Times are tough for the average U.S. consumer…

In short, the costs of many essentials have surged higher.

Food prices are up roughly 17% over the past two years. Housing prices have skyrocketed as well…

The median sales price for a U.S. home was $329,000 at the start of 2020. Today, it’s a staggering $431,000. And that doesn’t even factor in the massive spike in interest rates.

Put simply, the squeeze is on. And U.S. consumers are feeling it.

It’s more than just a bad attitude, too. As I’ll show you today, we can see it in the data…

U.S. consumers are especially miserable right now.

But for investors, that idea might not be as bad as it initially sounds…

The Organization for Economic Co-operation and Development (“OECD”) released the latest update of its Main Economic Indicators on December 9. The massive, 260-page tome details the economic state of the world.

Truthfully, it’s a boring read. It’s mostly full of tables upon tables of data.

Still, it’s packed with great insights. And it can help folks spot developing trends.

One particularly valuable indicator tracks consumer confidence…

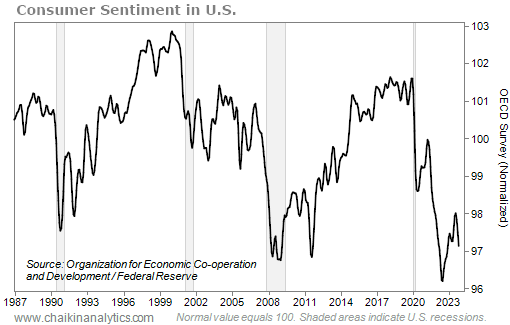

The OECD surveys how folks all over the world are feeling at any given time. And as I noted, U.S. consumers are feeling miserable today. Take a look…

This chart shows U.S. consumer sentiment since the 1980s. And the pattern is pretty clear…

High-flying economic times lead to good feelings among U.S. consumers. Then, recessions wipe out those good feelings.

That’s what happened just before COVID-19 hit in 2020. It also happened in 2007, just before the housing bust. And it happened in the early 2000s.

That makes today’s reading especially interesting. U.S. consumers are currently about as miserable as they were at the bottom of the housing bust.

Where does that leave us today?

Well, we did see similar sentiment activity during the “double-dip recession” of the 1980s. And students of history will recall that shift occurred during another big inflationary battle.

Put simply, inflation is brutal for U.S. consumers. And although the Federal Reserve seems to be winning the broader war against it, consumers are still losing individual battles daily.

Now, U.S. consumers are fighting back and aggressively seeking out deals…

Many folks aren’t buying items if they’re not on sale. Or as Walmart’s Chief Financial Officer John David Rainey puts it, consumers are “still very choiceful and using discretion.”

Because of that, a slowdown is likely. But we shouldn’t expect a huge wipeout…

History is clear that the deepest recessions occur after consumer sentiment swings from very positive to very negative. But today, consumers are too miserable for that to happen.

That means many segments of the market will continue to grind out new highs.

Good investing,

Vic Lederman