge to watch for that type of move.

But for now, the Power Gauge makes the story on these two retail titans clear…

Walmart is in a defined, long-term uptrend. And while Target surged higher after its earnings report this week, that doesn’t lock in the turnaround investors hope for yet.

Good investing,

Vic Lederman