When it comes to possible recession indicators, turning to “booze stocks” might seem strange at first…

But think about it for a moment. People like to drink during good and bad times.

As such, stocks of alcohol-related companies tend to do well ahead of a recession.

This steady demand is why booze stocks are a great defensive play.

In short, when the economy is deteriorating, investors pile into these stocks for their stability.

So today, let’s look at a pair of booze companies. We’ll see what their recent performance tells us about a potential downturn ahead…

Specifically, we’re looking at Diageo (DEO) and Brown-Forman (BF-B).

Diageo is a global giant that makes Johnnie Walker whiskey, Tanqueray gin, Guinness beer, plus a range of vodkas and other spirits.

Meanwhile, Brown-Forman is best known for its Jack Daniel’s and Woodford Reserve brands.

And ahead of recessions, these companies’ stocks have historically held up well.

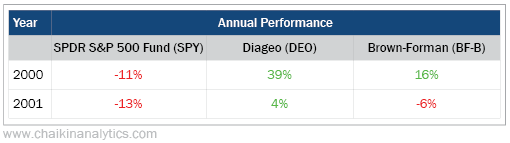

For example, back in 2000 to 2001, we were dealing with the bursting of the dot-com bubble. The U.S. economy spent most of 2001 stuck in a recession.

The market started sinking long before the economy tanked. In 2000, the SPDR S&P 500 Fund (SPY) fell more than 10%. And 2001 was even worse. As measured by SPY, the S&P 500 Index dropped more than 12% for the year.

But the booze stocks of Diageo and Brown-Forman avoided the carnage before the recession.

They delivered double-digit gains in 2000. And both stocks outperformed the S&P 500 during the recession in 2001. Take a look…

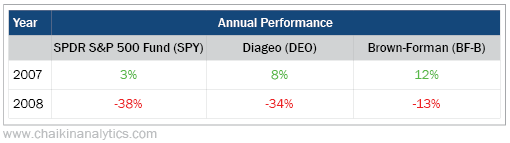

The same thing happened ahead of the Great Recession, which began in 2008…

In 2007, the S&P 500 delivered a measly 3% gain. Once again, before the recession, Diageo and Brown-Forman beat the index in 2007. And while both stocks fell during 2008, they still outperformed the index’s brutal 38% plunge. Take a look…

As you can see, booze stocks beat the S&P 500 in the year before and during the past two major recessions.

That brings us to today…

Put simply, booze stocks aren’t showing their typical “pre-recession” behavior right now.

They aren’t outperforming the S&P 500 – not even close.

In fact, Diageo and Brown-Forman are stuck in a major downtrend. Both stocks recently hit fresh 52-week lows. Meanwhile, the S&P 500 has been soaring over the past year.

Take a look at the chart below…

And unsurprisingly, the Power Gauge isn’t “bullish” on either of these booze stocks right now…

It currently gives Diageo a “very bearish” rating. Meanwhile, Brown-Forman earns a “neutral+” grade from our system.

Again, booze stocks are a traditional defensive play that does well ahead of a recession.

But right now, they’re badly underperforming the market.

It’s an important signal for anyone worried about a recession or a major market sell-off. The current market action with booze stocks doesn’t match what we’ve seen ahead of previous downturns.

Keep that in mind the next time you run into the latest “doom and gloom” headlines in the financial media. And looking ahead, I’m still bullish on stocks for 2024.

Good investing,

Vic Lederman