Editor’s note: The markets and our Chaikin Analytics offices will be closed Monday, May 29, for Memorial Day. So we won’t publish our Chaikin PowerFeed e-letter.

We hope you enjoy the long weekend. And you can expect to receive your next issue on Tuesday, May 30.

Before you look at the latest headlines, get ready for a roller-coaster ride…

You’ll see some stories about how we’re all doomed as a long, brutal recession begins. And other stories will detail how the worst days are already behind us.

It’s the same thing when you try to get updates about individual companies.

Take Meta Platforms (META), for example…

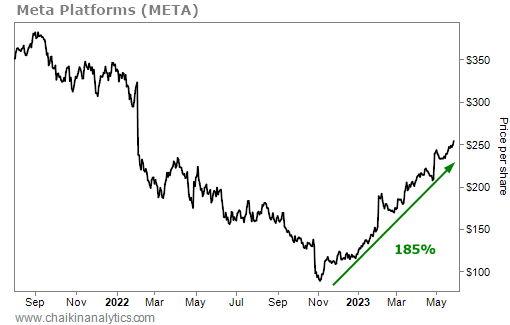

The social media juggernaut is in the middle of an incredible run. It’s up nearly 185% since early November. And yet, the headlines couldn’t be more contradictory…

Before the latest leg higher, a Barron’s article detailed one analyst’s warning about Meta Platforms. The analyst said the rally “is over” and urged investors to “lighten the load.”

Meanwhile, a Bloomberg article from around the same time noted that Meta Platforms was “the hottest tech stock in the market right now.”

These types of contradictions make it nearly impossible for investors to know what to do…

Should you buy shares? Should you avoid the stock – or perhaps even bet against it?

Today, I’ll show you how to cut through all the “noise” surrounding Meta Platforms in particular. But as you’ll see, it’s a great way to figure out what to do with any stock…

Meta Platforms couldn’t escape the “tech wreck” of 2022…

The stock reached an all-time high of roughly $382 per share in September 2021. But by last November, it had plunged more than 75% all the way down to less than $89 per share.

Then, just when many people thought Meta Platforms was history, the stock’s turnaround began. As I said, it has rallied nearly 185% off its bottom. Take a look…

Now, thanks to a major fine, the mainstream media is calling for the end again…

European privacy regulators fined Meta Platforms a record $1.3 billion earlier this week. They punished the company over the transfer of data from European Union citizens.

Meta Platforms plans to appeal. But the company has threatened to cease operations in the European Union if the two sides can’t come to terms. So the uncertainty around the stock is ramping up again.

Fortunately, at Chaikin Analytics, we have the perfect tool to cut through all the noise…

The Power Gauge.

In short, our one-of-a-kind system tells us that Meta Platforms’ future looks bright. As you can see in the Power Gauge screenshot below, it’s currently “bullish” overall…

No matter what the media says, we can see that Meta Platforms earns a “bullish” rating.

We could stop there if we wanted. But we can also dig deeper into the four factor categories. For example, we can see that the Experts category is rated as “very bullish”…

Notice that four out of five factors in this category receive the highest-possible mark, too.

Folks, this is exactly how we cut through the noise…

Sure, the media’s so-called experts all have opinions on Meta Platforms. But the Power Gauge tracks the real experts. And it’s almost unanimously “very bullish” in this category.

The media likes to contradict itself. But we don’t need to throw up our hands in response.

Instead, we can cut through the noise with the Power Gauge. It’s our guiding light.

Good investing,

Briton Hill