Tesla’s (TSLA) stock just soared more than 70% in the past three months…

That’s an incredible move higher. But even that wasn’t enough to smooth the electric-vehicle (“EV”) maker’s rough patch.

The stock is still down about 3% over the past year. Meanwhile, the S&P 500 Index is up roughly 23% over the same time frame.

Now, Tesla is facing additional bad news…

The California New Car Dealers Association recently reported sales numbers. And Tesla is losing ground in the state. In fact, the company has lost market share in California for three quarters in a row.

Just a year ago, it held nearly 65% of California’s EV market. Now, its market share stands at roughly 53%.

Obviously, just about everyone has an opinion on why this is happening…

Some blame Tesla’s CEO Elon Musk.

There’s no question that he has taken a public stand against California. He even moved Tesla’s corporate headquarters from there to Texas.

But the explanation could be less political, too…

“Light vehicle” registrations are down about 2% in the state in general. And at the same time, competitors are making big progress. Rivian Automotive’s (RIVN) R1S is now the top-selling large SUV in California.

So how does the Power Gauge interpret all of this? Let’s take a look…

Put simply, Tesla is sending mixed signals. And this is exactly the kind of situation that makes the Power Gauge so useful.

Just about a month ago, I pointed out that Tesla hadn’t made a new high in 31 months. Well, that’s still true today.

Sure, the company’s share price has soared in recent months…

A gain of more than 70% is a huge move. But Tesla’s share price would need to soar another 63% for the company’s stock to break new ground.

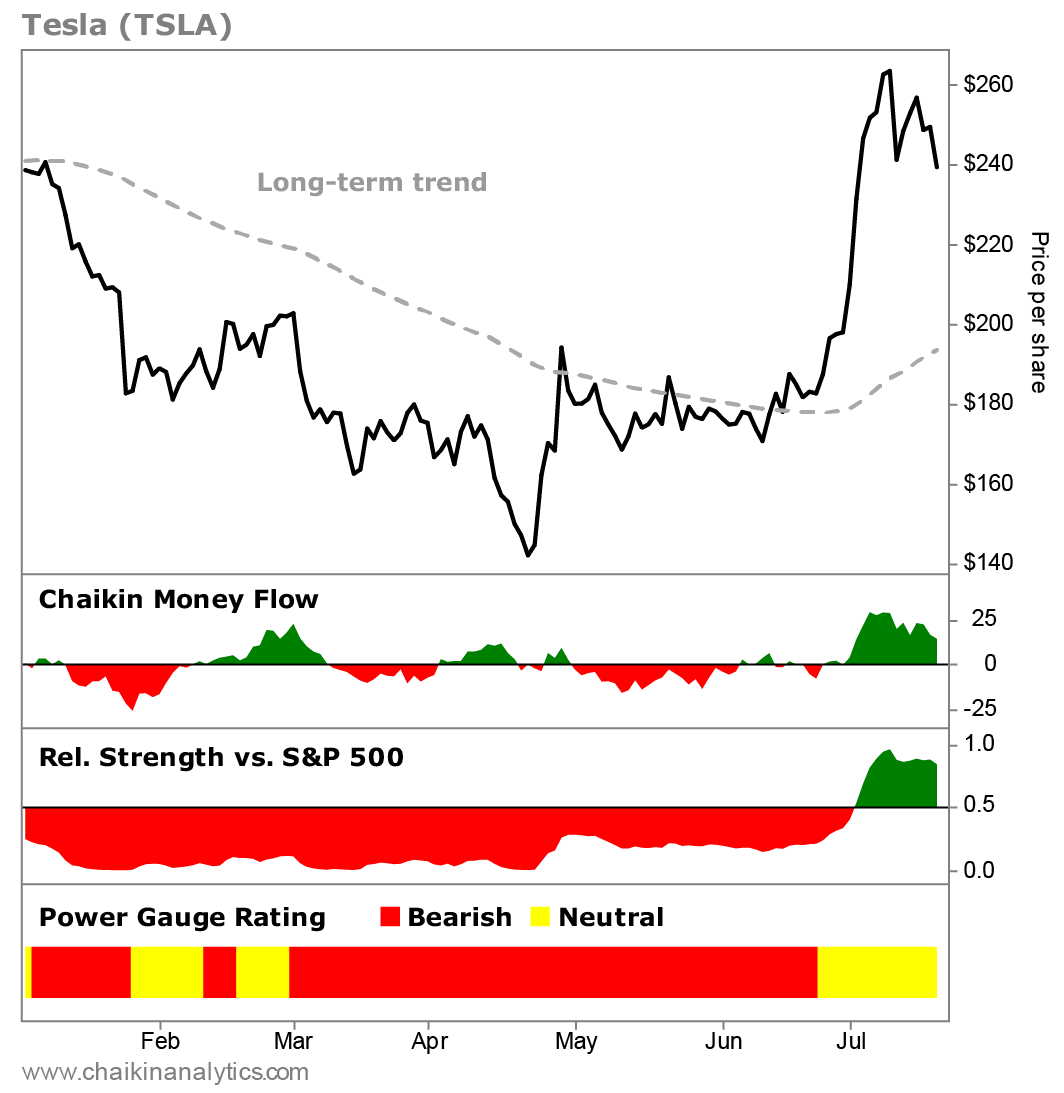

With that in mind, it’s not surprising that the company’s share price surge hasn’t resulted in a “bullish” Power Gauge rating. As you can see in the chart below, Tesla has maintained a “neutral” or worse rating for the entirety of this year…

Today, it holds a “neutral” rating.

And digging deeper, it’s clear why Tesla hasn’t earned a “bullish” rating yet. The company is struggling in three of the four factor categories the Power Gauge looks at – Financials, Earnings, and Experts.

Right now, the main thing going for it is the recent share price pop. The stock’s only positive grade is in the Technicals category.

So, where does that leave us?

Tesla’s recent surge was enough to push it back into “neutral” territory after several months in “bearish” territory. But it’s still not enough for a “bullish” rating yet.

Aggressive investors might see this as a turnaround opportunity. But those that are more cautious should wait for the other factors in the Power Gauge to confirm the trend.

After all, the automotive industry is facing considerable headwinds today. And we now know that Tesla is losing ground in one of the largest EV markets in the world.

Good investing,

Vic Lederman