If I asked you to name some AI-focused companies, I’m sure you could do it easily…

You would no doubt spot the major U.S. players in the space. Google parent Alphabet (GOOGL), IBM (IBM), and OpenAI – which has received billions of dollars of investment from Microsoft (MSFT) – dominate the AI landscape.

But what if I asked you to name some of China’s top AI companies?

My guess is that for most of you, the answer is no. And that’s a big deal…

China and the U.S. are currently in the middle of an AI race. And it could be more important than the space race between America and the Soviet Union was during the Cold War.

The winners will end up shaping just about everything in our modern lives. They’ll define how we get the answers to the questions we ask… change how companies determine our value as consumers… and shape the media of the future.

Despite that, most American investors are only paying attention to one side of this race. And if they think about the other side at all – China – they don’t like it…

I recently spoke with my friend Brendan Ahern about this issue. He’s the chief investment officer of KraneShares, which is an exchange-traded-fund (“ETF”) company. And he put it bluntly…

Vic, this is one of the most hated AI plays in the market right now.

Specifically, Brendan was talking about China-based Alibaba (BABA). You’ve probably heard of the company…

Alibaba is huge. It’s like Amazon (AMZN) in the sense that it’s online-retail giant. And it’s growing rapidly in cloud computing.

The company is growing its data-center presence. And it recently expanded the availability of its products into Mexico.

Alibaba also plans to build new data centers in South Korea, Malaysia, and Thailand. But that’s not all…

The company also has its own version of AI tool ChatGPT. And it’s planning on using AI to help it expand.

Today, Alibaba holds roughly 5% of the global cloud data market.

The big three – Microsoft, Alphabet, and Amazon – account for nearly 70%. But that means there’s still a lot of market share on the table for Alibaba to take.

What’s more, Alibaba’s stock was previously not accessible to most mainland Chinese investors… seriously. But that’s all changing right now.

The details are a little complicated. But the short of it is that it’s about to get a lot easier for Chinese citizens to buy shares of Alibaba. And experts at Morgan Stanley suspect the approvals for this could go through as early as next week.

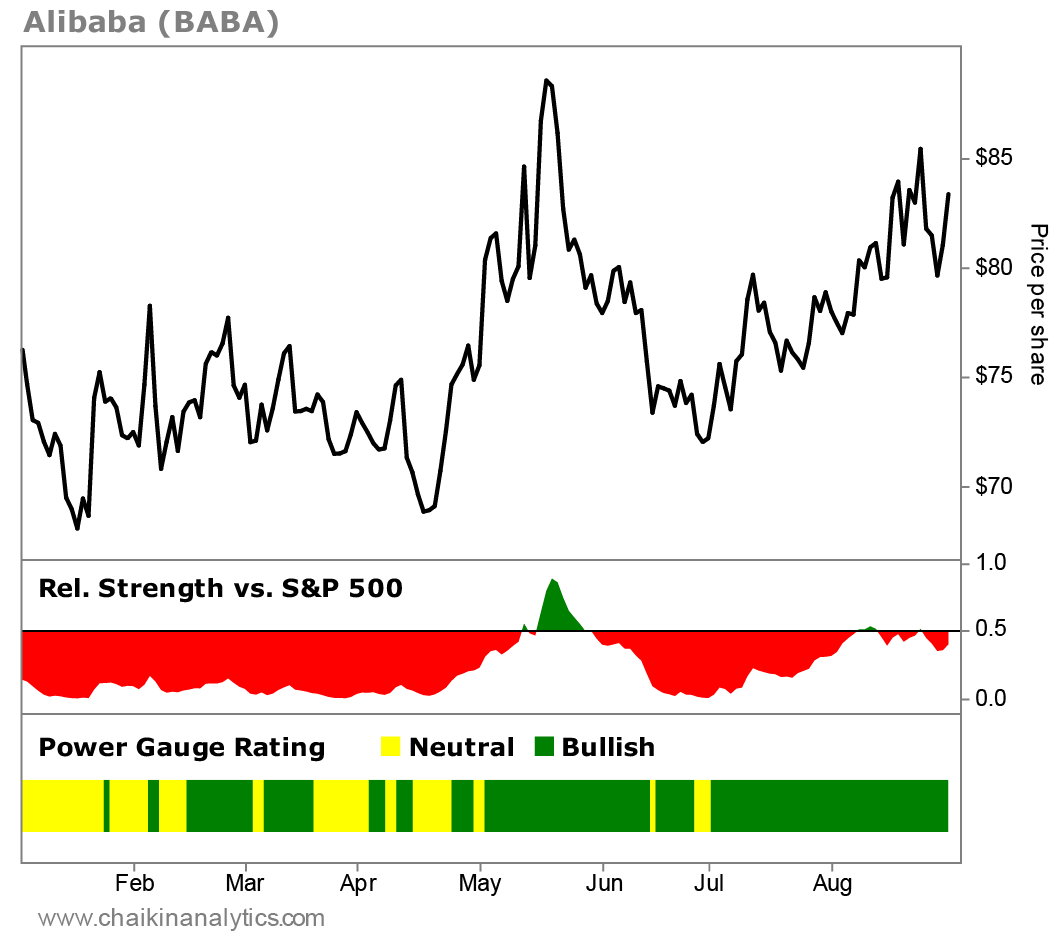

Meanwhile, Alibaba currently earns a “bullish” rating in the Power Gauge. And in the past month alone, its share price has jumped about 6%. In the chart below, you can see the stock’s overall move higher and frequent “bullish” ratings in 2024…

And yet, that hasn’t been enough to beat the broad market this year.

Even with the recent dip, the S&P 500 Index has soared around 16% in 2024. Over the same time frame, Alibaba is only up about 6%.

This is a story that Brendan knows too well. He has been laser-focused on Chinese stocks for more than 13 years.

We first met, in China, about eight years ago.

And today, investors are simply skittish around Chinese stocks – possibly the most they have been in the past decade.

We can see that by looking at the KraneShares CSI China Internet Fund (KWEB). It’s a “one-stop shop” ETF for China’s top tech companies.

Alibaba’s Hong Kong listing is KWEB’s second-largest holding at nearly 11%. The largest holding is Tencent – the gaming giant and maker of China’s super app WeChat.

Today, KWEB is down around 75% from its peak back in mid-February 2021. That’s a massive drop for China’s top tech companies.

It’s a drop that I believe will reverse eventually. After all, American investors may hate Chinese stocks today… But they like making money in the markets.

And Chinese companies, especially the big ones, have a history of soaring huge amounts in a short period of time. From the start of 2019 to its peak in 2021, KWEB jumped more than 175%.

Combine price action like that that with the AI boom, and it’s only a matter of time before investors reignite momentum in this corner of the market.

Here in the U.S., you might be watching only one side of this “modern-day space race”…

If that’s the case, remember that there are multiple participants. And there will be multiple winners along the way.

Good investing,

Vic Lederman