Folks, we’re still a long way from “normal”…

China’s slow exit from the pandemic left global supply chains in tatters. That meant limited stock of everything from groceries to semiconductors at the mercy of surging demand from other countries.

Then Russia invaded Ukraine – driving up global energy prices almost overnight.

And enter the Federal Reserve… The central bank took us on a roller-coaster ride from an era of unprecedented low rates to the steepest, most vicious rate-hike cycle in decades.

It was 11 rate hikes in less than two years for a total of 525 basis points. And since rates were coming from such a low base of 0.25%, the Fed effectively hiked rates 21-fold.

By the end of 2023, inflation had been brought down by almost two-thirds from its June 2022 high of 9.1%. It was last recorded at 3.4% for December 2023.

But instead of celebrating what is clearly a victory in the fight against inflation, the markets seem constantly on edge.

Folks have been traumatized by the dizzying events over the past four years. Investors spook easily at the mere mention of stronger economic data that could lead to a rebound in inflation. It makes no sense at all.

The truth is that we’ve become so used to low inflation that we’ve forgotten that the average inflation rate for the past 60 years is higher than recent levels. From 1960 to 2022, inflation averaged 3.8% per year.

If we go back 100 years, the average inflation rate is a slightly tamer 3.1%. That’s still not too far from the most recent figure.

My point is that even if inflation stayed where it is today or rose to the level of its 60-year average, it shouldn’t be cause for panic. The long-term picture tells us that everything is still OK.

And as I’ll explain next, we also have reasons to believe inflation will remain stable or come down further from recent levels…

The first reason is China, which is undergoing its slowest period of economic growth since the country joined the World Trade Organization more than 20 years ago.

China is dealing with a real estate slowdown unlike any it has experienced before. And this has decimated its stock market. As I mentioned last week, it’s a roughly $6 trillion market rout that began back in 2021.

Slower growth in China means weaker demand for everything from copper to iron ore by the world’s No. 1 consumer of base metals.

The next reason is energy prices, which have been stable despite the situation in the Middle East.

Recent attacks from the Iran-backed Houthi rebel forces in Yemen have forced oil tankers transporting about 10% of global oil supplies to reroute away from the Red Sea. That has added extra weeks to the tankers’ travel time.

However, this is being offset by worries about China – the country is the second-largest oil consumer, but its economy is in trouble – and soaring U.S. oil production.

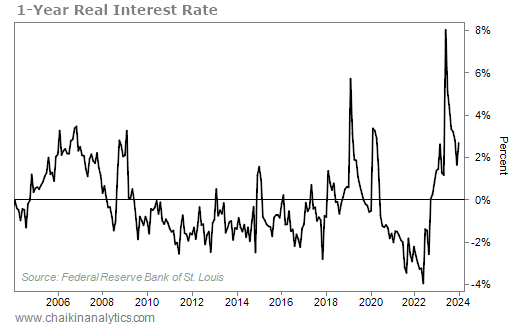

Lastly, real interest rates in the U.S. are among the highest levels we’ve seen in the past 20 years…

The real interest rate is the yield on the U.S. Treasury adjusted for inflation. It tells you how much you’re left with after taking into account inflation’s effect on your yield.

A high positive real interest rate, like what we have today, increases the appeal of keeping money in the bank – where it can generate positive real returns without risk to businesses and investors.

In the chart below, you can see that while real interest rates are down from the peak last year, they’re still much higher than they have been for most of the past couple decades. Take a look…

Sure, inflation has been made out to be this “boogeyman” that all of us need to be constantly worried about.

I disagree.

Of course, overly high inflation isn’t good. But inflation in general forces companies and investors to be more careful with how they utilize their capital.

It raises the cost of money. And in doing so, it puts pressure on companies and investors to find ways to generate higher returns for every dollar spent.

Looking ahead, that should be a good thing for the U.S. economy and the stock market.

Good investing,

Vic Lederman