A few weeks ago, my friend confessed something that no one ever wants to admit…

He lost big in the stock market.

And he wasn’t exaggerating, either… He was down 65% on a position – and yet, he was still holding on.

Unfortunately, this isn’t the first time I’ve heard such a story… Many of my friends have confided in me about their market losses over the years.

Losses happen… They’re an unavoidable investing reality.

No one finds winners 100% of the time. Even the world’s greatest investors fail.

But that doesn’t mean you need to let losses wreck your portfolio. While I can’t give personal stock advice, I can help you learn what to do when you’re in a situation like this.

Folks, it’s time for some real talk…

To deal with losses, you need a plan.

The truth is, none of the friends who’ve confided in me over the years planned ahead for how they would handle losses. They all ran headlong into positions that were “sure to be winners.”

Obviously, we should all use a strategy to avoid – or at least minimize – our losses from the outset. It’s important to go into every investment with a sound risk-management approach. Always consider proper position sizing and use stop losses to protect your capital.

But I get it… people make mistakes. And before long, like my friends, they’re in a deep hole.

So how do you handle losses once they’ve happened?

It’s simple… You must know when to fold your cards and walk away.

Many folks fail to consider what it really takes to recover a losing position. Think about it…

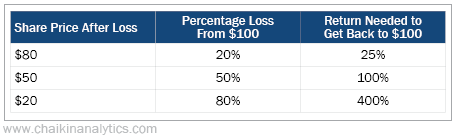

Let’s pretend we invested in DUD Company at $100 per share. The stock tanked soon after we bought shares… Now, it’s down to $50 per share. That’s a 50% loss. However, to get back to our original $100-per-share investment, the stock now must double – a 100% gain.

You can see a few basic scenarios in the following table…

While we all wish the math worked out the other way, it just doesn’t… As the losses get bigger, the hole you must dig yourself out of to get back to breakeven gets deeper.

Nobody wants to be in this position. But the reality is that nearly every investor has experienced losses at one point or another.

The key to long-term success is staying disciplined. In order to do that, I like to follow what I call the “20-35-50” rule. It works like this…

If I hit a 20% loss on a stock, I ask myself one question… Is the reason I bought the stock still true? I’ll stick with it if my answer is a resounding “Yes!” Otherwise, I’ll move on.

If I answer “Yes!” to that question but then the stock continues to drop, I’ll give it until a 35% loss. At that point, the stock would need to appreciate a little more than 50% to get back to breakeven. If I don’t believe the stock has a good chance of going up roughly 30% in the next year, I’ll fold.

And finally, if I wake up one morning and realize that my stock is showing a 50% loss, I’ll admit that it’s time to get out. A stock that goes down 50% isn’t likely to double in value in the next year.

It might seem elementary, but I’ve seen folks hold positions that would require a 200% gain to get back to breakeven. That’s simply not likely – especially with a stock that just tanked.

Never forget… good investors know when to walk away from losing positions. They don’t ride them down to zero. And they sure as heck don’t wait around for a stock to move up 200% just to get back to breakeven.

So from time to time, you must be OK with walking away and accepting losses. That’s how you’ll live to fight another day… And as long as you can minimize your losses, you’ll grow your wealth over the long term.

Good investing,

Karina Kovalcik