Folks, “Roaring Kitty” has been back in the spotlight recently…

Keith Gill is better known as “Roaring Kitty” on social media. He has been a vocal proponent of GameStop (GME). And he played a role in the 2021 “short squeeze” that sent the meme stock soaring.

You probably remember the event. GME shares spiked 8,000% at one point in less than a year before many brokerage firms halted trading on it.

That led to cries of a market “rigged” against individual investors. And Gill even ended up providing testimony about the event in front of Congress.

Put simply, it was a spectacle.

Earlier this year, Gill’s reappearance on social media caused another brief frenzy in the stock.

And just recently, a GameStop shareholder sued Gill – accusing him of engaging in a “pump and dump” scheme involving the stock. The shareholder ended up dropping the suit within days of the filing.

Now, long-term GameStop fanatics might be hoping for another wild ride.

So today, I’ll explain why the Power Gauge is signaling to be cautious on the stock right now…

Folks, there’s nothing wrong with having fun while investing. And if that means spending a bit of money on an occasional wild idea… that’s OK, too.

But we need to be realistic about it. Meme stocks like GameStop are attracting a specific type of “investor.”

That’s because this trade isn’t about investing. It’s about gambling on an extreme outcome.

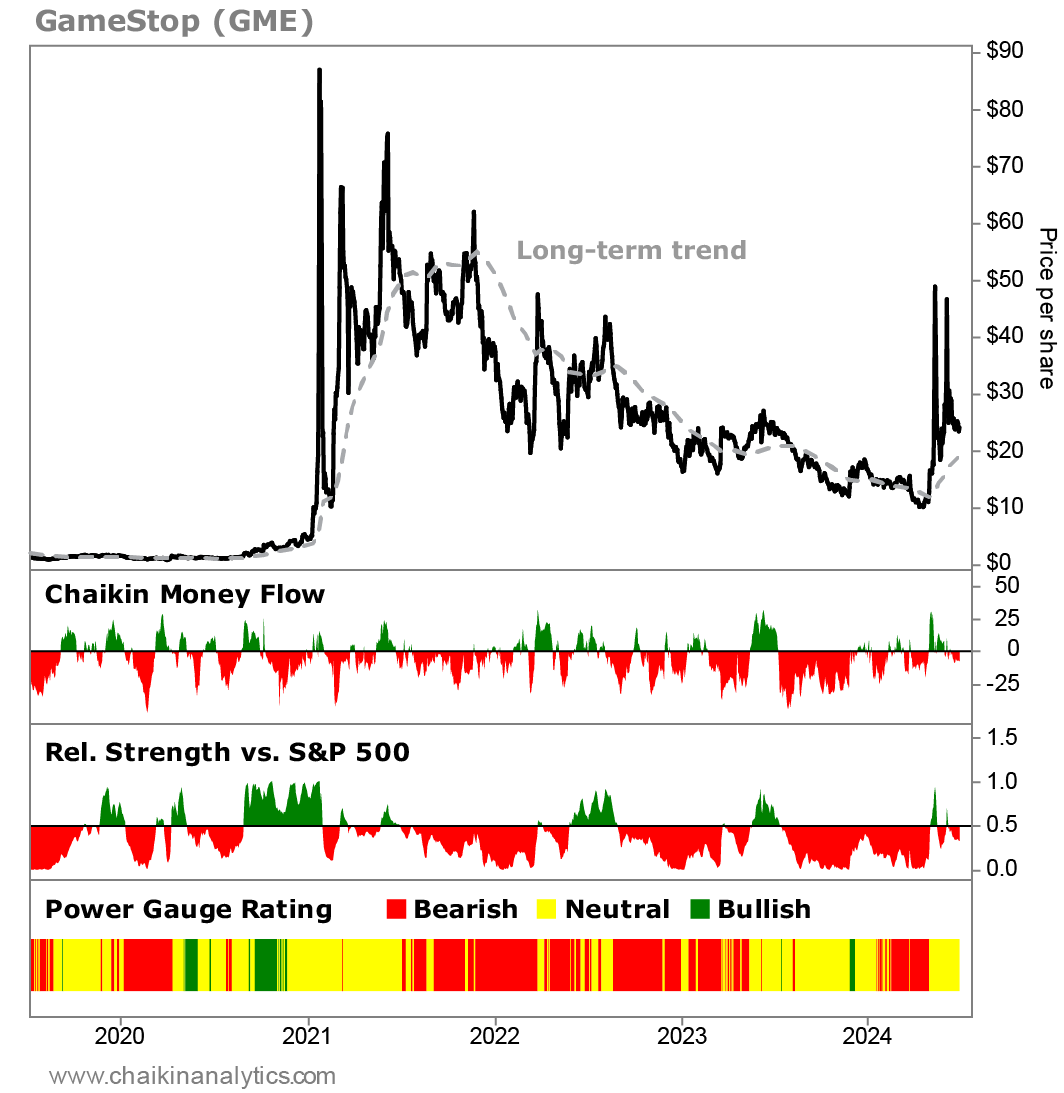

Just take a look at this five-year chart of GameStop with some data from the Power Gauge…

As you can see, the stock has struggled.

It was struggling before the short-squeeze event. And it has struggled since then.

You’ll also notice that GameStop has maintained a “neutral” or worse Power Gauge rating for most of the past five years.

And based on its relative strength versus the S&P 500 Index, you can see that the stock has underperformed the market during most of that same time.

Meanwhile, GameStop hasn’t been consistently attracting what we would describe as normal institutional trading activity. We can see that with the weak readings for Chaikin Money Flow. This measures the so-called “smart money” on Wall Street.

Instead, we see a stock that had unusual spikes higher and subsequent blowups. But that doesn’t mean it’s an “investment.”

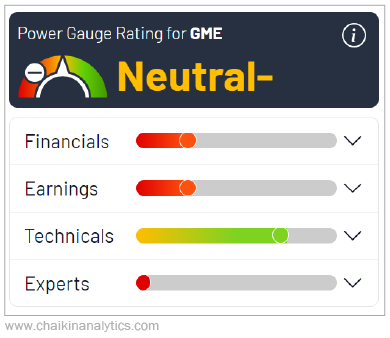

Today, GameStop earns a “neutral-” rating from the Power Gauge. That means the stock was previously rated “bearish” but has moved above its long-term trend line.

That makes sense. The return of Gill is bringing broader retail attention back to the stock. But one look at the company’s Power Gauge rating makes it clear that the crowd is here to gamble. Take a look at this screenshot from our system…

GameStop fails in the Financials, Earnings, and Experts categories. And if you’ve followed the news, you know that the company has cashed in on media frenzy.

GameStop’s share count has exploded since its low in 2021. The company has issued billions of dollars’ worth of shares in the past few years.

So if you’re looking to gamble in the markets… a meme stock like GameStop might be exactly the kind of thing that interests you.

But don’t let the media attention fool you into thinking there’s something real going on here.

If you’re looking for an “investment,” GameStop just isn’t it… at least, not by any reasonable standard.

Good investing,

Vic Lederman