Folks, maybe it hasn’t felt like it at times… but we’re still in a bull market.

The stock market is absolutely soaring this year. (I know, I’ve said it repeatedly…)

The S&P 500 Index is making new highs. And it’s up about 20% since the start of the year.

But that doesn’t mean you want to own every stock out there. Heck, even the S&P 500 is hiding wealth destroyers.

Now, maybe that sounds extreme. But it’s true.

Today, let’s look at a company that has lost more than 75% of its market value. It’s a stock that you obviously would have wanted to avoid this year.

Then, we’ll look at a less obvious example – a stock that’s dragging down returns in a soaring bull market.

Put simply, these are the kind of wealth destroyers we should be using the Power Gauge to avoid. So let’s get into it…

I know this might sound obvious… but you should probably avoid buying “bearish” stocks in a bull market.

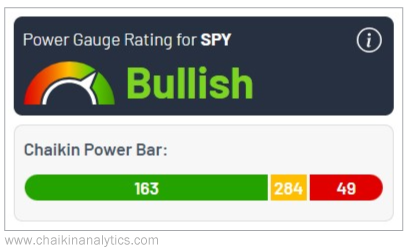

Sure, the S&P 500 is broadly soaring. But there are still serious pitfalls there. Take a look at this screenshot from the Power Gauge…

Based on the SPDR S&P 500 Fund (SPY), the Power Gauge sees 163 “bullish” or better opportunities in the broad market. But at the same time, 49 stocks earn a “bearish” or worse rating.

Think about that for a moment…

We’re talking about the 500 largest stocks listed in the U.S. market. And the Power Gauge is urging you to avoid about 10% of them.

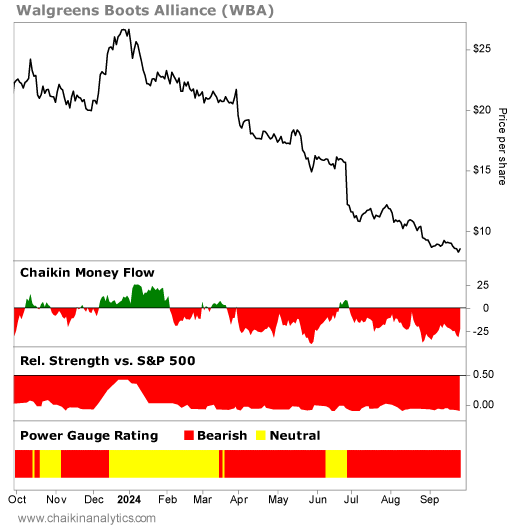

This is serious business, too. When it comes to wealth destroyers in SPY, just look at pharmacy chain Walgreens Boots Alliance (WBA)…

Walgreens is a household name. But that hasn’t stopped its share price from collapsing…

The stock is down a staggering 65% this year. And as you can see, it has been in “bearish” or worse territory for most of 2024. Walgreens clearly isn’t benefiting from the bull market.

But maybe that one is too obvious. After all, Walgreens’ struggles this year are national news at this point.

So let’s take a look at a different dangerous stock…

Video-game company Take-Two Interactive Software (TTWO) is a perfect example. It’s another underperformer hiding in plain sight in the S&P 500…

As you can see, the stock hasn’t had a “bullish” rating since November. And this year, while it hasn’t performed nearly as bad as Walgreens, the stock is struggling.

Take-Two Interactive has fallen about 5% in 2024. Remember, we’re in a bull market… the stock should be soaring.

With a $27 billion market cap, Take-Two Interactive is a giant in video games. It also owns big game developers and publishers. Despite that, in one of the best S&P 500 years on record, it’s struggling.

Now I already hear it… “Vic, I see that – but just look at how well the broad market is doing.”

And it’s true that the S&P 500 is soaring. But that doesn’t mean you’re obligated to hold the wealth destroyers hiding in it.

With the Power Gauge, you can find them and cut them out of your portfolio before they destroy your wealth.

Good investing,

Vic Lederman

P.S. Right now, Chaikin Analytics founder Marc Chaikin is also sounding the alarm on a different group of wealth destroyers…

Marc recently went on camera to share a critical market update. In it, he explained that dozens of stocks could soon see a dramatic, unified sell-off. But he also shared the No. 1 step to take to protect yourself.

Don’t miss out on this narrow window of opportunity to position yourself. Get all the details from Marc right here.