Folks, the U.S. military industrial complex can’t keep up…

That’s the crux of the draft version of the U.S. Department of Defense’s coming National Defense Industrial Strategy report. It’s packed with stark warnings about our defense capabilities.

Here’s one of the most surprising takeaways from the report…

U.S. defense spending is near its lowest level since World War II.

It clocked in at roughly 3.1% of U.S. gross domestic product last fiscal year. That’s still a huge dollar amount. But the percentage is small compared with other times in U.S. history.

In turn, a big problem is brewing for the U.S. military…

We’re shipping a lot of our existing supplies of tanks, missiles, and other weapons to help Ukraine and other allies around the world. But we can’t replace these items quick enough.

Today, we’ll use the Power Gauge to dig deeper into the state of the defense industry…

We’ve already seen some of the repercussions of this problem in Ukraine…

In May 2022, President Joe Biden and Lockheed Martin (LMT) promised to double the production of Javelin anti-tank missiles by 2024. And Uncle Sam opened the money spigot…

By last December, the security-assistance package from the U.S. to Ukraine grew to $21 billion. Among other things, this package included roughly 8,500 Javelin missiles.

But the plan ran into trouble almost immediately…

The defense industry caved under the pressure. A year later, production is still ramping up. Now, the U.S. hopes to double production by 2026 – two years later than the original plan.

It’s hard to understate the importance of these weapons systems…

Some sources put the Javelin missile’s “kill rate” at up to 90%. But whatever the actual number, it’s so high that a viral marketing campaign dubbed the weapon as “Saint Javelin.”

We can’t build enough of these missiles – at least not as fast as they’re needed. Even worse, this problem isn’t unique to the weapons used to help Ukraine in its current conflict…

The Defense Department also found that China is running circles around us in shipbuilding.

According to the think tank Center for a New American Security, China has launched 160 new ships since 2013. The U.S. only managed to build 66 new ships over the same period.

Folks, everything we’ve talked about so far today leads us to one takeaway…

Uncle Sam will spend more on defense in the next few years. And it will likely be a lot more.

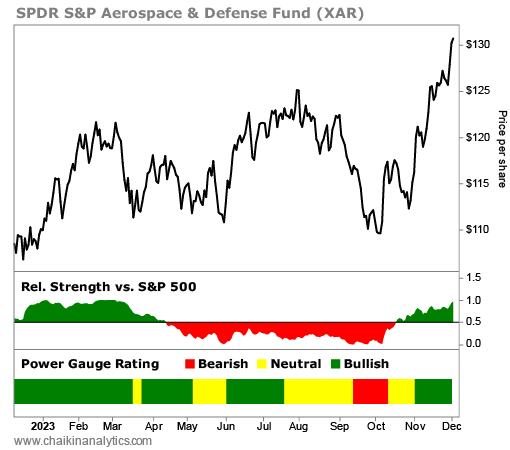

The Power Gauge helps us track this shift as it unfolds. We monitor the defense industry through the SPDR S&P Aerospace & Defense Fund (XAR). It gets a “bullish” grade today…

Notice that XAR turned higher in early October. Then, the defense-focused exchange-traded fund (“ETF”) started soaring later that month. It’s now up nearly 20% over that span.

Next, look at the bottom panels on the chart…

You’ll see that the Power Gauge flipped to “bullish” again on XAR as this rally began. The ETF once again started beating the benchmark S&P 500 Index around the same time.

That’s a powerful combination. And importantly, a lot of growth potential remains…

You see, most of XAR’s holdings currently earn a “neutral” rating from the Power Gauge. But as momentum shifts in this industry’s favor, they’ll likely flip to “bullish” or better ratings.

In the end, XAR is set for even bigger gains…

Uncle Sam is now grappling with the realities of lean defense spending. And we’ll likely see a big push from both political parties in the coming months and years to fix that problem.

When Uncle Sam turns on the money spigot, it can change the game for these companies.

So I’ll keep a close eye on the defense industry. And I recommend you do the same.

Good investing,

Vic Lederman