Editor’s note: The recent volatility has rattled investors…

However, as we’ve said many times this year here at Chaikin PowerFeed, pullbacks happen – even in a strong market. Despite the dips along the way, the S&P 500 Index is still up about 13% this year. And Chaikin Analytics founder Marc Chaikin has long expected more gains by the end of 2024.

Meanwhile, our friend Brett Eversole just noticed something big in another major U.S. index…

Regular readers know that Brett is an editor at our corporate affiliate Stansberry Research. Today, we’re sharing an essay from him that most recently published in the September 5 edition of his free DailyWealth e-letter. In it, Brett explains how a recent rare occurrence points to more upside ahead for a particular index…

Investing was easy in the first half of 2024. Then, we saw an aggressive shake-up.

Unemployment jumped in July… A little-known hedge-fund trade blew up in August… And investing went from enjoying a smooth ride higher to experiencing gut-wrenching declines.

But the major stock indexes quickly recovered most of their losses. And while we’ve seen more volatility since then, that rebound led to a rare situation.

One particular index soared double digits in just two weeks. According to history, that means another 12% rally is possible from here.

And as I’ll explain, it’s one more reason we want to stay bullish today…

The Nasdaq Composite is the most volatile of the major U.S. stock indexes. It holds more of the Big Tech names that have driven the market higher in recent years. But that sword cuts both ways.

These large stocks tend to be more volatile than the overall market. That means they go up more when times are good… but they also fall more when times are tough.

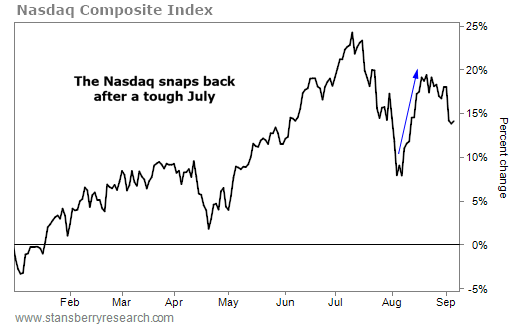

The Nasdaq fell the most in last month’s market shake-up. It was the only major index to tip over into an official correction, dropping 13% from its July high to its low on August 7. But it also staged one of the quickest rebounds – one that led to a rare setup.

You see, the Nasdaq managed to rally 10.6% in just two weeks. Take a look…

The Nasdaq continues to be volatile. But it was able to quickly erase most of the losses it took in July and early August. And that move was significant.

This kind of rebound doesn’t happen often. We’ve seen 35 other two-week rallies of 10% or more since the data begins in 1971. That’s roughly once every year and a half. And when we see rallies like these, prices tend to keep rising. Take a look…

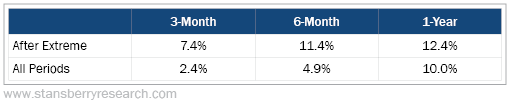

The tech-heavy Nasdaq has been a big winner since it launched more than half a century ago. It has returned 10% a year over that time. But you can improve those gains if you buy after a two-week rally like we just witnessed.

Similar setups led to 7.4% gains in three months, 11.4% gains in six months, and 12.4% gains over the following year. That’s solid outperformance versus a typical buy-and-hold strategy. Plus, the Nasdaq was higher a year later 71% of the time.

You’ll also notice that the outperformance is most extreme in the three-month and six-month periods. That means the Nasdaq tends to soar most in the weeks right after these rallies. Then, it slows down to a more normal pace as the months go on.

The “easy ride” might be over for now. But if you got out of the market in July, don’t make matters worse by repeating that mistake today…

History shows that the Nasdaq should move higher. And the largest gains will likely happen in the next few months.

Good investing,

Brett Eversole

Editor’s note: Over at DailyWealth, Brett and his colleagues share insights like this every weekday morning that the markets are open… 100% free. Don’t miss out – you can learn more about signing up for DailyWealth by clicking here.