Three companies control the market for making advanced semiconductors…

Only one of them is American.

Taiwan Semiconductor Manufacturing (TSM) is based in Taiwan – squarely in China’s sights. Meanwhile, South Korea-based Samsung Electronics has its unstable neighbor to the north.

And unfortunately for the U.S., Intel (INTC) is struggling to get back in the game.

It couldn’t strike a deal with Apple (AAPL) and missed the smartphone market. It didn’t see graphics processing units (“GPUs”) as the engines of AI – and missed that, too.

Now, as mobile phones and AI increasingly take on PCs, Intel is under fire. And key to its success is getting back on its feet in manufacturing.

It’s critical for Intel. It’s also important for U.S. supply-chain security.

Manufacturing was always key to Intel’s dominance in the PC space. It invests around 30% to 40% of its research-and-development (R&D) budget every year in manufacturing technology.

This investment has paid off. In some cases, process-technology improvements increased Intel’s chip speeds by 25%.

Intel manufactures chips all over the world. But today, it’s one of the few U.S. semiconductor companies with its own factories. And it’s the only one that can make the very smallest circuits.

But over time, Intel fell behind…

In semiconductors, size drives speed – but in an inverse way. The smaller the circuit, the faster the chip. This is measured in nanometers (“nm”).

A decade ago, Intel started to struggle at 10 nm chips. TSM beat Intel at making chips at 7 nm and 5 nm.

In 2019, Intel competitor Advanced Micro Devices (AMD) took almost a third of the PC processor market because it had faster chips.

These chips were made in Taiwan. TSM made them for AMD at those smaller line widths.

Today, the world is moving to making chips at 3 nm.

And Intel needs to catch up. To get back in the game, it’s spending $100 billion to upgrade and expand its manufacturing.

The U.S. accounts for around 85% of all semiconductor designs. But less than 10% are manufactured here.

That has caught the attention of the U.S. government. It’s spending $50 billion to boost domestic semiconductor manufacturing. Intel will get almost $20 billion of that money.

To spread the cost of this investment, Intel wants to start making chips for other companies. Nvidia (NVDA) and Qualcomm (QCOM) are prime candidates, but neither have signed up yet.

Intel expects these new investments to start paying off in 2026. That’s an aggressive schedule to spend $100 billion. But it’s also a long time in the fast-changing world of tech.

If Intel reaches its milestones sooner than expected, that would be a positive. If it announces a contract with Nvidia or Qualcomm, that would be a strong sign that the company is back in the game.

And if the investment pays off, it will be a big win for Intel. It will also be a big win for U.S. supply-chain security.

However, Intel’s stock has been falling this year. Then, earlier this month, it collapsed after the company reported disappointing earnings results.

Now, Intel’s stock price is back to where it was in the late 1990s. That’s a huge reversal in fortune.

Because of that, some investors might think it’s time to start bottom-fishing. But here at Chaikin Analytics, let’s see what the Power Gauge has to say first…

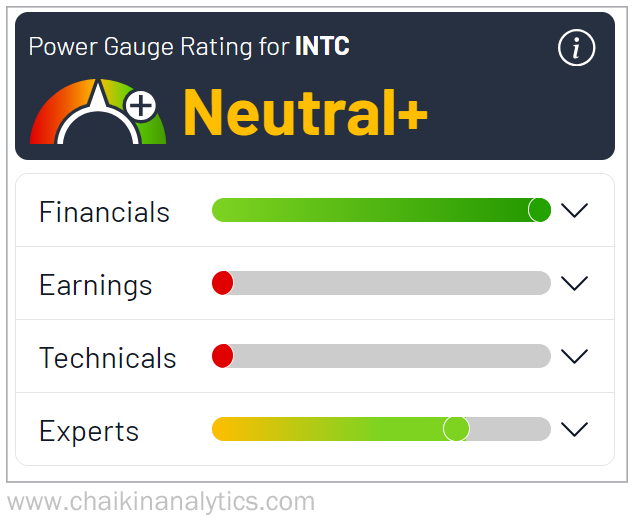

Right now, Intel gets a “neutral+” rating in our system. Here’s its breakdown among the four categories the Power Gauge tracks…

Intel only gets one “very bullish” rating – it’s for the Financials category. Intel’s price-to-book ratio is low relative to other semiconductor companies. And its price-to-sales ratio is low.

But neither of these indicates a positive outlook. Tech companies with good outlooks generally sell at higher multiples of both ratios.

Meanwhile, Intel’s Experts category is “bullish.” But Earnings and Technicals are both “very bearish.”

