Folks, the stock market’s top-performing subsector has a problem…

You see, the market isn’t just one big object. It’s made up of thousands of individual companies. And they fall into a variety of categories.

Regular readers know that the Power Gauge gives us an easy way to track the market’s 11 top-level sectors. And it helps us see what’s happening with 21 different subsectors as well.

Investment-data companies S&P Global and MSCI put together these sectors and subsectors. They all follow the so-called “Global Industry Classification Standard” (or “GICS,” for short).

Here’s the important part…

These sectors and subsectors are industry standards.

Whether they realize it or not, every investor follows the GICS. And for the most part, these standards do an acceptable job of tracking their intended industries.

You’re probably wondering why I’m bringing all this up today…

Well, one subsector just ripped higher. It’s up more than 10% since its November 10 low.

This subsector was the market’s top performer over that span. And it caught my eye.

But a closer look at the Power Gauge tells us something dramatic is happening beneath the surface. In fact, as you’ll see, it doesn’t get much worse than this subsector right now…

I’m talking about the SPDR S&P Health Care Equipment Fund (XHE).

As I said, XHE is moving higher right now. It has gained more than 10% over the past 10 trading days. That bumped it to the top of the Power Gauge’s subsector list for performance.

And yet, the Power Gauge also shows that XHE is in a “very bearish” spot. Take a look…

XHE’s Power Bar ratio is abysmal. Remember, that’s the ratio of “bullish” to “bearish” stocks.

Only one of the 70 stocks with Power Gauge ratings in XHE is “bullish” or better today. That’s far worse than the 34 stocks that currently earn a “bearish” or “very bearish” rating.

Folks, this is one of the worst subsector breakdowns I’ve ever seen.

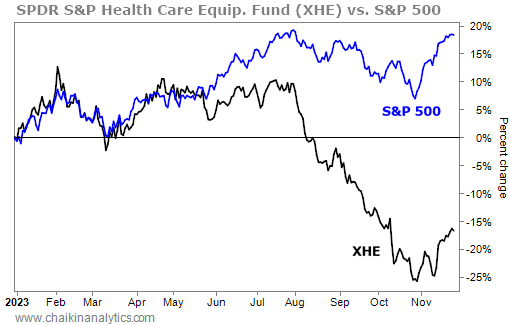

The Power Gauge’s “very bearish” outlook is justified, too. After all, XHE’s struggles in 2023 are clear when we look at the chart…

The broad market is thriving this year. The S&P 500 Index is up about 19% in 2023. At the same time, this entire subsector is floundering. Take a look…

Now, I’ll admit that the chart does show a little bit of promise for XHE. You can see clearly that this subsector bottomed in late October. Then, it made a “higher low” this month.

We can also see the bounce that sent it soaring to the top of the Power Gauge’s subsector list. So if you were only looking at the chart, you might see XHE as a potential opportunity.

But remember… the Power Gauge is still “very bearish” on XHE right now.

Sure, health care equipment stocks will likely turn around at some point. And they just performed well over a brief stretch. However, our system is as clear as it gets…

Put simply, XHE is the “worst of the worst” subsector today.

It’s dramatically underperforming the market. It’s the only subsector to hold a “very bearish” rating. And it has one of the most lopsided Power Bar ratios I’ve ever seen.

Don’t try to catch this falling knife.

Good investing,

Vic Lederman