It started to feel like we would never see this again…

After all, the world suffered a brutal pandemic. Then the supply chains faltered. And soon after, inflation soared.

All the while… gold stayed silent.

Sure, the metal had soared from 2019 to its 2020 peak. It climbed roughly 50% in 20 months.

But after that… gold prices got stuck.

In fact, gold didn’t make a new high for more than three years. It was a brutal, sideways grind.

But then, something dramatic changed. At the end of last year, gold prices broke out to a new high. And they kept going higher.

Now, we’re seeing gold mining stocks react to the new price trend. And the Power Gauge is flashing a “very bullish” signal on gold miners.

Today, let’s take a closer look at the situation…

Gold miners have had it rough for the past few years. Again, gold prices traded sideways from mid-2020 through most of 2023.

But inflation and labor costs also soared. That made it hard to make money mining gold.

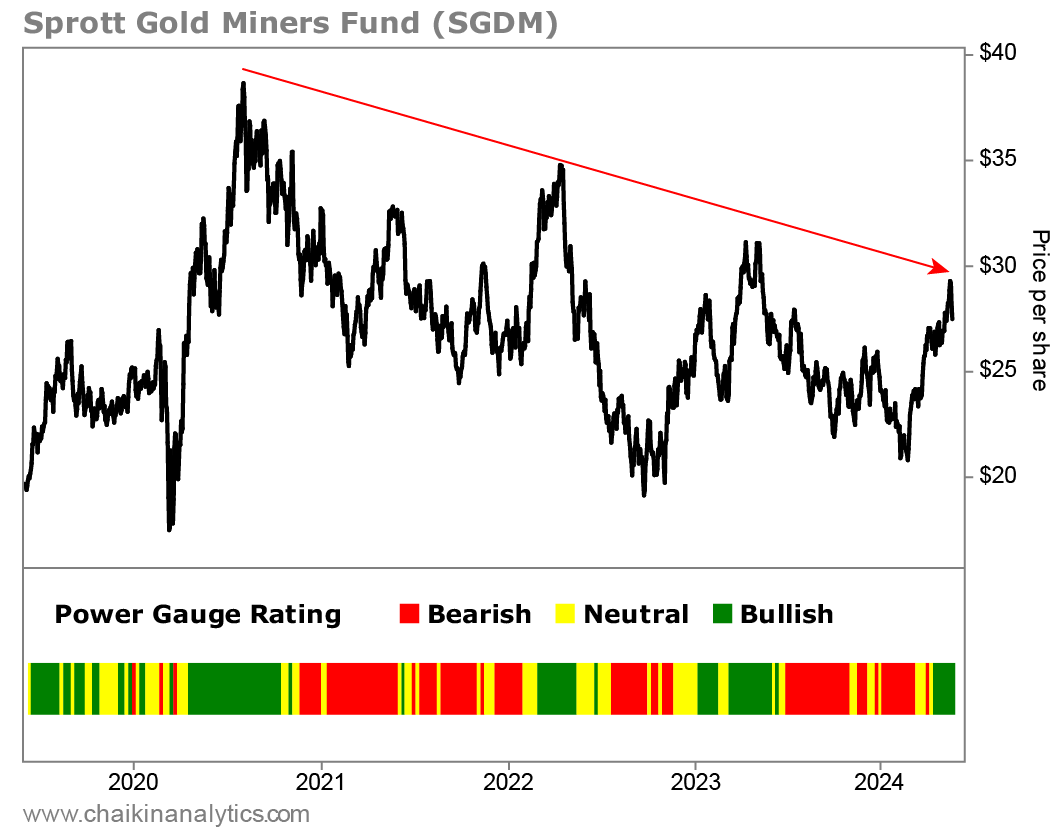

We can see how that played out on a chart of the Sprott Gold Miners Fund (SGDM)…

This exchange-traded fund (“ETF”) holds the world’s most important gold miners – like Barrick Gold (GOLD), Franco-Nevada (FNV), and Newmont (NEM).

And as you can see in the chart below, gold miners have collectively suffered in recent years…

You’ll also notice that amid the larger downtrend, SGDM saw some ups and downs. And on the five-year price chart, the most recent move higher might not look all that inspiring.

But don’t let this fool you…

This is the first uptrend we’re seeing since gold prices moved significantly higher.

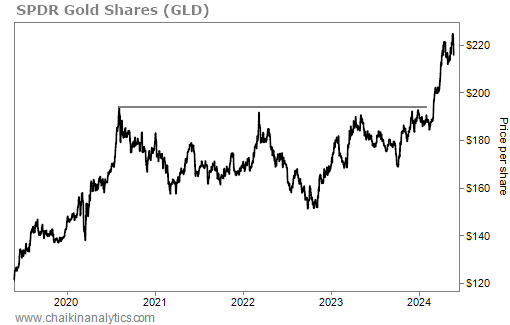

It’s obvious when we look at the five-year price chart of the SPDR Gold Shares (GLD) – the largest physically backed gold ETF in the world…

You can see clearly that gold has made a major directional change after trading sideways. And that’s what’s currently driving gold miners higher.

Combined with falling inflation, that means a massive tailwind.

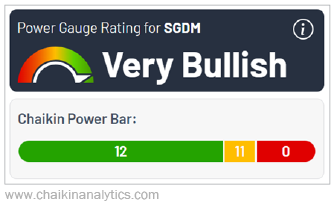

So it’s no surprise that the Power Gauge sees big upside potential with SGDM. As you can see in the screenshot below, the ETF currently earns a “very bullish” rating in our system…

In fact, 12 of the rated stocks in SGDM earn a “bullish” or better grade from the Power Gauge. Eleven are in “neutral” territory. And none earn a “bearish” or worse rating.

Put simply, the Power Gauge sees a big opportunity with gold miners. And most importantly, the situation is different in the context of the past few years…

Previously, uptrends in gold stocks required an extremely critical eye. After all, gold prices were stuck.

But now, that has changed…

Gold prices are soaring. And gold stocks are starting to soar, too.

So if you’re not already keeping a close eye on this segment of the market… I recommend you check it out.

Good investing,

Vic Lederman