Maybe that headline seems too obvious…

But as regular Chaikin PowerFeed readers know, Marc Chaikin lives and breathes the Power Gauge. Since I work closely with him these days, I’m steeped in it as well.

And at the end of the day… I don’t clock out from the Power Gauge.

You see, the Power Gauge measures darn near everything. That’s because darn near everything in America relates back to a publicly traded company.

In turn, it means darn near every part of my daily life connects to a Power Gauge rating.

Last week, I had a classic “I wonder what the Power Gauge says” experience…

I traveled to Washington, D.C. for a meeting. And my flight from Florida wasn’t full. In fact, several rows of the plane were completely empty.

That caught my attention. And I couldn’t help but think of the Power Gauge’s take on airlines.

Within seconds, I got the answer…

Folks, I know it may seem trivial. But this is how the Power Gauge can work for you…

You observe something in your daily life and think, “Hm, I wonder what that could mean.”

With the Power Gauge, it’s easy to get a “one click” answer. That’s exactly what I did as soon as my flight landed in Washington…

Now, I realize that one under-booked flight doesn’t tell us much about anything.

But since the COVID-19 pandemic, we’ve heard countless stories about the “reopening” of America. And we’ve been inundated with talk about how a newfound push to get outside would send travel-related stocks soaring.

Well, the Power Gauge makes it easy to know that something is wrong with this narrative right now – at least when it comes to airlines.

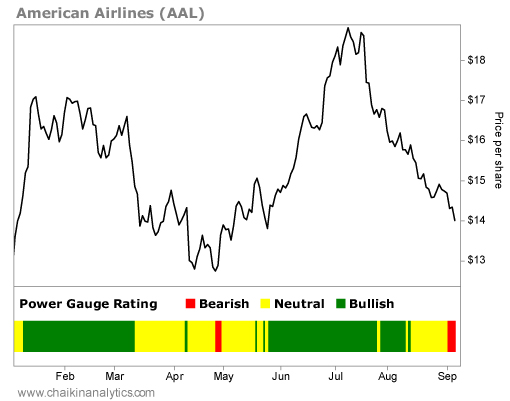

You see, I flew to Washington on an American Airlines (AAL) flight. And it just so happens that the Power Gauge turned “bearish” on the airline’s stock last week. Take a look…

You can see that American Airlines’ stock has endured a choppy year. But despite all the volatility, it has managed to squeeze out a gain of about 10% since the start of 2023.

That’s significantly less than the S&P 500 Index’s roughly 16% rise in that span, though. And now, for the second time this year, the Power Gauge is flashing a “bearish” warning.

American Airlines isn’t alone in its struggle, either. In fact, it’s actually one of the better-performing stocks in the passenger airlines industry.

Thanks to the Power Gauge, I know that’s true as well…

As it turns out, the passenger airlines industry holds a dubious distinction. It’s currently the worst-rated industry in the Power Gauge. Take a look…

None of the 21 passenger airline stocks with Power Gauge ratings are “bullish” or better.

With just a little bit of digging, I also found that volume at airport checkpoints is stalling. In fact, the last month of passenger travel is barely above where it was in 2019.

In other words, the airline industry’s era of massive rebound growth is over.

Initially, I spotted this shift from a personal experience. And because the Power Gauge is part of my daily life, I quickly saw that the entire industry group is struggling today.

Now, I know to look for opportunities elsewhere. And with the Power Gauge’s help, that’s exactly what I’ll do.

Good investing,

Vic Lederman