Editor’s note: Stocks are surging to new highs once again…

The S&P 500 Index is already up about 11% this year. Meanwhile, the Nasdaq Composite Index is up roughly 12% in 2024.

And as signs of euphoria start to show up, a lot of folks might worry that the top is in.

That brings us to today’s essay from our friend Sean Michael Cummings…

Regular readers know that Sean is an analyst at our corporate affiliate Stansberry Research. He first published this essay in Stansberry’s free DailyWealth e-letter on Monday.

In it, Sean details one sign of euphoria that recently crept back into the market. But as he explains, it doesn’t mean stocks are destined to plunge from here…

An image of a man in a chair just cost short-sellers $2 billion…

The post appeared on social platform X last week, shared by Keith Gill.

Keith was at the center of the meme-stock mania in 2021. You might not remember him by name. But his pandemic-era posts about video-game retailer GameStop (GME) drove shares up 30 times in January 2021.

It was a euphoric time to be a retail investor… But it was also a sign of the market top. The S&P 500 Index peaked less than a year later and entered a bear market in 2022.

It has been three years since Keith last posted on X (going by the username “Roaring Kitty”). Then, on Mother’s Day, he broke his silence to post this image…

GME soared more than 175% by Tuesday evening last week. The rally wiped out 10 digits’ worth of short-seller value in about 48 hours.

Now that meme stocks have been back in the headlines, you might think that investor euphoria is back… and the top is almost in.

But history disagrees. This bull market is still in its early phases… which means there’s still plenty of time to make money before the peak is in. And a simple look back in time can show us why…

The most recent bull market – which included the meme-stock mania – lasted from the pandemic bottom in March 2020 to January 2022.

When GameStop peaked, there were about 11 months left until the bear market started.

But what you might not realize is that the post-pandemic period was an anomaly… It was the shortest bull market in 90 years.

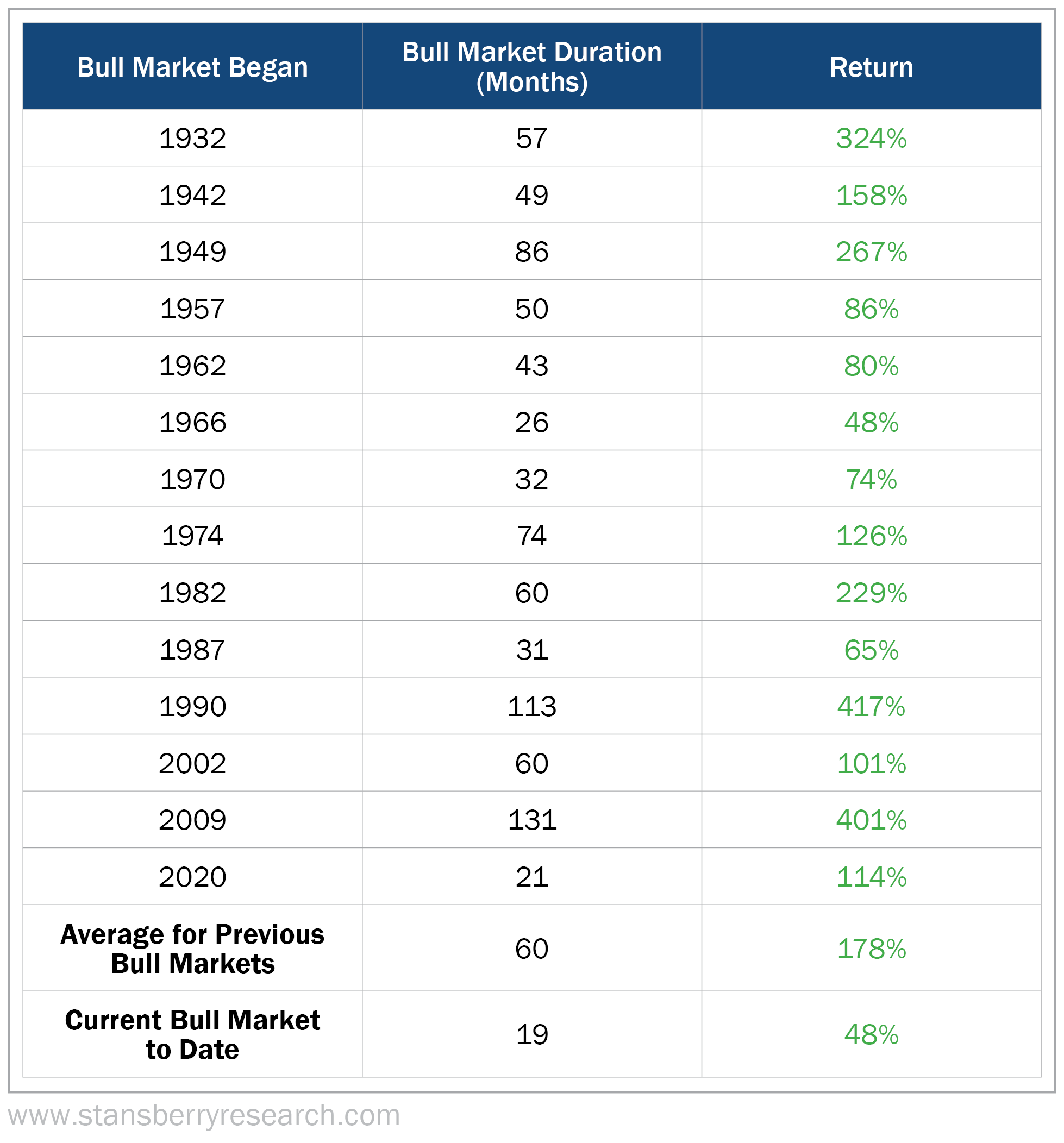

To prove this, I looked through the history of the U.S. stock market and found every bull run since the bottom of the Great Depression. Then, I found the duration and returns for each one.

The results were clear. It showed that the current bull market is still just picking up steam. Take a look…

Since the bottom of the Great Depression, we’ve seen 15 bull markets in U.S. stocks. Their average length was 60 months.

The longest bull market was 131 months (from March 2009 to February 2020)… And the shortest, as I mentioned, was the 21-month pandemic rally from March 2020 to January 2022.

If the current rally ended today, it would be even shorter than that. Today’s bull market sits at just 19 months.

Of course, it took nearly 11 months for the market to peak after meme stocks rallied last time. But even if that happened again, it would only stretch the current duration to 30 months – still 50% shorter than the historical average.

Simply put, the pandemic-era bull run was an outlier. It’s a flawed benchmark for bull runs in the U.S. stock market. And you shouldn’t plan for a repeat just because meme stocks are back in the headlines today.

Instead, I suggest you view the recent action through a different lens…

The bull market is rewarding risk today. As it continues “melting up,” we’re likely to see even bigger gains ahead… And we won’t need to gamble on meme stocks to reap the benefits of this broad market boom.

Good investing,

Sean Michael Cummings

Editor’s note: In DailyWealth, Sean and his colleagues cover the day-to-day opportunities they’re seeing in the markets. And they’re committed to sharing the world’s best wealth ideas with their readers.

DailyWealth is 100% free and publishes every weekday morning when the markets are open – just like the Chaikin PowerFeed. Learn more about how to receive these insights by clicking here.