Some people use data to drive their perspective. Others don’t.

And some say what is politically advantageous…

Now, you may have heard that Treasury Secretary Janet Yellen recently made a gaffe during an interview earlier this week. And by my measures, it’s a pretty big one.

You see, the interviewer was asking about inflation and high prices. She also asked if Yellen had felt “sticker shock” at the grocery store.

Before the interviewer could finish the question, Yellen interrupted with a flat “no.” And as she expanded…

I think largely it reflects cost increases, including labor cost increases that grocery firms have experienced, although there may be some increases in margins.

Folks, this is downright silly. And just about everyone knows it. I know I’ve had sticker shock at my local grocery store… and I’m sure you have, too.

So today, let’s look at what the data actually says. And we’ll connect that to our investing perspective…

Now, there’s no question that Yellen should know better. After all, her resume is about as impressive as it gets.

In the 1990s, she served on President Bill Clinton’s Council of Economic Advisers. Then she went on to become the president of the Federal Reserve Bank of San Francisco.

After that, Yellen served as vice chair of the Federal Reserve. And she held the top job of Fed chair from 2014 to 2018.

So there’s no question that she should know inflation at the grocery store has still been running hot. After all, that’s exactly what the data shows…

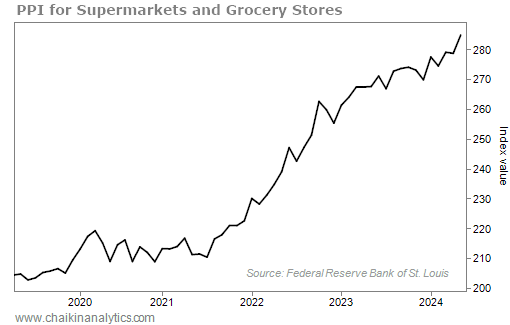

The chart below shows the producer price index (“PPI”) – specifically for supermarkets and grocery stores. And there’s no question that inflation in this area is soaring…

From 2023 to 2024, inflation in this corner of the market has climbed more than 6%. I would be shocked if Yellen wasn’t aware of this.

In fact, we’re in one of the most inflationary periods in more than 40 years!

From 2000 to 2020, annual inflation averaged just 2.1%. And inflation today has remained stubborn enough that we’ve even heard some Fed rumblings about the possibility of another rate hike.

As Fed Governor Michelle Bowman said in a speech earlier this week…

We are still not yet at the point where it is appropriate to lower the policy rate…

I remain willing to raise the target range for the federal funds rate at a future meeting should progress on inflation stall or even reverse.

You may not like this hawkish stance. But it does reflect the reality of the situation.

Sure, inflation is down from the big highs two years ago. But it has still been stubborn. And the economy is still running hot.

So, Yellen might claim that she doesn’t see sticker shock at the grocery store. But most consumers do.

On the investing side, there’s one key takeaway…

The music hasn’t stopped.

Despite an incredible run of rate hikes, the Fed hasn’t managed to push America into a recession. And aggregate inflation is still roughly 3%.

That’s a full percentage point higher than the Fed’s target rate.

In other words, this “hot” economic cycle is still playing out. And that means there’s still room for stocks to run higher.

Good investing,

Vic Lederman

P.S. Earlier this week, my colleague and Chaikin Analytics founder Marc Chaikin went on camera to share a startling update to his market outlook for the rest of the year…

In fact, it’s one you’ve almost certainly never heard before. And you likely won’t hear it anywhere else.

And that’s not all. Marc also made a huge personal announcement about his life’s work.

If you missed the big reveal, don’t worry… We’ve made a full replay available with all the details right here.