If you’re a chart junkie like I am, you might’ve noticed a significant bounce recently…

In short, government bonds rallied off their mid-June lows.

The iShares 20+ Year Treasury Bond Fund (TLT) is up roughly 7% from its June 14 low. That’s a big move for a long-duration exchange-traded fund (“ETF”).

Shorter-duration government-bond ETFs like the iShares 3-7 Year Treasury Bond Fund (IEI) show the same pattern over the past month, too. They all bounced after their June 14 low.

Finance nerds might see this recent move higher as a relief…

After all, rising bond prices suggest that rapidly soaring rates are cooling off (since they move inversely).

Or in simpler terms, it seems the market is getting a break from the Federal Reserve’s iron grip.

But don’t let this signal fool you…

It’s another bear market trap like what Chaikin Analytics founder Marc Chaikin discussed last Thursday. And ultimately, if investors hoping for some relief with government-bond ETFs aren’t careful, they could be in for a rude awakening.

Here’s why…

Basically, government-bond ETFs bounced starting in mid-June for two intertwined reasons.

This first has to do with the perceived safety of the U.S. dollar. And secondly, higher interest rates mean investors are getting a higher rate of return than they did in the past.

Foreign investors like this combination…

Rising rates make bonds a better relative investment. That shift attracts more investment, usually from overseas. Think about it…

Imagine you’re an investor in Europe. If you could get 2% returns from investing in the U.S. or 1% returns from investing in Germany, where would you put your money?

You would pick the U.S., of course.

However, in order to invest in the U.S., you need to trade in your euros for U.S. dollars. And in turn, that drives demand (and in turn, price) for the U.S. dollar higher.

That’s exactly what’s happening today…

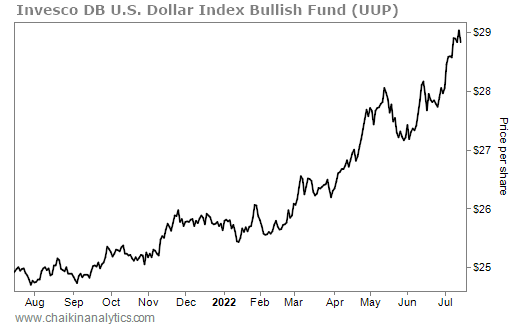

The Invesco DB U.S. Dollar Index Bullish Fund (UUP) measures the strength of the U.S. dollar against a basket of six major currencies – the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. And as you can see in the following chart, based on UUP, the U.S. dollar has been getting stronger and stronger so far this year…

But although government-bond ETFs have rallied, we should expect bumpy roads ahead…

You see, the most recent inflation data for June hit another four-decade high of 9.1%.

That means the Fed needs to continue its fight against inflation. It’s essentially committed to raising the benchmark interest rate further in the coming months.

Rising rates mean the prices of bonds will fall. And related to that, the value of government-bond ETFs will also fall.

It’s a war between climbing demand for the U.S. dollar and the fundamental relationship between bond prices and interest rates.

I get it. This topic is a little bit in the weeds. But the bottom line is…

With more rate hikes ahead, don’t rush into buying government-bond ETFs yet.

A short-term pullback is likely. And a longer-term pullback wouldn’t surprise me, either…

If more foreign countries start raising their interest rates, it would ease the narrow spread from U.S. rates. And in turn, that would make U.S. bonds less attractive to those investors.

In the end, don’t let the recent bounce for government-bond ETFs fool you into thinking prices will keep rising. Expect those gains to reverse – at least over the short term.

Good investing,

Karina Kovalcik