Market rotations are always full of surprises… And a recent one in July didn’t disappoint.

The “Magnificent Seven” mega-caps lost some of their altitude. Value stocks outperformed growth ones, while small caps outperformed large caps.

And for the first time in a long time, expectations toward inflation cooled. Interest-sensitive stocks popped.

The biggest gainers for the month were financials, utilities, and real estate.

The Power Gauge was watching all this. And early in July, it turned positive on banks.

On July 5, it switched from “neutral” to “bullish” on the SPDR S&P Bank Fund (KBE). Then on July 12, it did the same on the SPDR S&P Regional Banking Fund (KRE).

Since those respective dates, KBE is up about 16% and KRE is up about 8%.

But while bank stocks moved, the underlying fundamentals of the sector didn’t change much. And those fundamentals still have the same problems they did six months ago.

So we’re all for taking a closer look at the banks. But even amid strong overall subsector ratings in the Power Gauge, it pays to be picky. The differences in fundamentals between banks can be huge…

Our one-of-a-kind Power Gauge has a great record on banks.

In November 2022, Chaikin Analytics founder Marc Chaikin said during a special online event that a shift in the financial system could cause a run on the banks. That December, the Power Gauge flipped to a “bearish” rating on KRE.

In early March 2023, Silicon Valley Bank and Signature Bank failed. First Republic Bank followed in early May.

Financial panic ensued. Wall Street thought this was 2008 all over again.

Luckily, the damage didn’t spread. But it served as a stark reminder that the banking system is often just one step away from disaster.

This past November, the Power Gauge spotted another change. It flashed a “bullish” signal on KRE on November 3. The fund rallied as high as 23% before the Power Gauge went “neutral” again in February of this year.

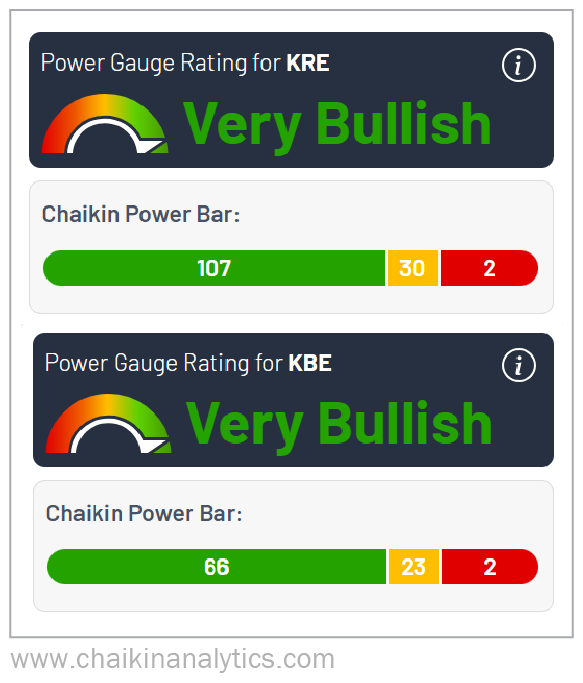

By now, as I also mentioned last month, KRE moved back into “bullish” territory… and so did KBE. Today, both funds are rated “very bullish.”

So what’s going on?

Like all companies, banks have two sides to their balance sheet. But unlike most companies, both sides of their balance sheets are hypersensitive to interest rates going up or down.

Banks’ assets are mostly loans. Liabilities tend to be deposits. But when rates change, the asset side is stickier than the liability side.

So when the Federal Reserve raises rates, banks’ interest margins get crushed. They start paying up immediately on deposits. But it takes longer for them to reprice their loans.

And the opposite occurs when rates go down. They immediately start paying less on deposits. And they take their time repricing those loans. The difference goes right to the bottom line.

This is likely what’s behind the recent rally.

But that doesn’t mean that banks are completely risk free today… The issue is commercial real estate (“CRE”).

On average, office vacancy rates across the U.S. were 20.1% in the second quarter of this year. That’s the highest they’ve ever been. And it’s the first time in history that vacancy rates have crossed 20%.

Worse, about 60% of active office leases currently in effect were signed before the pandemic.

A typical office lease is for five years. That means the pain is just starting to unfold.

According to an analysis published earlier this year by S&P Global Ratings, banks with more than $100 billion in assets have nearly 13% exposure to CRE loans. But for banks with less than $10 billion in assets, the exposure is more like 38%.

Morgan Stanley says that some $2 trillion of CRE loans will come due in the next year. Regional banks hold 70% of those loans.

So there will be pain… at some point.

Meanwhile, the Power Gauge is still giving us plenty to look at. As you can see, both KRE and KBE have far more “bullish” or better holdings than “bearish” or worse ones…

For starters, stay with the banks rated “bullish” or “very bullish.” Banking is a closely studied sector, so it makes little sense to bottom-fish.

The Power Gauge was negative on SVB Financial – Silicon Valley Bank’s parent company – and First Republic long before their troubles emerged. So that’s another reason to stay with the bank stocks with “bullish” or better ratings.

Then, get local. Try to find out the markets in which a bank makes loans. See if you would be comfortable offering loans in that market.

And most importantly, determine what the bank’s exposure is to CRE. In some parts of the country, that’s fine. In others, it’s not.

Lastly, keep an eye on the Power Gauge. And see what it’s saying – both about the sector and an individual bank.

Again, KRE and KBE are both in strongly positive territory right now in the Power Gauge. It sees opportunity in bank stocks. And hopefully, we aren’t close to another crisis in the banking sector.

But if we are, we’ll use the Power Gauge to help us avoid the worst of it – just like we’ve done before.

Good investing,

Joe Austin