You personally might not like its coffee…

But the fact that 10 million customers walk into one of Starbucks’ (SBUX) coffee shops every day is a big statement about its universal appeal.

Since its humble beginnings in 1971 in a rented storefront in downtown Seattle, the company is an iconic global brand today.

It has more than 38,000 stores worldwide. More than half of them are outside the U.S.

Starbucks also employs a whopping 381,000 people. Most of these folks are baristas – they take orders, work the espresso machines, and prepare food and drinks.

Now, the company says it wants to add another 17,000 stores globally by 2030. That’s a rate of nearly seven new stores opening every single day.

And here’s the interesting part…

Starbucks also wants to double the hourly earnings of its U.S. workers. At the same time, it plans to cut down costs by $3 billion over the next three years.

That got me thinking…

How can a company as big as Starbucks keep growing its stores and doubling wages… while cutting costs at the same time?

As we all know, inflation is still a global concern. Cutting costs isn’t easy when the price of electricity, rent, wages, and raw materials keep going up.

The solution is technology.

A big shift is taking place in the consumer-facing aspect of businesses…

It’s going to make the coffee shops, fast-food restaurants, and convenience stores of today seem like the general stores of the 1800s. And it has a lot to do with automation.

In today’s essay, I’ll explain the details…

Of course, using automation for repetitive processes has been around for decades.

When you think of robots and automation, you probably think of industrial factories. And the human interaction is mainly just somebody keeping watch over these machines in case something goes wrong.

But automation has been slowly introduced to everyday consumers in recent years…

For example, in 2015, fast-food giant McDonald’s (MCD) started introducing self-service kiosks that allowed customers to place their own orders. Today, McDonald’s locations all over the world have these kiosks, with one physical cashier as a backup.

While a self-service kiosk might not be what you think of as a “robot,” it’s still automation. These machines are getting customers used to the idea of having less interaction with people when ordering food.

Meanwhile, robots are already being used in the coffee industry. Articulated robot arms can make any kind of drink from start to finish.

For example, in New York, a business called Botbar Coffee features a two-armed robot that can serve up to 50 drinks in an hour. Take a look at it…

And on the other side of the world, in Singapore’s Changi Airport, a kiosk with a robot called Ella serves artisanal coffee.

Now, I’ll note that neither McDonald’s nor Starbucks has spelled out solid plans to roll out automated stores just yet. But it’s clear where this is all heading…

Companies are always looking for ways to improve profit margins at a time when wages just keep going up. Technology gives them a way to do this.

Regardless of how you feel about it, automation is here. Across industries – including food and retail – more is coming. And looking ahead, it might just be a matter of time before we say goodbye to some of our friendly neighborhood baristas.

So in this backdrop… what does this mean for us as investors?

Here at Chaikin Analytics, the Power Gauge recently picked up on strength in an exchange-traded fund with exposure to this corner of the market…

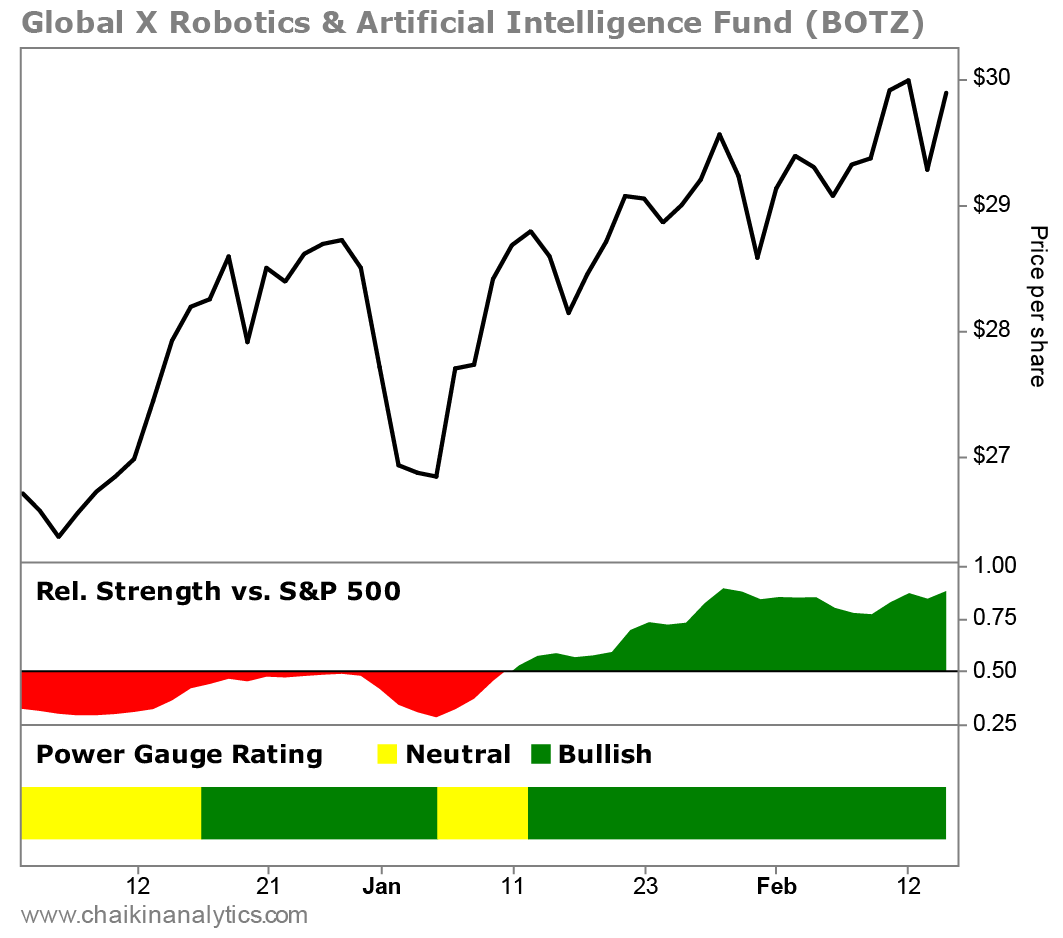

The Global X Robotics & Artificial Intelligence Fund (BOTZ) holds a basket of companies serving up the growing demand for automation. And since the Power Gauge turned “bullish” on it two months ago, BOTZ is up about 7%. Take a look…

As you can also see in the chart, BOTZ briefly flipped to “neutral” in early January, but is back in “bullish” territory today. And you can see that the fund has shown strong relative strength versus the S&P 500 in recent weeks.

Considering the “bullish” rating for BOTZ, the Power Gauge still sees opportunity ahead in this corner of the market.

Good investing,

Vic Lederman