Editor’s note: As regular readers know, Chaikin Analytics founder Marc Chaikin has decades of experience in the markets…

That means he remembers what trading used to be like – how it was done before the ultra-fast, Internet-based technology of today.

That brings us to today’s essay from our friend Dr. David Eifrig over at our corporate affiliate Stansberry Research…

Better known there as “Doc,” his experience ranges from Wall Street to medicine. He got his MBA from Northwestern University’s Kellogg School. After that, he spent a decade working for big firms on Wall Street.

Then, Doc turned his focus to the medical field. After earning his MD from the University of North Carolina, he became a board-eligible eye surgeon.

In short, Doc has seen it all over the decades.

The essay we’re sharing today is adapted from the July 12, 2023 edition of his free Health & Wealth Bulletin e-letter. And in it, Doc tells a story from the old days of Wall Street. It’s one that shows the importance of keeping a level head in the markets…

On May 29, 1962, John J. Cranley may have single-handedly saved the stock market…

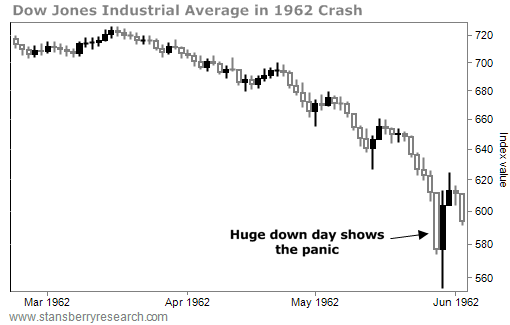

The market was in the midst of a crash… a big one. A selling frenzy of unknown origin had led to a full-on panic.

It started a day earlier, on Monday, May 28, when the Dow Jones Industrial Average dropped 34.95 points. At the time, that was the second-largest one-day drop ever.

The only worse single-day fall was the 38.33-point drop on October 28, 1929, known as “Black Monday”… which kicked off a major stock market crash and the Great Depression.

Many people – including lots of professional floor traders, investment bankers, and mom-and-pop investors – had lived through the stock market crash of 1929. They remembered the pain of those days.

And that wasn’t all…

Feeding the frenzy was a lack of information. At the time, ticker-tape machines stationed all over Wall Street printed out every trade, one at a time. The machines could only print 500 characters per minute. So when volume surged, the tape got behind.

After the market closed on Monday, the tape took an extra 90 minutes to print the trades for the day. The prior record for a delay was 34 minutes.

That meant if you were looking to sell, the price you saw was already more than an hour old. That’s a lifetime when prices are plummeting. And the growing uncertainty and poor access to information led to even more panic. Take a look…

In those days, American Telephone and Telegraph – or just “Telephone,” as it was known then – was the market’s bellwether. For those trying to gauge the health of the market, Telephone was the pulse.

When the market “opened” the next day, Tuesday morning’s trades backed up. Telephone shares didn’t even start trading until an hour after the market opened. When it finally did, shares opened at $98.50 – down 2.1% overnight.

The collapse continued…

Shares of Telephone bounced around throughout the morning. They dropped as low as $98.13 but eventually squeaked their way back to $100.

No one knew it then, but the market-maker in Telephone shares, George M. L. La Branche Jr., had orders in his books to sell 20,000 shares of American Telephone and Telegraph at $100.

That was a massive amount at the time, and it created an oversupply of shares at that price. Telephone wasn’t going to trade for more than $100 per share until those shares got cleared out.

Enter our hero, John J. Cranley, a partner at Dreyfus and Company…

For whatever reason, Cranley calmly placed an order to buy 10,000 shares of Telephone at $100 (equivalent to a $7.8 million buy in today’s money).

The oversupply of shares to be sold disappeared… and Telephone started surging. It hit $106.25 within an hour.

Cranley never revealed his motivations. To this day, we don’t know if he was buying for himself, his firm, or the Dreyfus mutual fund. (These funds were a relatively new force on Wall Street.)

One other factor helped Telephone’s stock trade strongly that day…

While the ticker tapes were again hours behind in printing all the trades, a few select stocks received priority in line.

Whenever Telephone traded, it jumped the queue, and tape readers got a quick flash update. When “T 100” printed out across town, the markets came to life. General Motors and Standard Oil jumped $5. U.S. Steel jumped $3.

About an hour after Cranley’s big trade, the Dow Jones news service printed out the notice: “The market has turned strong.” Indeed, it had. The panic was over. Stocks doubled over the next few years.

“Telephone” was, of course, the company we now know as AT&T (T).

As you can imagine, had you bought AT&T for $100 a share in 1962, you’d be exceedingly rich today.

And Cranley knew it. He understood that in the middle of a panic, he could get a bargain on a stock that would reward him for years.

Today, folks often complicate investing.

“Pros” spend hours a day looking at technical stock charts and sifting through reams of data, trying to find the next big moneymaker. I’m not one of those traders. I tell my team all the time: “KISS – Keep It Simple, Stupid.”

Look for companies that will pay you regularly for years to come… and you’ll set yourself up for a wealthier future.

Good investing,

Dr. David Eifrig

Editor’s note: In a real-money demo, Doc uses his experience to show a pro golfer how to collect $4,000 in 60 seconds. And as he explains, the trading strategy behind it has led him to an incredible 94% success rate since 2010.

In short, it’s a way to target the best companies in the market and instantly collect payouts of hundreds of dollars at a time. And it doesn’t involve touching stocks, bonds, or any conventional investments up front.

Watch Doc’s demo for yourself and learn more about his strategy right here.