You probably heard this type of criticism a lot last year…

“Except for a few tech giants, the market doesn’t look that strong.”

At the time, it was true. Yes, the S&P 500 Index spent most of 2023 in positive territory. But the so-called “Magnificent Seven” dominated the market last year.

Regular Chaikin PowerFeed readers are familiar with the Magnificent Seven: Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA).

The average gain for these stocks was an eye-popping 111% in 2023. And three of them – Nvidia, Meta, and Tesla – each soared more than 100%.

Outside of the Magnificent Seven, the gains were minimal.

The pundits argued that this was a sign of an unhealthy market.

You’ll sometimes hear this concept referred to as “breadth.” If most stocks are in negative territory, it means the market has poor breadth.

The simplest way to check the market’s breadth is by comparing the S&P 500 with the Invesco S&P 500 Equal Weight Fund (RSP).

In short, RSP isn’t “market-cap weighted.” It owns equal amounts of all 500 stocks in the S&P 500. That makes it a better gauge of how the average stock in the index is doing.

While the S&P 500 soared more than 24% last year, RSP was up just less than 12%. In other words, RSP delivered less than half the gain of the “regular” S&P 500.

It’s clear that owning large-cap stocks was the winning strategy in 2023.

But market conditions change over time. And as I’ll explain today, the “bigger is better” trend is starting to fade…

With the first quarter of 2024 in the books, let’s look at some performance numbers that show what I’m talking about…

As you can see, the Magnificent Seven still beat the market in the first three months of the year. But that nearly 17% average gain is mainly thanks to Nvidia’s 82% surge.

If we remove Nvidia, the average gain is less than 6%. In other words, outside of Nvidia, the rest of the Magnificent Seven underperformed the S&P 500 in the first quarter of 2024.

And the equal weight index is telling a similar story…

Through the first three months of 2024, RSP jumped more than 7%. That trailed the S&P 500 by roughly three percentage points. This means the biggest stocks still outperformed the rest of the pack – but not by much.

Put simply, the recent breadth data shows the market is getting healthier. The gains aren’t limited to a few big names – like the Magnificent Seven.

If this trend continues, we’ll see smaller stocks start outperforming their larger counterparts later this year.

In the first quarter of 2024, small-cap stocks didn’t do much. The iShares Russell 2000 Fund (IWM) – which tracks the small-cap Russell 2000 Index – was up about 5%.

In fact, most stocks in the Russell 2000 were in negative territory over that same time frame. Only 47% of the names in the index saw gains.

But digging a bit deeper, we can see signs of “green shoots” in a few specific areas…

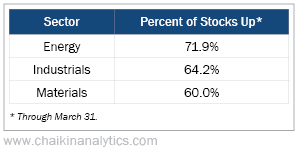

Exactly three sectors in the Russell 2000 had more winners than losers in the first quarter of 2024. Take a look…

Notably, these are the same three sectors I mentioned last week.

The takeaway here is similar…

We need to pay close attention to these kinds of trend shifts.

Specifically, I’ll be watching conditions in the small-cap space over the coming months.

If the market’s breadth keeps improving, that’s where we’ll find the biggest winners later in 2024.

Good investing,

Vic Lederman