Editor’s note: Here at the Chaikin PowerFeed, we’ve shared occasional essays from our friend Brett Eversole over at our corporate affiliate Stansberry Research…

Regular readers know that Brett has been bullish for 2024 – and so have we. As such, we’ve shared insights from him on why he thinks stocks have more room to run higher.

That’s the case with today’s essay, which first appeared in Brett’s free DailyWealth e-letter on April 4. We’ll turn things over to him to explain another piece of evidence for more upside ahead…

Investing is starting to feel easy again…

That’s a major change from the pain in 2022 – and the disbelief in 2023. Stocks have marched higher this year with nearly zero volatility.

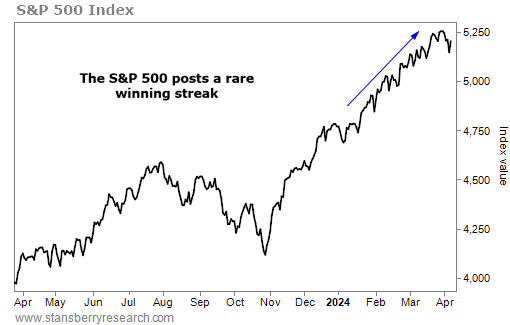

The S&P 500 Index has already hit more than 20 new all-time closing highs this year. But even that isn’t the biggest force behind the “easy” feel in markets.

Far more important is this… Even on days when we’re not hitting new highs, we’ve been darn close.

Based on history, that means the gains we’ve seen can continue – with 17% potential upside over the next year.

No bull market is a one-way ride up. Stocks can still swing erratically during a rally… with lots of downs alongside the ups. Those kinds of markets can feel scary, even though everyone is making money.

By contrast, an “easy” market is marked by a relentless push higher. Stocks go up a little at a time, day after day. The down days are rare. And they’re never more than a slight breather.

That’s what we’ve seen so far in 2024. Stocks have marched higher in a steady, workman-like fashion. Take a look…

One way to measure the ease of today’s market is its proximity to all-time highs. By this measure, the S&P 500 just pulled off an incredible streak.

Specifically, stocks recently hit a streak of staying within 2% of an all-time high for 60 straight trading days. The lack of volatility is what makes investing feel easy.

This is a good sign for future returns, too. We’ve only seen 11 other streaks this long in the past 30 years. And the gains have a history of continuing. Take a look…

The past three decades have been great for stock investors. The S&P 500 returned 8.4% a year over that period. But if you buy during times like today’s easy market, you can do much better…

Similar setups led to 6.6% gains in six months and 16.5% gains in the next year. That’s massive outperformance. It’s nearly double what you’d normally expect to earn in a year with a typical buy-and-hold approach.

What’s more, these situations have a perfect track record of consistent profits. Stocks were higher 100% of the time a year later… And they were up double digits 81% of the time.

The market has gotten easy for investors this year. But we shouldn’t fear a reversal anytime soon, according to history.

We’ve just seen an incredible streak. And it points to even bigger gains in the months ahead. Make sure you’re positioned to take advantage of it.

Good investing,

Brett Eversole

Editor’s note: To get insights like this from Brett and his team on a regular basis, we encourage you to check out his DailyWealth e-letter…

It’s 100% free of charge and publishes in the morning each weekday the markets are open – just like the PowerFeed. You can learn more about it and sign up by clicking here.