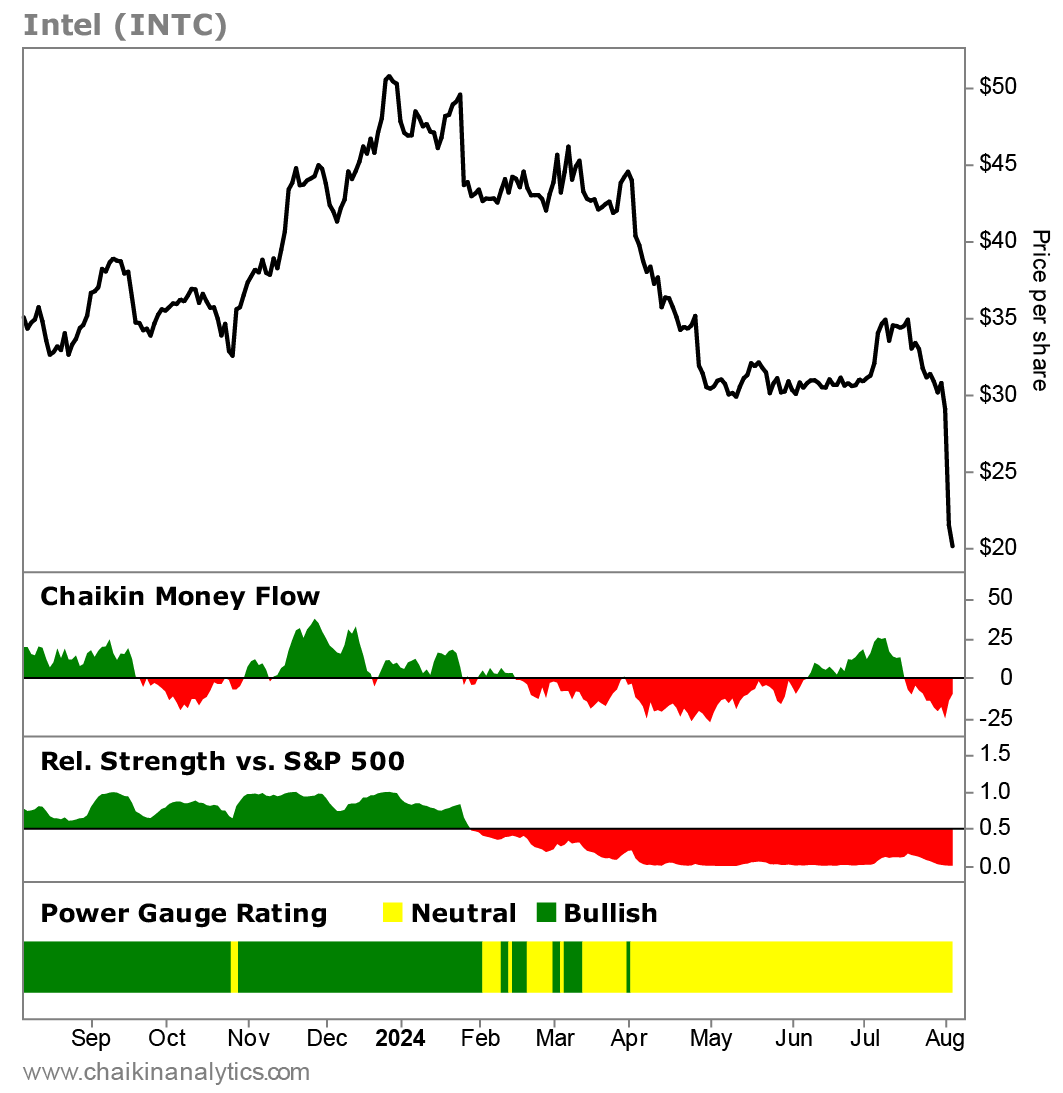

And take a look at this one-year chart of Intel with some data from the Power Gauge…

As you can see, Intel has been in “neutral” territory for most of this year.

Meanwhile, the weak Chaikin Money Flow indicator shows that the “smart money” on Wall Street has been selling the stock.

And with weak relative strength versus the S&P 500 Index, Intel has been heavily underperforming the market in recent months.

The weak Chaikin Money flow indicator and weak relative strength are clear signs of caution from the Power Gauge.

With such a great history in manufacturing, Intel could make a turnaround work. It’s also unlikely that the government will let Intel fail.

But right now, success is a long way off…

And I want to see a stronger signal overall on Intel from the Power Gauge. I wouldn’t rush to bottom-fish the stock.

Good investing,

Joe Austin