When it comes to Amazon (AMZN), I’m more than a little biased…

I’m addicted.

But can you blame me?

The ubiquitous website has almost everything. And it seems like it can all be at my door in a couple of days.

Heck, many items arrive the next day.

Without question, Amazon is the master of U.S. supply-chain logistics.

But if you’ve followed the news at all over the past week, you likely already know that the Federal Trade Commission (“FTC”) has a big problem with that. Specifically, the consumer-protection agency said Amazon “has seized control over much of the online retail economy.”

In other words, the FTC is taking aim at Amazon for being an illegal monopoly.

Now, it might be true that Amazon is seizing control of online retail. After all, I’m far from the only one who loves its business. It’s the retailer of choice for millions of Americans.

And the company’s market share is still growing…

Amazon accounted for roughly 20% of U.S. e-commerce sales in the first quarter of 2017. Today, that number has climbed to around 30%.

I can see why the FTC is taking aim at Amazon. But that doesn’t mean the FTC will win.

In short, we’ve been down this road before with another big retailer. We’ll touch on that situation today.

And more importantly, we’ll cover the Power Gauge’s current take on Amazon. As you’ll see, it’s critical for us to follow our system’s lead…

If you’re like me, you probably remember that Amazon wasn’t always a political target. In fact, not so long ago, mega-retailer Walmart (WMT) was facing this kind of political ire.

You probably remember some of the core arguments, too. Folks said things like, “It has too much control. It destroys small businesses. It’s anticompetitive.”

Well, Walmart is still around. It’s still just as big as ever – if not even bigger than before.

These days, the spotlight is on Amazon.

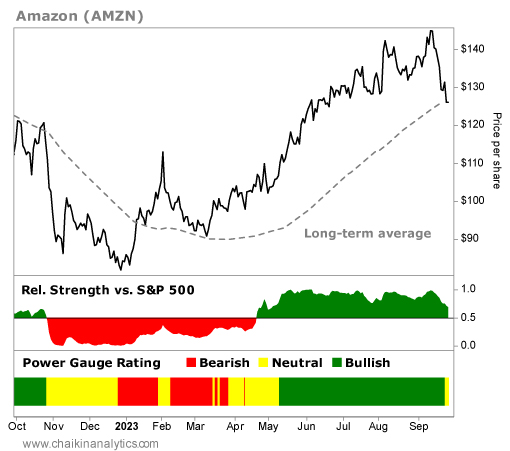

The FTC officially announced its lawsuit on Tuesday. That means the market has had a few days to digest the news. And as you can see, investors are beating Amazon up lately…

Amazon’s recent downturn is attention grabbing. The stock is down roughly 13% from its September 13 high.

But as we all know, the market is enduring a rough patch. For example, the tech-focused Invesco QQQ Trust (QQQ) is down around 4% from its mid-July high.

Importantly, Amazon and QQQ both earn “neutral+” ratings from the Power Gauge today. That means our system likes them fundamentally. But they’re both trading below their long-term averages.

With Amazon, you can see that on the chart above. The dotted line is its long-term average. The stock just dropped below that level over the past few days.

In short, the Power Gauge sees Amazon as a “bullish” stock. But our system knows not to rate a stock that way if it’s trading below its long-term average.

Our takeaway is simple…

Yes, Amazon’s stock is down about 13% over the past couple weeks. But the market isn’t crushing it over the FTC’s lawsuit. It’s just getting caught up in the broader pullback.

As investors, we should tread lightly for now. That’s reflected in the Power Gauge’s rating.

But the company’s long-term outlook remains strong…

Most experts believe the FTC’s case is a longshot. It will likely take years to play out. And even if the FTC finds some success, Amazon will fight it every step of the way.

Amazon remains a strong company. But its share price is below the long-term trend today.

For that reason, it earns a “neutral+” rating.

Good investing,

Vic Lederman