Extreme winter weather is gripping large parts of the U.S…

Specifically, the recent arctic blast has put temperatures well below freezing in Chicago. And the city’s electric-vehicle (“EV”) owners are finding out exactly what that means for their cars.

Chicago has 21 so-called “superchargers.” Those are the “fast charging” stations built by electric-car king Tesla (TSLA).

But in Chicago, these stations are now littered with dead Teslas.

Put simply, the lithium-ion batteries that electric cars rely on don’t play well with the extreme cold.

Now, some sources recommend not even attempting to charge lithium-ion batteries when the temperature drops below freezing. (And functionality isn’t so great above 80 degrees Fahrenheit, either.)

This is a massive problem for EV owners. They’ve bought into the dream of electric cars. But their cars struggle in many weather conditions.

Chicago residents are learning that firsthand. And it’s a PR nightmare for Tesla.

But that’s not the company’s only problem. As I’ll explain today, Tesla is facing another issue – and its stock recently turned “bearish” in the Power Gauge…

It looks like the allure of Tesla’s cars is fading quickly. And we know that because of rental-car company Hertz (HTZ).

Back in 2021, Hertz made a massive bet on EVs. The company said that it would buy roughly 100,000 Teslas for its fleet.

At the time, Hertz’s interim CEO Mark Fields said “electric vehicles are now mainstream, and we’ve only just begun to see rising global demand and interest.”

But demand and interest were nowhere near what the company thought it would be.

It turns out that people want their rental cars to “just work.” And the hassle of navigating charging stations and an unproven technology are still off-putting for most folks.

The recent winter wipeout in Chicago shows that consumer fears aren’t entirely off base. Whether owning or renting, EVs come with new struggles.

That’s not the only problem…

Hertz has also disclosed that its Tesla fleet is expensive to repair. The tech-heavy cars cost more to fix than traditional gas-powered cars when they wreck.

Because of all this, Hertz is selling roughly 20,000 of the EVs – mainly Teslas – in its fleet. And the company hasn’t been shy about explaining why it’s bailing on its EV vision.

Not surprisingly, investors are taking notice. And so is the Power Gauge.

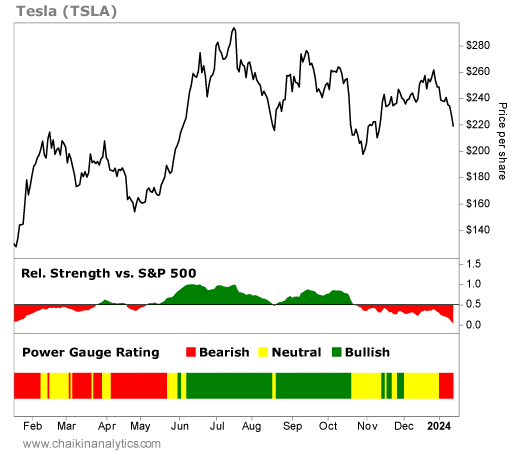

As you can see in the chart below, Tesla turned “bearish” in our system at the beginning of January…

The stock has also been firmly underperforming the broad market in recent months.

Over the past six months, Tesla is down about 24%. Meanwhile, the S&P 500 Index is up about 5% over that same time frame.

That’s a huge spread. And it’s one worth paying attention to.

We also want to keep a close eye on Tesla’s rating from the Power Gauge – which today stands at “very bearish.” It tells us that the company is struggling overall across the 20 specific factors our system measures.

And it means that Tesla is likely to continue to underperform in the coming months. Put simply, you’re better off putting money to work elsewhere.

Good investing,

Vic Lederman