The world’s most populated country also houses one of its top stock markets right now…

In fact, this stock market is up about 22% over the past year. That’s not far behind the S&P 500 Index’s roughly 25% gain over the same period.

I’m talking about India.

Nearly 1.5 billion people live in the country. It’s just ahead of China’s roughly 1.4 billion.

India already has the world’s fifth-largest economy. And it has been growing an average of 8.2% annually for the past three years.

At the rate it’s growing, it’s poised to be the third-largest economy in just three more years.

A major economy hasn’t grown this fast since China’s golden period in the early 2000s. China’s economy roughly doubled in size in seven years.

Many investors have been waiting for another chance to ride such a wave of prosperity…

Keep in mind that India’s stock market has already been on an epic tear. The big gains for Indian stocks started long before its economy finally began to take off.

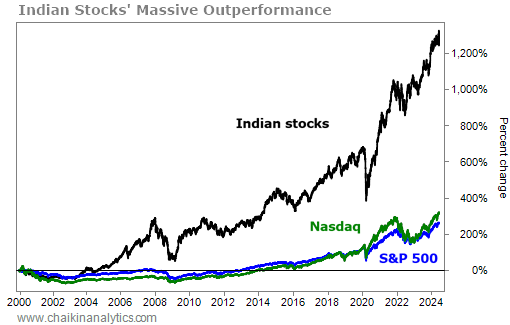

Since the start of 2000, the country’s main Sensex Index has risen nearly 1,300%. Indian stocks have far outperformed the S&P 500 and Nasdaq Composite Index. Take a look…

If you’re wondering why you likely haven’t heard of a market performing this much better than U.S. stocks, there’s a simple explanation…

Not many Indian companies trade in the U.S.

In fact, only nine Indian stocks are listed on the U.S. stock exchanges.

That’s because Indian companies are only allowed to list here in the U.S. with American depositary receipts (“ADRs”).

Now, ADRs are common. In fact, more than 2,000 of them trade on U.S. exchanges. And hundreds of them come from China.

But having ADRs entails big costs. And they’re not always as liquid as regular stocks. As a result, ADRs become impractical for companies unless U.S. investors demand them.

That just hasn’t been the case for Indian companies – until recently.

Folks, India is becoming more connected to the U.S. economy than ever before…

Due to the U.S. economic rivalry with China, India is becoming a new base for Western manufacturing. That includes Apple (AAPL), which produced $14 billion worth of iPhones in India last year.

Meanwhile, Cisco Systems (CSCO) began manufacturing in India last year. It set a target of $1 billion in combined exports and domestic sales over the years ahead.

Major semiconductor firms are also investing $15 billion in India. In total, these companies plan to build three chipmaking plants in the coming years.

That’s not all…

Via a joint venture, coffee giant Starbucks (SBUX) wants to open a new shop in India every three days. And fast-food chain KFC now has more than 1,000 stores in the country. It opened nearly 300 new locations last year alone.

India’s corporate earnings are on the rise as well. They’re expected to grow 15% this year.

Moreover, India’s demographics are similar to China’s 30 years ago. More than half of India’s population is younger than age 30. Nearly 12 million of them join the workforce each year.

That means India needs about 10% economic growth per year to be able to create enough jobs for its huge workforce.

Finally, the country’s general election just ended. The results gave incumbent Prime Minister Narendra Modi a third term.

I’ll note that his political party didn’t win another single majority. But together with allied parties, Modi’s party can form a coalition government.

So now, investors can be confident that Modi’s business-friendly policies will likely continue for the next several years. In other words, India’s market looks poised to keep winning.

The Power Gauge agrees…

Again, only a handful of Indian companies trade in the U.S. through ADRs. But investors looking for exposure to Indian stocks can turn to the iShares MSCI India Fund (INDA).

Right now, the Power Gauge confirms the positive outlook for the country. It gives INDA a “very bullish” rating.

That’s a great sign. And it’s why I’ve got my eye on Indian stocks today.

Good investing,

Vic Lederman