Sometimes, being a “leader” just isn’t what you’d hope…

On March 11, 2021, fabric and crafts retailer Joann (JOAN) announced its initial public offering (“IPO”) pricing. The company would start trading on the Nasdaq exchange the next day. And it had been roughly 10 years since Joann last traded publicly.

The company applauded itself in the press release. It said it was “the nation’s category leader in sewing and fabrics and one of the fastest growing players in the arts and crafts industry.”

But despite the fanfare, Joann didn’t get off to an ideal start…

At the time, the company had 855 stores in the U.S. And it had just paid down $433 million in debt. That brought its total debt load to roughly $930 million.

Still, Wall Street wasn’t impressed.

Joann had hoped to raise $186 million in the IPO. But it only raised roughly $131 million.

Share prices fared poorly, too.

Trading opened around $12. That was well below the proposed price range of $15 to $17.

It only got worse from there. And as I’ll explain, the Power Gauge saw it coming…

As regular Chaikin PowerFeed readers know, the Power Gauge requires at least a year of data to assign a rating. And as soon as it was able to do so, our system flashed a warning sign for Joann.

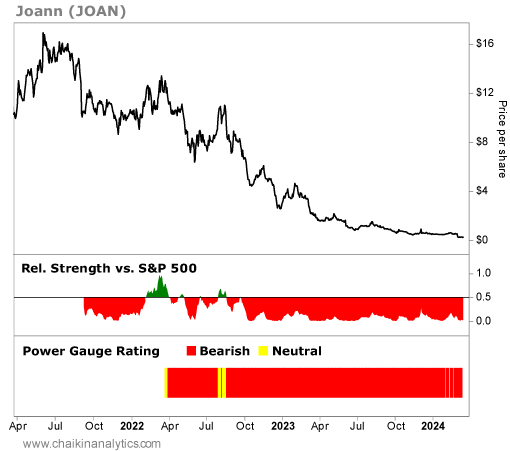

Take a look…

It started with a “neutral” rating…

At the time, JOAN shares were trading between $12 and $13. That was above the IPO price.

The Power Gauge also noticed that Joann had briefly outperformed the S&P 500 Index. We see that using a proprietary relative-strength measure.

On the chart, it’s the green and red panel. And as you can see, the run of outperformance didn’t last long…

In fact, Joann has underperformed the broad market nearly the entire time it has traded publicly. That’s not what you want to see from a “leader” in a space.

Not surprisingly, the Power Gauge quickly assigned Joann a “bearish” rating. And the stock has maintained that rating – or worse – for most of its existence.

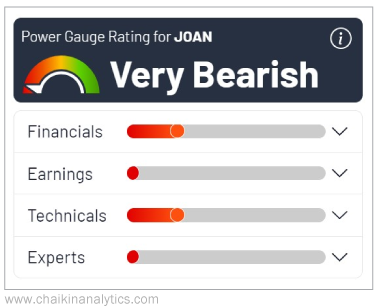

Digging just a little deeper into our system, we can see that the individual factor category ratings for the company are about as bad as they get right now. Check out this screenshot from the Power Gauge…

Remember, the Power Gauge rates 20 individual factors split into four distinct categories. Today, every one of Joann’s top-level categories earns a “bearish” or “very bearish” rating.

And just yesterday, the company announced that it’s filing for bankruptcy.

Folks, it’s unquestionable that hindsight makes this one seem obvious. Joann’s listing was on shaky ground from day one.

That said, a year after the IPO, the stock was outperforming the broad market. And it looked like it might have had potential to be a big winner.

But the Power Gauge knew better. And it flashed a clear warning.

Today, JOAN shares trade for less than $0.20. That’s a staggering 98% loss in just a few years.

It’s the kind of wipeout that can crush a portfolio.

Sure, we can all think that we would avoid a blowup like Joann…

But I’d rather have the advance warning from the Power Gauge to avoid a trap like this.

Good investing,

Vic Lederman