There’s no question the broad market has had an incredible 2024 so far…

The S&P 500 Index is up roughly 21% this year. It has also been hitting new highs again. And so has the Dow Jones Industrial Average.

But what about the tech-heavy Nasdaq 100 Index? Folks assume that hot tech stocks are supposed to soar past the slower-moving broad market.

Well, that hasn’t happened recently. But as I’ll explain, a quick look at the Power Gauge tells us it likely will soon…

First, if you’re wondering what’s holding the Nasdaq 100 back… just look at Big Tech.

You’ve likely heard plenty of stories in the media about layoffs.

For example, back in the spring Tesla (TSLA) announced plans to lay off roughly 14,000 people. In August, Intel (INTC) dropped another 15,000 workers. That same month, Dell Technologies (DELL) let go of 12,500 employees.

That doesn’t even touch on the antitrust probe against Google’s parent company Alphabet (GOOGL). We’ve heard increasing chatter about a potential breakup of the company. (If you missed it, I shared my long-term view on that situation back in August.)

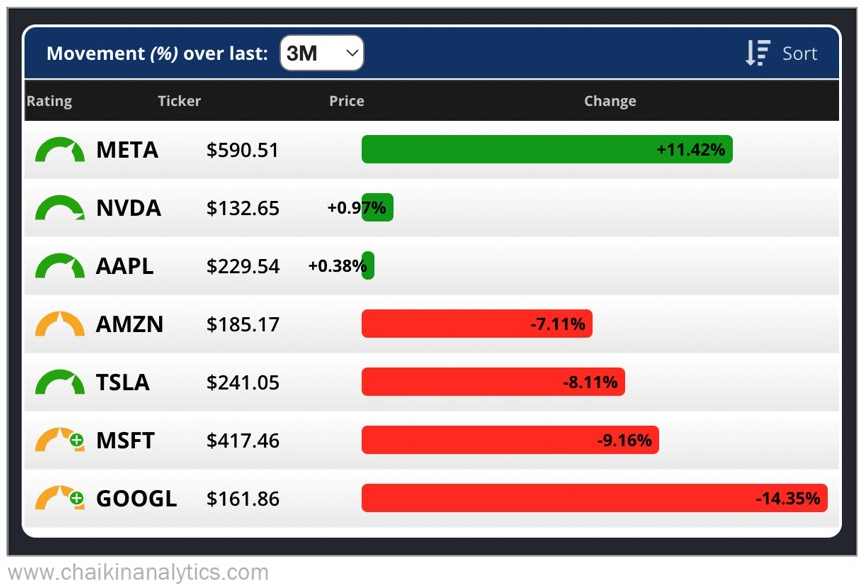

I put together a quick list of the so-called “Magnificent Seven” stocks in the Power Gauge. And it illustrates the Nasdaq 100’s problem perfectly…

Put simply, Big Tech has struggled over the recent three-month period. And that’s a big deal for the Nasdaq 100.

As you can see, Apple (AAPL) has barely moved sideways. And it makes up roughly 9% of the index.

Microsoft (MSFT) is the next largest holding at about 8%. It’s down more than 9% over that three-month period.

So it might seem simplistic, but it’s obvious that Big Tech is what’s holding the Nasdaq 100 back from new highs.

But not for long…

The below screenshot from the Power Gauge shows the Magnificent Seven’s performance over the recent one-month period. As you can see, it’s a different story…

It’s obvious that whatever was tying Big Tech down isn’t as bad as it was. And the Power Gauge agrees broadly, too.

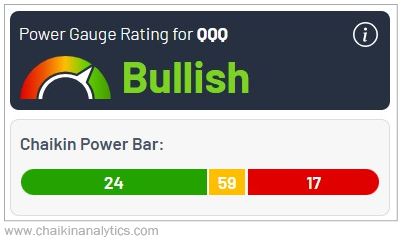

We use the Invesco QQQ Trust (QQQ) to track the index in our system. And QQQ recently turned “bullish” in the Power Gauge. It has mostly been in “neutral” territory since late July.

Better still, the number of “bullish” stocks in QQQ is growing. Here’s how the breakdown stands in the Power Gauge…

As you can see, QQQ holds 24 stocks with “bullish” or better ratings. Meanwhile, 59 are rated “neutral.” And 17 earn a “bearish” or worse rating.

Obviously, we would want to see more stocks move from “neutral” to “bullish.” But as we’ve seen today, that’s in progress.

Companies like Amazon (AMZN), Microsoft, and Alphabet are still in “neutral” territory in the Power Gauge. But their performance over the recent one-month period shows us that they’re in the process of turning around… big time.

With that kind of momentum, it makes sense to expect that the Nasdaq 100 could be on the way to new highs again soon.

Regular readers know that Chaikin Analytics founder Marc Chaikin has been predicting a big end to this year for stocks. And with Big Tech on the move higher again… that helps support the case for more upside ahead.

Good investing,

Vic Lederman