Editor’s note: Here at the Chaikin PowerFeed, we’ve noted previously that too many investors are chasing risk with meme stocks like GameStop (GME)…

As we’ve said, these types of trades aren’t about investing. They’re about gambling on an extreme outcome.

Over at our corporate affiliate Stansberry Research, our friend Sean Michael Cummings has also been warning about another type of high-risk activity in the markets…

Today’s essay from Sean published in Stansberry’s free DailyWealth e-letter last Monday. In it, he explains how investors need to be highly cautious of a particular investment product that has promised casino-like gains…

Americans are turning into risk addicts…

Take sports betting, for example. Six years ago, the U.S. Supreme Court overthrew a federal ban on the activity… And by 2023, the one-year total betting market reached a staggering $120 billion.

Now, I’m not opposed to gambling. It’s good fun, and it can even pay off on occasion. But the risk addiction is getting out of hand…

According to a recent study, legalized sports betting reduces net stock market investing by 14%. In other words, some folks are turning their backs on investing… and embracing high-stakes gambling instead.

And now, risk addiction is reshaping the stock market itself.

A new kind of exchange-traded fund (“ETF”) has promised casino-like multipliers for single stocks. But betting on these products may be even riskier than gambling…

In July 2022, a new financial product hit the market – “leveraged single-stock” ETFs.

These products do exactly what it says on the label. They offer exposure to just one company, with leverage. For example, the Direxion Daily TSLA Bull 2X Shares (TSLL) lets you own Tesla (TSLA), but with double the potential gains – and double the risk of losses.

Like sports gambling, single-stock leveraged products are big business. Traders have already sunk $5 billion into leveraged Nvidia (NVDA) ETFs alone.

However, these products are extremely risky. And it might not be for the reasons you think…

See, single-stock ETFs don’t multiply a stock’s performance over the long term. They only multiply its price action for a single day.

That means your position “resets” every morning… which can absolutely crush your returns over time.

I described the math behind this process in an issue of DailyWealth back in October 2022. As I said back then…

Let’s say that on Monday, a single stock and its twice-leveraged ETF both open at $100. By the end of the day, the stock falls 10% for a $10 loss. The ETF doubles that loss and falls $20.

Now the stock is worth $90, and the ETF is worth $80.

On Tuesday, the stock goes on a tear. It rises 10% – a gain of $9. The ETF doubles that, soaring 20%. Because it started the day at $80, the ETF’s gain is $16.

So the stock closes at $99, down just 1% from where it started. Meanwhile, the ETF closes at $96. With double leverage, you might have assumed you’d be down 2% on the ETF… But instead, you’re down 4%.

The ETF reset at a lower basis on day two, so its upside potential fell. That’s the problem with leveraged funds… They decay with every drawdown.

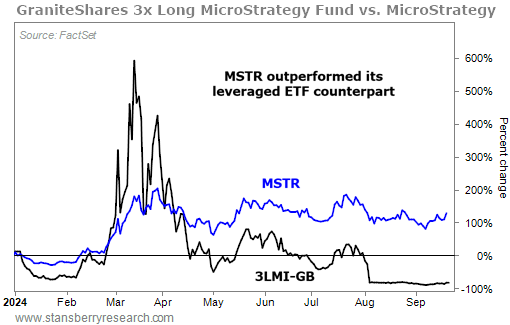

Today, we have a new example of just how dangerous this is. It’s the GraniteShares 3x Long MicroStrategy Fund (3LMI-GB)…

This ETF seeks to triple the gains of U.S. technology company MicroStrategy (MSTR).

If you bet that MicroStrategy would rise at the start of the year, you were dead on. MSTR has soared more than 100% year to date. The stock has been a big winner.

But if you’d tried to multiply your bet with a leveraged ETF, you would have made a big mistake.

See, MicroStrategy is a hyper volatile stock, moving 7% on average every day. Those whipsaws leave a lot of room for decay to set in…

Sure enough, in a year when MicroStrategy has soared more than 100%, its triple-leveraged ETF has fallen more than 80%. Take a look…

Even if 3LMI-GB buyers made the right call on MicroStrategy, they took a huge loss if they held the fund long term.

Single-stock ETFs seem like a way to make easy money. But simple math shows how badly these products can harm your investment over time.

The risk addiction may be fun, and even a little thrilling. But remember, the stock market is not a casino… And treating it like one is a great way to lose money.

Good investing,

Sean Michael Cummings

Editor’s note: To receive regular insights like this from Sean and his colleagues, consider signing up for DailyWealth. Just like the PowerFeed, it publishes in the morning every weekday the markets are open. And it’s 100% free. Learn how to sign up for DailyWealth by clicking here.