Folks, something is changing in the market…

If you’ve been paying attention, you know that one thing has defined this bull market. That’s high-flying tech stocks.

Over the past six months, tech stocks – as measured by the Technology Select Sector SPDR Fund (XLK) – have soared more than 26%. And that same fund is up more than 44% over the past year.

Those are staggering returns.

But over the past 30 days, something has changed. Another group of sectors has outperformed tech.

Maybe you’ve seen signs of this brewing in the news. Stories of more layoffs in the space and political “tech wars” have been bubbling to the surface.

Just over the weekend, China announced it would transition its government computers away from Intel’s (INTC) and Advanced Micro Devices’ (AMD) chips. And the U.S. is already limiting the export of Nvidia’s AI-related chips to China.

In that context, it’s no surprise that even the broad market S&P 500 Index has outperformed tech over the past 30 days.

Now, I’m certainly not saying this is the end of tech. But it’s significant. And it’s something we want to take a closer look at…

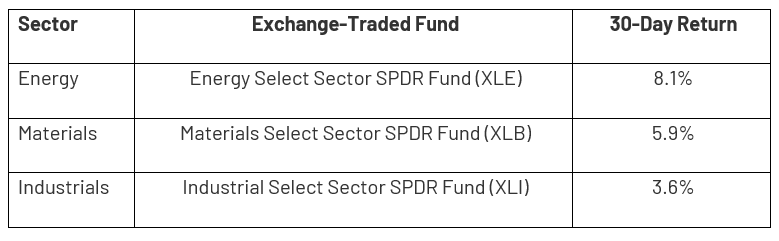

Today, let’s look at the three top-performing sectors over the past 30 days. Each of these has outperformed tech.

Specifically, tech stocks are up about 2% over the past 30 days. That’s fine. But it’s not the red-hot performance we’ve seen in recent months.

Now, a group of very specific sectors is outperforming. Take a look…

Folks, this should catch your attention. The top-performing sectors over the past 30 days were downright boring.

I’m talking about energy, materials, and industrials. That’s nothing like the flashier sectors – such as tech, communications, or financials.

This is important because it means that, at least over the past month, the market got defensive. And it pivoted into more “solid” or tangible sectors.

In fact, even small caps performed better than tech stocks. The iShares Russell 2000 Fund (IWM) gained nearly 3% in the past 30 days.

Put simply, a “broadening out” of our bull market would be healthy. After all, it’s unrealistic to expect a handful of tech stocks to carry the entire stock market forward.

Does it mean I’m going to go pouring my money into energy? No, not yet.

The past month’s top-performing sector still shows a number of warning signs…

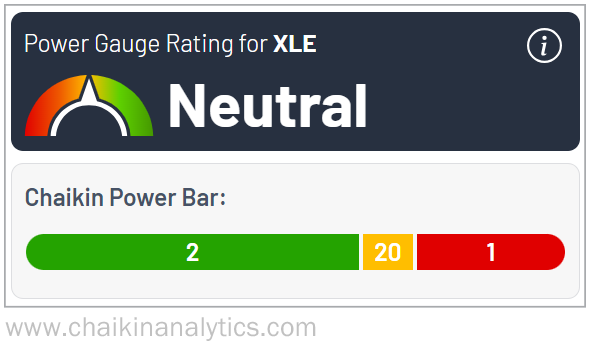

XLE is our measure of the energy sector. The fund holds many recognizable names. But the top three holdings make up more than 48% of the fund.

These are ExxonMobil (XOM), Chevron (CVX), and ConocoPhillips (COP). Right now, none of them earn a “bullish” rating in the Power Gauge.

And of the 23 rated stocks in XLE, our system only gives two of them a “bullish” or better rating. Take a look…

So, we saw some market churn last month. And investors pivoted to some historically defensive sectors. Again, energy was the top-performing sector.

But that doesn’t mean we’ve seen a full-blown transition into that space yet. And as you can see, the Power Gauge currently assigns a “neutral” rating to XLE.

That means this is something we want to watch closely.

Of course, I’m not hitting the panic button on tech. But I’ll be paying attention to how it performs ahead against energy and those other, more “boring” sectors.

Good investing,

Vic Lederman