Today, I want to talk about a group of people I admire…

They’re some of the hardest workers in America. Their dedication, grit, and productivity are nothing short of inspiring. And now, the Power Gauge is taking notice of their efforts…

I’m talking about the employees at small-cap industrial companies.

Before we dive in, let me quickly define a couple of terms…

By “small cap,” I’m talking about companies with a market cap between $300 million and $2 billion. That’s the total value of all the company’s shares of stock.

And when I say “industrial,” I mean companies that make goods or produce materials.

In other words… these companies are the bedrock of the American economy.

The men and women working for these companies aren’t just clocking in and out. They’re putting in blood, sweat, and tears to help build the future of our country.

I’m not kidding…

Manufacturing accounts for just 8% of U.S. employment – and roughly 35% of our productivity growth. And not surprisingly, it captures around 20% of capital investment.

Those numbers are massive, folks.

That’s why investors like us always need to pay attention to small-cap industrial companies. And it’s why it matters so much that the Power Gauge is now “very bullish” on this space…

But the thing is, small-cap industrials suffered last year…

The Invesco S&P SmallCap Industrials Fund (PSCI) is our preferred way to track this space.

From its peak in November 2021 through its September 2022 bottom, PSCI lost roughly 25% of its value. That’s worse than the S&P 500 Index’s loss of about 21% over that span.

But now, the trend is reversing…

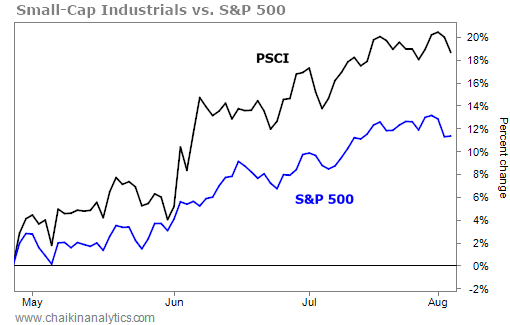

You can see in the following chart that PSCI is up around 19% since late April. That’s much better than the S&P 500’s roughly 11% gain over the same period. Take a look…

The broad market is doing well. But small-cap industrials are doing even better.

With the Power Gauge’s help, we can see that PSCI’s outperformance is likely to continue…

Today, PSCI earns a “very bullish” rating from the Power Gauge. That means most of the stocks in this exchange-traded fund (“ETF”) are “bullish” or better. Take a look…

We’re seeing the trend reversal in small-cap stocks elsewhere, too…

The iShares Russell 2000 Fund (IWM) is our preferred measure for small caps as a whole.

At the end of July, IWM also flipped to a “bullish” rating in the Power Gauge. And like PSCI, it has also beaten the S&P 500 over the past few months.

These days, we’re spending a lot of time on the mega-cap market dominators. After all, the so-called “Magnificent Seven” stocks are leading the market higher right now.

But as we’ve seen today, small-cap industrial stocks are thriving as well. In fact, they’ve done better than the broad market over the past few months.

PSCI isn’t the kind of ETF you’d buy if you want to make big returns. But its recent strength helps us see that the bedrock of the American economy is doing just fine today.

Good investing,

Vic Lederman