The economy often moves slower than investors expect…

For example, policies from new presidents don’t change the economy overnight. It takes time to build single-family homes. And there’s an incredible lag between interest-rate policy and real-world results.

Put simply, macroeconomic trends take time to play out.

Now, if you’ve been paying attention to the financial media, you’ll know that commercial real estate is in trouble. It has been since the COVID-19 pandemic broke out in 2020.

That’s because the pandemic changed the white-collar landscape. The big shift to working from home never fully ended.

Sure, some companies have been calling employees back to the office. But many employers have transitioned to “hybrid” work, with a combination of in-office and at-home presence. The fear of losing workers in droves has led to compromises.

Meanwhile, just about anyone with a basic understanding of economics could see this was a problem for physical offices. After all, office space vacancies soared. And commercial real estate prices are dependent on cash flow – or “rents.”

So it’s no surprise investors expected a storm in commercial real estate.

They waited… and waited. Heck, they waited for years.

Some even gave up. They thought that maybe the storm wasn’t coming.

But folks, it’s here now. As I’ll explain today, the data is as clear as it gets…

Commercial real estate prices are falling… In fact, they’re falling fast.

It’s the first time we’ve seen this since the 2008 housing bust. And it’s something we need to take seriously.

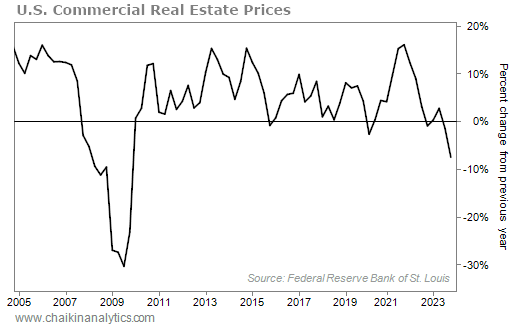

The chart below measures U.S. commercial real estate prices. Specifically, it shows the percentage change from the previous year.

So when a quarterly price is below the zero line, it’s telling you that the price has fallen by that percentage compared to the prior year.

Take a look at how prices have changed since the mid-2000s…

Right away, you’ll notice that the line very rarely goes negative… That makes sense.

Commercial real estate is one of the strongest businesses in the world. You just have to look at growing cities to know that.

So it makes sense that the line would stay above zero most of the time. It’s unusual for commercial real estate prices to fall that far.

As you can see on the chart, the last time they turned deeply negative was after the 2008 bust.

In fact, in the fourth quarter of 2009, commercial real estate prices were 30% below their levels from the prior year. That’s a catastrophe.

Obviously, we’re nowhere near there today. But prices are falling.

The latest reading from past quarter tells us that prices have fallen 7.5% from the prior year. In the real estate world, that’s a big decline.

But that doesn’t mean it’s time to run for the hills.

Yes, prices are falling. But delinquency rates are relatively stable.

In fact, delinquencies on commercial real estate loans are roughly where they were in 2004. We’re seeing some defaults… But it’s nowhere near “bad.”

Putting it all together…

Commercial real estate investors are hurting. Prices are falling. And I expect we’ll see more pain ahead as the storm continues.

But defaults are still low. So we know that we’re not at crisis levels today.

This is a space I’ll be watching closely. And I recommend you do the same.

In the meantime, remember that macroeconomic trends take time to play out. It could easily take a few quarters before we see a significant change in the data.

Good investing,

Vic Lederman