Americans like the idea of having a strong U.S. dollar…

After all, a strong currency projects a strong economy.

It means we can buy more from other countries with the same amount of our currency.

When we travel abroad, merchants everywhere are happy to accept a strong U.S. dollar.

Investors worldwide also flock to the dollar as a safe haven during times of crisis.

But after a big surge for most of this year, the almighty dollar hasn’t been looking so strong recently…

The U.S. Dollar Index measures the value of the dollar against a basket of six currencies. These are the Japanese yen, euro, Swiss franc, Canadian dollar, British pound, and the Swedish krona.

And since its recent highs in late June, the index is down more than 4%.

That’s a big drop in the value of the dollar in such a short period.

Moreover, it’s down an even bigger 10% against the Japanese yen since early July.

These large declines in the dollar are happening just as interest rates in the U.S. are expected to start falling.

As you surely know, inflation in the U.S. has been coming down. Based on the Consumer Price Index (“CPI”) for July, it fell to 2.9% year over year. That’s the lowest reading since March 2021.

This is giving the Federal Reserve more wiggle room on interest rates.

Indeed, according to a recent Reuters poll, most economists expect the Fed will cut rates by 75 basis points (“bps”) by the end of this year.

These would be the first rate cuts by the Fed since the pandemic hit in 2020.

Now, 75 bps might not sound like much…

But for an institutional fund with, say, $100 million to invest… it’s a lot of money. A 75-bps reduction would mean $750,000 less in interest income per year.

Lower interest rates on the dollar make holding the currency less appealing to investors. They increase the appeal of holding other currencies – like the yen, euro, or pound.

That’s why we’re seeing weakness in the dollar lately.

But it doesn’t mean less opportunity for U.S. investors…

As money leaves the dollar, it flows to other currencies. In turn, this boosts the value of assets priced in these currencies.

In short, when the dollar is weakening, owning assets in other currencies is usually a good idea.

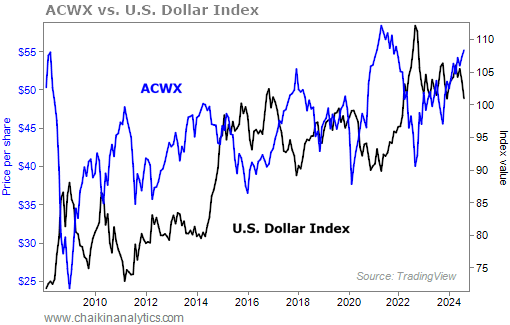

That’s what we see with iShares MSCI ACWI ex U.S. Fund (ACWX)…

This exchange-traded fund (“ETF”) tracks the MSCI ACWI ex USA Index. Both of those names are a mouthful, but they’re not that complicated…

The MSCI ACWI ex USA Index is composed of large- and mid-cap non-U.S. equities. Its largest markets include Japan, the U.K., Canada, China, and France.

Put simply, the index represents the world’s major markets except the U.S. ACWX tracks that index.

And history shows that when the dollar is weak, ACWX does well. Take a look…

This isn’t surprising. Money leaving the dollar means money flowing into these markets. And if the weakness in the dollar continues, ACWX is a great way to take advantage.

The Power Gauge agrees. Right now, it gives ACWX a “bullish” rating. Our system turned bullish last week, just as the dollar’s decline accelerated.

Now, just because an ETF tracking global markets except the U.S. tends to rise as the dollar declines, that doesn’t mean that U.S. stocks aren’t going to do well…

But if you’re looking for an alternative investment to hedge against a declining dollar as the Fed is poised to cut rates, ACWX is worth considering.

Good investing,

Vic Lederman