One of the biggest pharmacies in the U.S. is in a rough spot…

You might have heard it in the news already. Walgreens Boots Alliance (WBA) is struggling.

Just this past Thursday, Walgreens released disappointing third-quarter earnings results. And the company announced that it would close a “significant” number of underperforming U.S. stores.

Specifically, as Walgreens CEO Tim Wentworth said in the press release…

We continue to face a difficult operating environment, including persistent pressures on the U.S. consumer and the impact of recent marketplace dynamics which have eroded pharmacy margins.

This is terrible for the company. But the problems aren’t new…

Walgreens’ share price has struggled since 2020. And this year has been particularly challenging.

So today, let’s take a closer look through the lens of the Power Gauge…

Folks, it should be obvious that we don’t want to buy stocks in defined downtrends. And there’s no question that Walgreens is in a downtrend.

Since the beginning of 2020, WBA shares have tumbled about 80%. That’s a crushing defeat.

But Walgreens is a household name. And by now, there’s no question that the stock is “cheap” from a valuation perspective.

Heck, Walgreens is trading at a price-to-sales ratio of 0.07. That means for every $1 of sales the company does, Wall Street values it at $0.07.

Beyond that, Walgreens is part of a strong industry group in the Power Gauge – Consumer Staples Distribution & Retail.

And right now, that industry group is packed with “bullish” stocks. That means there’s an economic tailwind pushing the group higher.

Put that way, Walgreens’ stock might sound appealing. And it’s possible this could tempt investors to buy… hoping for a turnaround.

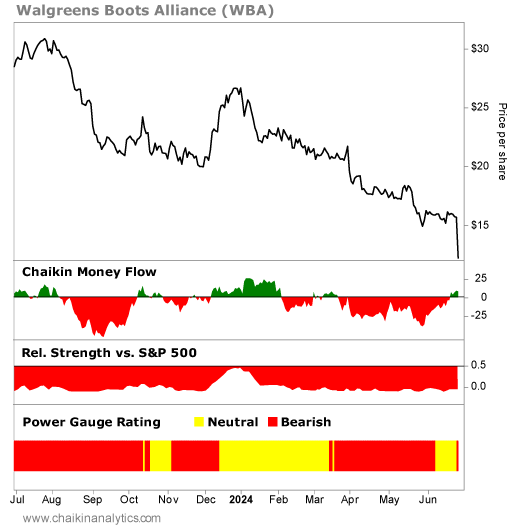

Well, the Power Gauge makes it easy to know that it’s not time yet. Take a look at this one-year price chart with some data from our system…

We can see some key signals from the Power Gauge…

The first is the Chaikin Money Flow indicator. Regular readers know that Chaikin Analytics founder Marc Chaikin invented it back in the 1980s. It’s used to track the buying patterns of the so-called “smart money” on Wall Street.

As you can see in the first panel below the price chart, Walgreens’ Chaikin Money Flow has been sharply negative for most of the past year. And right now, this indicator is rated “very bearish” in the Power Gauge.

This means institutional investors haven’t been falling for this “value trap.”

Next, the second panel below the price chart shows Walgreens’ relative strength versus the S&P 500 Index. And with this indicator deep in the red, we can see clearly that Walgreens is underperforming the broad market.

This year alone, Walgreens has tumbled more than 50%. Meanwhile, the S&P 500 is up nearly 15% so far in 2024.

That’s severe underperformance. And it’s important because it makes it clear that there isn’t a hidden turnaround in progress at Walgreens.

Lastly, you’ll notice that Walgreens has maintained a “bearish” or worse rating in the Power Gauge for most of the past year.

And that’s the clear signal we need…

It means that the Power Gauge has evaluated 20 individual factors driving Walgreens’ stock. Taken together, they currently add up to a “bearish” overall rating.

Now, Walgreens might be a little too obvious. After all, the stock has been in free fall for years.

But have you ever been tempted to buy a stock that seems overly hated? What about buying a stock that felt like an obvious “deal?”

The Power Gauge has the tools we need to immediately confirm or reject those ideas.

And that’s why it’s a good idea to check it before putting money to work in a stock… even a household name like Walgreens.

Good investing,

Vic Lederman

Editor’s note:

P.S. Last week, Marc went on camera to explain how the Power Gauge is signaling a major opportunity in a specific group of stocks right now…

In fact, a market signal with 100% perfect historical accuracy is telling Marc it’s finally time to share his No. 1 favorite stock strategy. And he expects it to beat the S&P 500 and the “Magnificent Seven” stocks for years to come.

If you missed Marc’s big reveal, you can still watch a replay with all the details right here.