Editor’s note: The markets and our Chaikin Analytics offices will be closed Monday, December 26, in observance of Christmas, so we won’t publish the Chaikin PowerFeed e-letter that day. You’ll receive your next issue on Tuesday, December 27. Enjoy the holidays!

Many folks invest in companies they recognize…

For example, the world’s biggest businesses get a lot of attention – and rightfully so. Companies like Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL) all make products that we use every day.

Some investors might even allocate a large portion of their portfolios to these stocks.

And frankly, this type of outsized bet paid off for folks over the past decade. After all, these tech titans all produced incredible returns as the bull market ripped higher and higher.

But today, things are getting a little strange…

Many investors are making an even bigger bet on these stocks right now. And a lot of them don’t even realize it.

Even worse, it sets folks up for disaster as these stocks fall – like many have this year…

We all understand the basics of “diversification”…

It’s the whole idea about not putting “all your eggs in one basket.” If that one basket breaks, you’ll lose all your eggs.

In an effort to diversify their portfolios, people often invest in the S&P 500 Index…

After all, the S&P 500 is made up of the 500 largest companies by market cap on U.S. stock exchanges. And since it includes so many stocks, investors assume that it’s diversified.

But that’s where people go wrong.

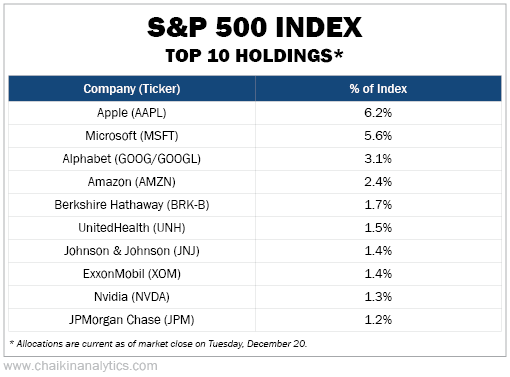

Let me show you what I’m talking about. Here’s a breakdown of the S&P 500’s top 10 holdings…

And as you can see, Apple and Microsoft are the two largest companies in the S&P 500. Together, they currently make up almost 12% of the entire index.

That might not seem like a lot at first. But let’s say you already hold a 10% stake in Apple. And 50% of your portfolio is tied up in an exchange-traded fund (“ETF”) that tracks the S&P 500.

The math gets a little confusing, but here’s the main point…

Your expected exposure to Apple is 10%. But because you also indirectly hold some of the company’s shares through the S&P 500, your real exposure jumps to more than 13% without the stock even moving.

Sure, extra exposure could work in your favor if the stock goes up. But that also causes your exposure to creep even higher. And then, when the stock falls, it hurts worse.

Plus, many folks operate a 401(k) account for retirement and another personal account that they use in the nearer term. So in reality, this exposure often exceeds 15%.

A perfectly diversified, 500-stock portfolio should feature a 0.2% weighting in each position. But in the S&P 500, Apple’s weighting is currently more than 30 times that amount.

Even worse, other ETFs end up with overexposure to the top tech companies, too. And unsuspecting investors have no idea that it’s increasing their risk.

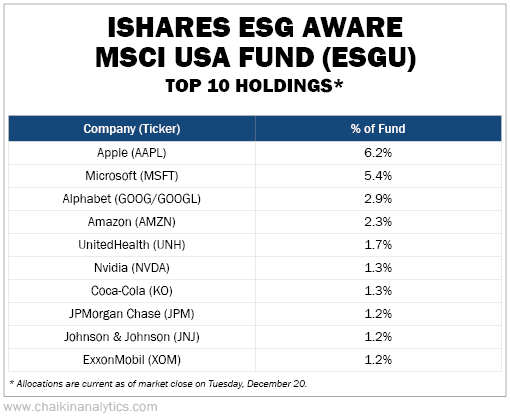

For example, just look at the iShares ESG Aware MSCI USA Fund (ESGU).

It’s the largest “ESG” ETF on the market. It has more than $19 billion in investor money behind it.

Now, ESGU supposedly tracks stocks that have “favorable environmental, social, and governance (‘ESG’) ratings.” But guess what its top 10 holdings look like…

Once again, Apple takes an outsized slice of the pie. It accounts for more than 6% of ESGU. Astute readers will realize that it’s the exact same weighting as the S&P 500 itself. (I wrote about these “stealth ESG scams” and how they can kill your returns back in June.)

If you invest in a few ETFs like that, your portfolio will end up with little diversification at all. And if the stocks you’re overexposed to start plunging… watch out.

That’s what happened with a lot of these tech stocks this year. And a lot of investors suffered big losses as a result.

In the end, it takes a much more “active” approach to make sure you’re actually investing your money the way you want. Otherwise, you’re flirting with danger every day.

Don’t just blindly count on others to “diversify” your portfolio. Do it yourself.

Good investing,

Karina Kovalcik