When times are tough, many investors turn to gold…

It’s a commonly accepted “safe haven” asset. And that’s especially true during inflationary periods like what we’re living through right now.

That’s a big reason why gold is hovering near a record high.

But as I’ll explain today, investors can do even better than buying the precious metal…

You see, certain gold coins perform even better than the metal itself over the long term.

I’m personally rounding out the finishing touches on a collection of Roman 12 Caesars coins. And I enjoy learning the history of different gold coins – along with the hobby of collecting them.

So I was thrilled when I recently got a chance to sit down with an expert in the field…

My friend, Geoff Anandappa, is a coin and collectibles specialist. He’s the director of Rare Tangible Assets (“RTA”), a firm that provides services to high-net-worth investors in the market.

Specifically, Geoff and I talked about a little-known corner of the gold-coin market. And importantly, he explained why it’s positioned to soar in the coming months.

Let’s get into it…

In short, Geoff believes English coins are really starting to take off.

That might sound random at first. But English coins have outperformed nearly every asset class over the past 30 years.

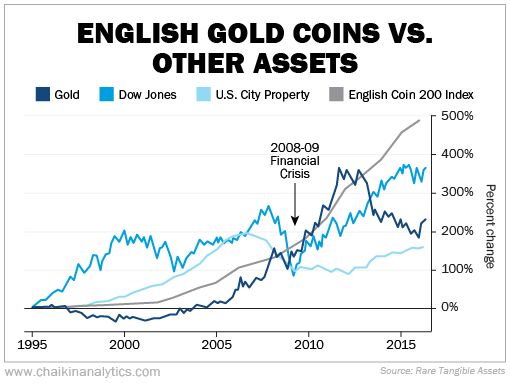

First, look at this chart from Geoff’s research…

RTA tracks the prices of several ancient and rare English coins in an index.

As you can see in the previous chart, these coins have proven to be a very stable asset class. And that was true even during the toughest times over the past few decades…

Just look at what happened during the financial crisis. You can see in the chart that the prices of these English coins rose steadily as stocks and U.S. property values fell.

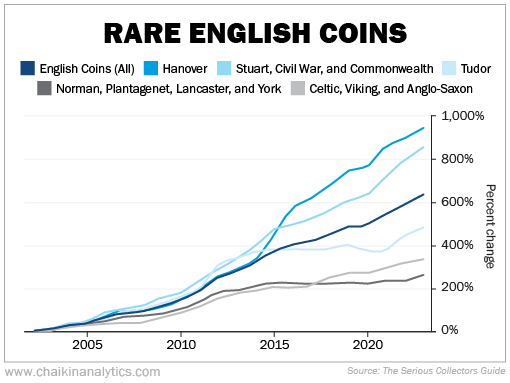

Now, here’s another chart from Geoff…

This chart breaks down the RTA index of English coins into more specific categories. And it points to the group of coins that Geoff recommends paying close attention to right now…

Tudor coins.

The lightest-blue line on the chart represents this group of coins. As you can see, they’ve lagged behind other types of English coins. But that’s about to change…

As their name implies, these coins were minted in England during the Tudor dynasty. And this type of currency lasted from 1485 to 1603.

The Tudor dynasty included monarchs such as Henry VII, Henry VIII, and Elizabeth I.

Tudor coins were highly valued. They were viewed as a symbol of the monarch’s power and wealth. And like most currencies, they were also used as gifts and to pay off debts.

Today, more than 400 years after the fall of the Tudor dynasty, collectors covet these coins. And they already fetch high prices at auction.

But something is happening that Geoff says could send these specific coins soaring…

More professional services are beginning to “grade” the coins.

That means collectors will soon have a much better idea of what they’re buying. And they could make outsized returns by speculating on ungraded coins and getting them graded.

For example, a collector bought this Queen Anne 1705 gold Five Guineas (ungraded) for £90,000 in 2014. After that, the coin achieved a very good Numismatic Guaranty Company grade of “MS 62+” and sold at auction for more than £220,000 in 2020.

The grading of the coin alone made it an incredible investment.

Now, this specific coin is from the Stuart era that followed the Tudor dynasty. But it’s still a powerful example of how grading can dramatically support an increased price.

That might sound funny. After all, a graded coin is the same exact coin as the ungraded one. But here’s the kicker…

Once a reputable firm grades a coin, investors can trade it with significantly lower risk.

Graded coins become a collectible commodity that investors can profit from. And with more coins being graded than ever before, investors are taking note of the opportunity.

In the months ahead, coin prices will increase and liquidity will improve for collectors.

So if you have some extra cash to put to work in a unique market, consider rare coins today.

They’re proven hedges against inflation. And they’ve performed well across all kinds of markets for decades.

And personally, I just find them incredibly appealing.

Good investing,

Briton Hill