Folks, the S&P 500 Index is nearing new highs…

After the steep pullback last month and earlier this month, stocks have been rallying. By now, the S&P 500 is about 1.7% away from a new high. And it’s likely the index will cross that level in the near future.

As measured by the SPDR S&P 500 Fund (SPY), the broad market has also regained its “bullish” rating in the Power Gauge. That comes after a short stretch in “neutral” territory.

Meanwhile, seven of the 11 top-level sectors now earn a “bullish” or “very bullish” rating in our system.

But that doesn’t mean you can just throw a dart and find a winning stock…

We’re still seeing some dark spots. And one corner of the market is particularly worth avoiding…

In the Power Gauge, this sector is stuck in “neutral” mode. And an associated subsector holds the dubious title of worst-ranked in the Power Gauge. Let’s take a closer look today…

It may not feel like it, but the price action of the broad market is still strong.

Over the past three months alone, SPY gained nearly 6%. So far this year, it’s up almost 19%.

Folks, that’s a staggering return. And it calls into question any segment of the market that isn’t keeping pace.

So today, let’s look at one of those laggards – the energy sector. In the Power Gauge, we track it with the Energy Select Sector SPDR Fund (XLE).

While SPY is up nearly 6% over the past three months, XLE is down more than 5%.

That means the energy sector has underperformed the broad market by roughly 11% over this recent three-month time frame. Looking at the Power Gauge, it’s easy to see why…

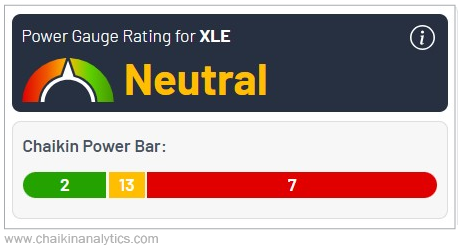

As you can see, XLE currently earns a “neutral” rating. And it holds only two “bullish” stocks… but seven “bearish” or worse ones.

By Power Bar ranking, that ranks it second to last among the top-level sectors. But we can dig a little deeper…

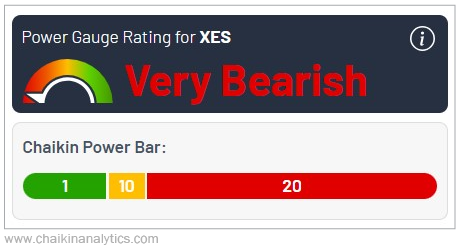

You see, the SPDR S&P Oil & Gas Equipment & Services Fund (XES) is the lowest-ranked subsector in the Power Gauge. And its Power Bar rating is abysmal. Take a look…

As you can see, XES currently gets a “very bearish” rating. Meanwhile, the fund holds just one “bullish” stock… and 20 “bearish” or worse stocks.

That puts XES firmly in last place in the subsector rankings.

Like you would expect, that has also translated to terrible performance. Over the past three months, XES has tumbled around 11%.

So the market is on the edge of making new highs. And it might feel like you could soon “buy anything” and win.

But the Power Gauge is clear. Right now, the energy sector is hurting.

And oil and gas services are among the worst of the worst.

Does that mean they’ll stay that way forever? Of course not…

But it does mean that picking stocks in this segment of the market poses a big uphill battle right now. The Power Gauge simply sees too many “bearish” pitfalls here today.

So as this market evolves, look for the “bullish” opportunities. And avoid the “bearish” ones – like we’re seeing right now in oil and gas services.

Good investing,

Vic Lederman