You might have seen it in the financial media this past weekend…

Oil cartel OPEC and its allied countries just made a major decision about their oil production.

OPEC itself accounts for roughly nearly 50% of global oil exports. Its member countries hold roughly 80% of the world’s proven oil reserves.

The oil cartel formed the extended OPEC+ coalition in 2016. The expanded group includes nations like Russia, Mexico, and Malaysia.

And since late 2022, OPEC+ has made some deep production cuts. The group has been cutting output by nearly 5.9 million barrels per day. That’s nearly 6% of global demand for oil.

These cuts were set to expire this year. But on Sunday, OPEC+ agreed to maintain the bulk of the cuts into 2025.

Put simply, this production-cut agreement is about as serious as it gets. It’s a big development for the energy sector as OPEC+ tries to keep oil prices high.

So today, let’s look at the sector through the lens of the Power Gauge.

We’ll see where energy stocks fall in our system’s ratings. And we’ll look at the energy sector’s current trend and Power Gauge rating to see what could be ahead for this corner of the market.

If you haven’t noticed, energy stocks are having a bit of a rough run…

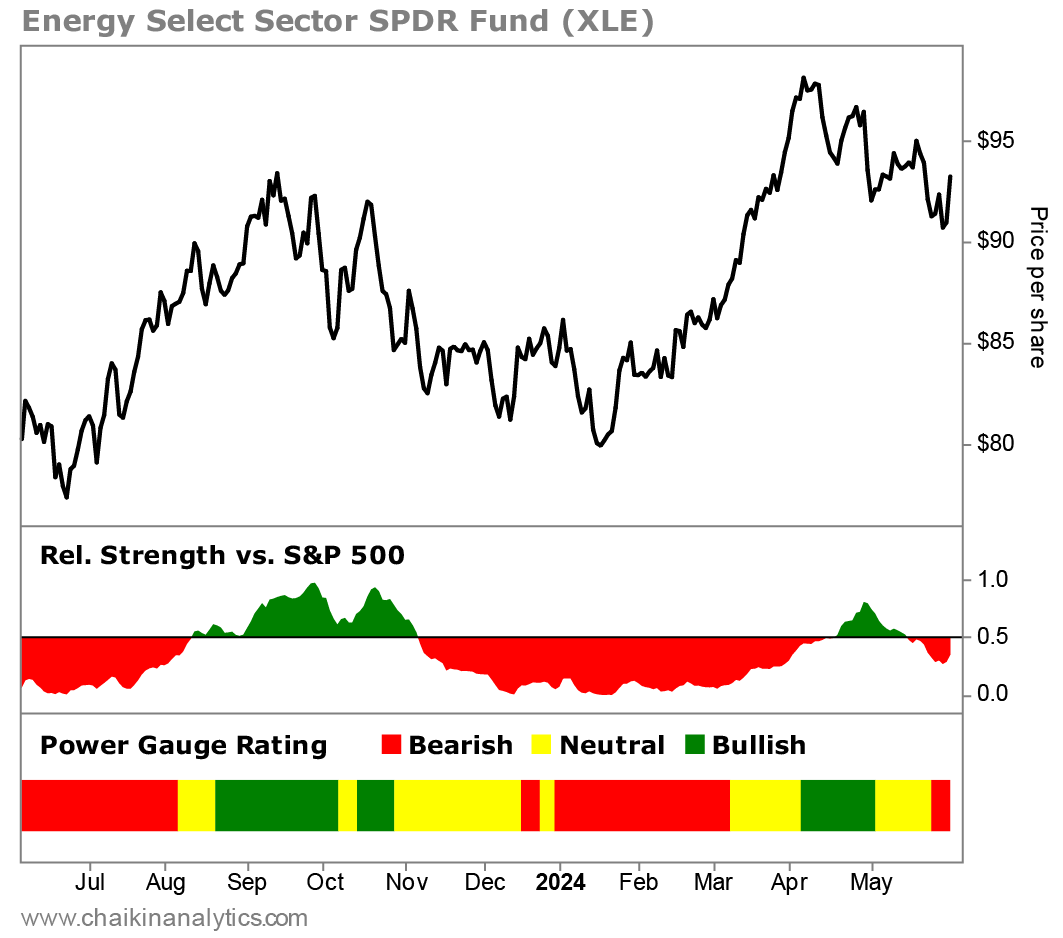

In the Power Gauge, we measure the sector using the Energy Select Sector SPDR Fund (XLE). This exchange-traded fund (“ETF”) holds huge energy names like ExxonMobil (XOM), Chevron (CVX), and Phillips 66 (PSX).

XLE was surging earlier this year. But it peaked on April 5. And since then, the ETF is down about 7%. Meanwhile, the S&P 500 Index is up about 1% over that same time frame.

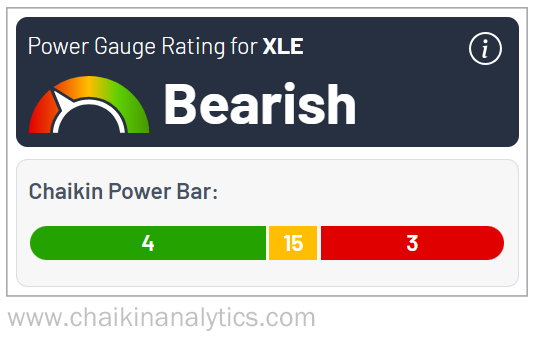

Not surprisingly, the Power Gauge currently gives XLE a “bearish” rating.

But it’s more than just the price action that determines the rating…

The below screenshot from our system shows XLE’s Power Bar. It consolidates the ratings behind every rated stock in the fund. And it displays them in an easy-to-read graphic.

As you can see, XLE currently has four holdings in “bullish” or better territory. It also has three stocks rated “bearish” or worse. Meanwhile, the remaining 15 holdings are stuck in “neutral” territory. Take a look…

With most of the holdings having “neutral” ratings, that means there’s a lot of opportunity for movement. Those “neutral” holdings could move into “bullish” or “bearish” ratings.

And considering the OPEC+ decision on extending production cuts, you might think it could be time to load up on energy stocks.

Well, I wouldn’t quite yet…

Let’s look at a one-year chart of XLE with some data from the Power Gauge. Specifically, the first panel under the chart below shows XLE’s relative strength versus the S&P 500.

As you can see, XLE has been underperforming the broad market. And the fund’s relative strength versus the market has been getting worse in recent weeks. Take a look…

Taken all together, it still looks early to rush out for energy stocks.

The sector ETF currently holds a “bearish” rating from the Power Gauge. Only four of its stocks earn a “bullish” or better rating right now. And the fund has been underperforming the broad market.

Fortunately, the Power Gauge makes this easy to see concisely. And using it, we can watch closely for a turnaround that’s more than just a headline.

I’ll be using the Power Gauge to keep an eye on XLE. And I recommend you do the same.

Good investing,

Vic Lederman