You might not think chicken nuggets have much to do with investing…

That’s especially true for dinosaur-shaped “Fun Nuggets.” After all, they’re made for kids.

But this product is a serious business for Tyson Foods (TSN). And unfortunately for the packaged-food producer, that part of its business just suffered a big setback…

On Saturday, the U.S. Department of Agriculture reported that some 29-ounce packages of Tyson’s dinosaur-shaped nuggets could contain metal. Specifically, according to Tyson…

A limited number of consumers have reported they found small, pliable metal pieces in the product.

To be safe, the company recalled nearly 30,000 pounds of chicken nuggets.

A massive recall of a popular product is not what Tyson needs right now. The company’s stock is down 25% this year. And it has lost more than 50% from its February 2022 peak.

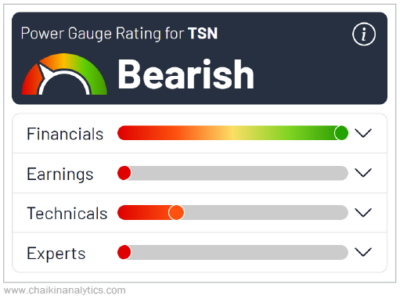

With a performance like that, I’m willing to bet that you could already guess the Power Gauge’s take. In short, our system currently holds a “bearish” rating on the company.

Today, I want to take a closer look at this situation. As you’ll see, the Power Gauge believes the near-term future is bleak for Tyson. But it’s not all bad news for the stock…

Put simply, Tyson is a big deal in the chicken-production space…

In fact, Tyson is the largest poultry producer by sales in the U.S. And the Arkansas-based company currently employs more than 140,000 people.

But the company’s market-dominating position hasn’t helped its stock recently…

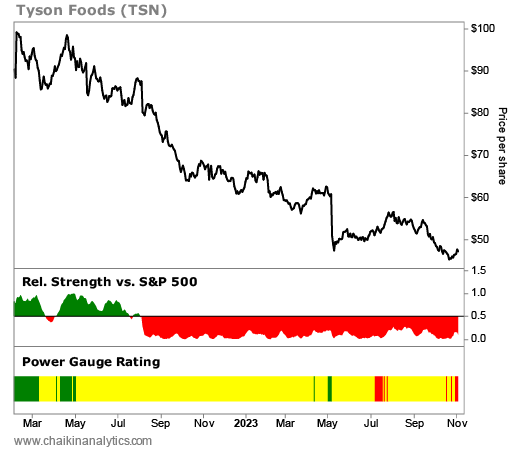

You’ll notice that the stock has plunged over the past 21 months. It closed as high as $99.09 per share in February 2022. But it’s down 53% to roughly $46.50 per share today.

Tyson lost its “bullish” overall rating in the Power Gauge in the spring of 2022. And by that August, the stock was firmly underperforming the benchmark S&P 500 Index.

The Power Gauge’s Earnings, Technicals, and Experts categories paint a dismal picture for Tyson today. These three categories account for 15 out of the system’s 20 overall factors. And the company currently earns a “bearish” or “very bearish” grade in each category.

So it makes sense that Tyson receives a “bearish” overall rating…

But I want you to notice something interesting with the Financials category…

Tyson currently holds a “very bullish” rating in this category. And for good reason…

The company’s price-to-sales ratio is 0.3 today. That means the market currently values every dollar of its sales at roughly 30 cents.

In other words… Tyson’s stock is extremely cheap based on its sales.

I’ll be watching this situation closely…

Tyson’s stock is in free-fall mode. We don’t want to try to “catch a falling knife.” And with a “bearish” rating, the Power Gauge points to more pain for the company in the short term.

But the stock is undervalued right now.

Today isn’t a good day for dino nuggets. But tomorrow could be a good day for dino-nugget investing.

Keep Tyson on your watch list for now.

Good investing,

Vic Lederman